Question: Problem 8 - 2 3 ( Algorithmic ) Involuntary Conversions ( LO 8 . 1 2 ) Teresa's manufacturing plant is destroyed by fire. The

Problem Algorithmic

Involuntary Conversions LO

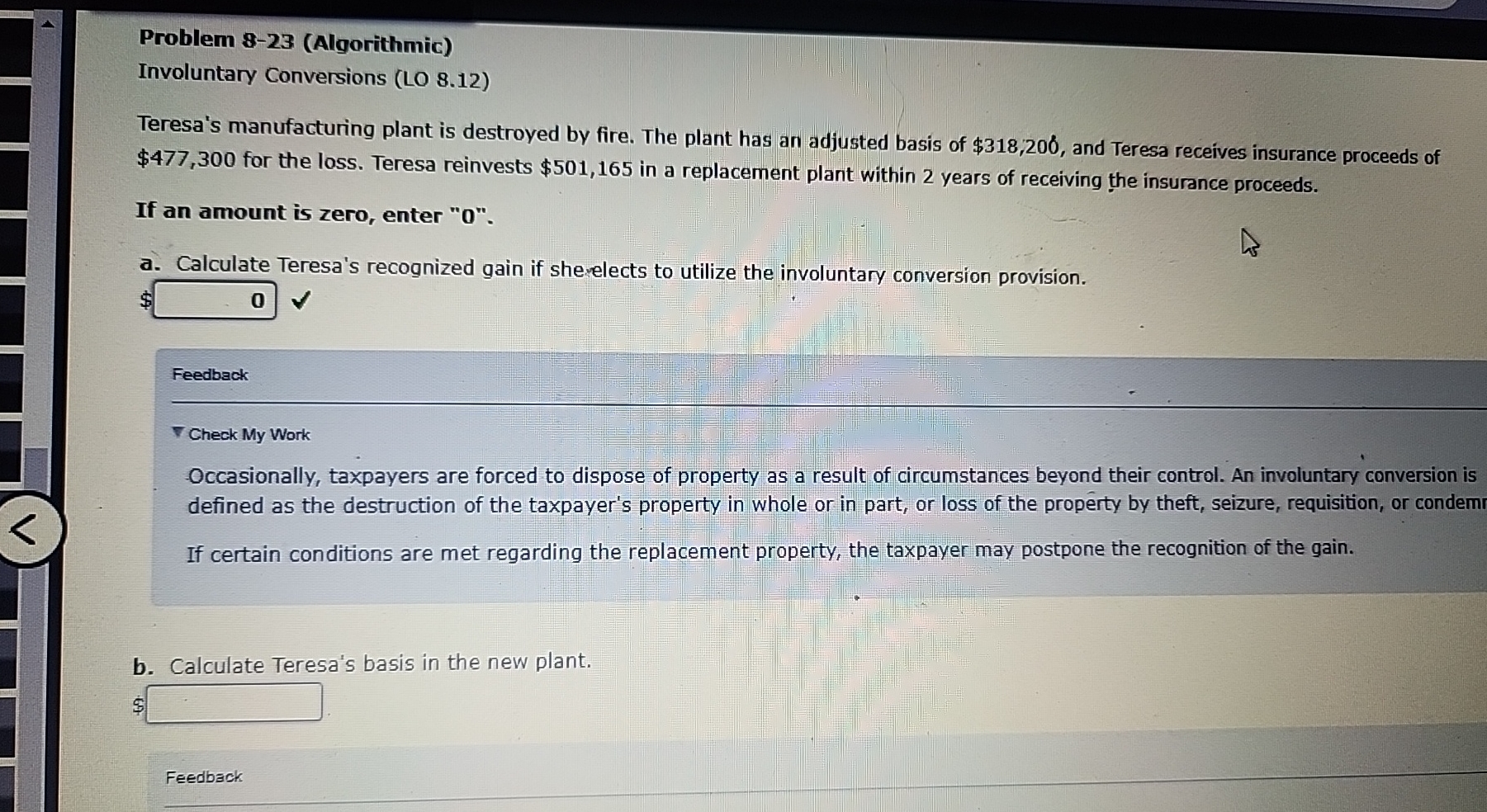

Teresa's manufacturing plant is destroyed by fire. The plant has an adjusted basis of $ and Teresa receives insurance proceeds of $ for the loss. Teresa reinvests $ in a replacement plant within years of receiving the insurance proceeds.

If an amount is zero, enter

a Calculate Teresa's recognized gain if sherelects to utilize the involuntary conversion provision.

$

Feedback

Check My Work

Occasionally, taxpayers are forced to dispose of property as a result of circumstances beyond their control. An involuntary conversion is defined as the destruction of the taxpayer's property in whole or in part, or loss of the property by theft, seizure, requisition, or condemr

If certain conditions are met regarding the replacement property, the taxpayer may postpone the recognition of the gain.

b Calculate Teresa's basis in the new plant.

Feedback

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock