Question: Problem 8 - 1 4 APT Consider the following simplified APT model: FactorExpected Risk Premium ( % ) Market 6 . 5 Interest rate 0

Problem APT

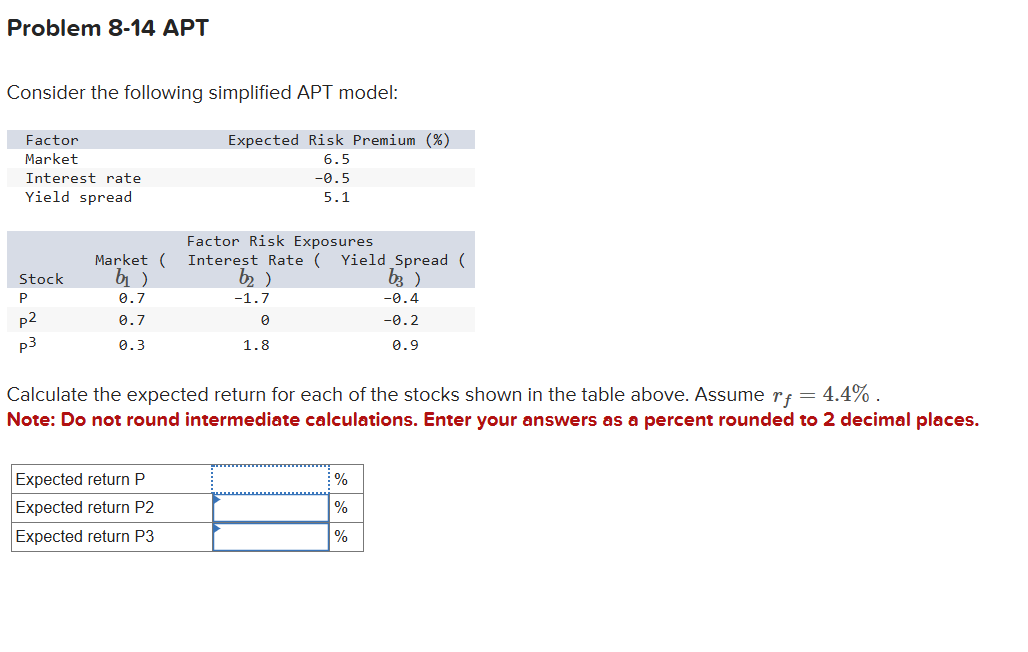

Consider the following simplified APT model:

FactorExpected Risk Premium MarketInterest rateYield spread

StockFactor Risk ExposuresMarket bbInterest Rate bbYield Spread bbPPraise to the power of Praise to the power of

Calculate the expected return for each of the stocks shown in the table above. Assume rfrf

Note: Do not round intermediate calculations. Enter your answers as a percent rounded to decimal places. Problem APT

Consider the following simplified APT model:

Calculate the expected return for each of the stocks shown in the table above. Assume rf

Note: Do not round intermediate calculations. Enter your answers as a percent rounded to mathbf decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock