Question: Problem 8 - 4 6 ( LO . 2 , 4 , 9 ) Dennis Harding is considering acquiring a new automobile that he will

Problem LO

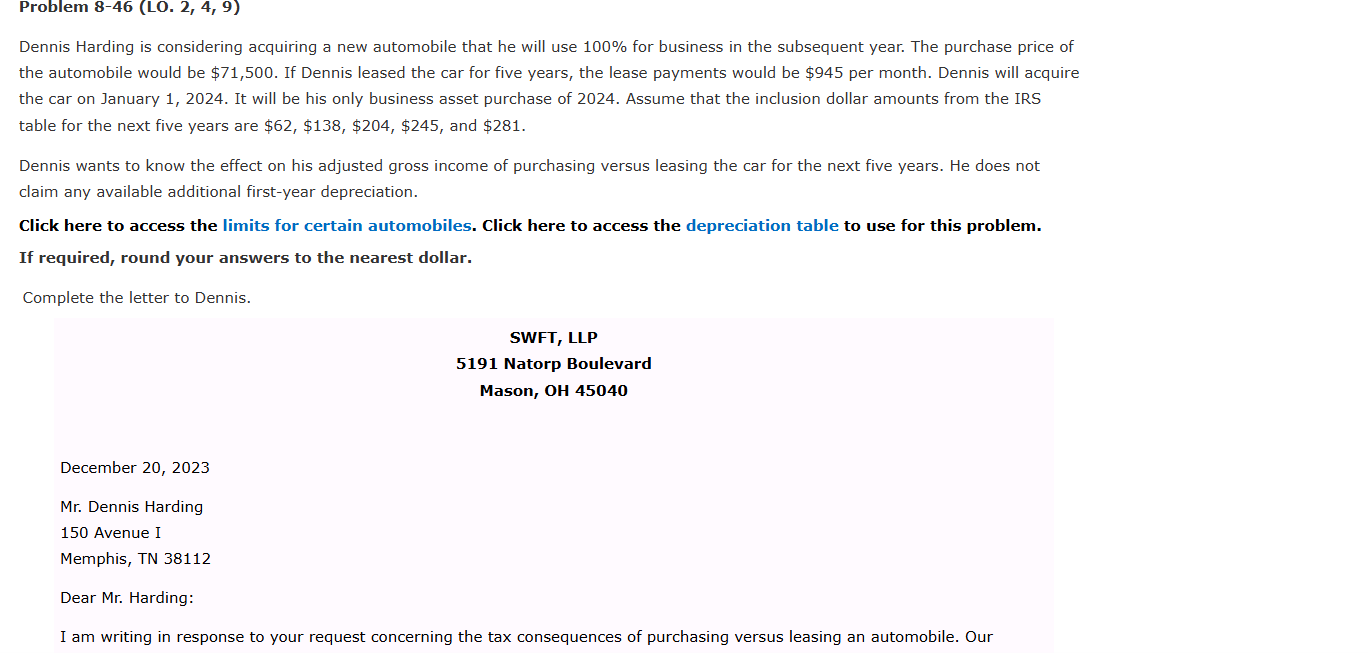

Dennis Harding is considering acquiring a new automobile that he will use for business in the subsequent year. The purchase price of the automobile would be $ If Dennis leased the car for five years, the lease payments would be $ per month. Dennis will acquire the car on January It will be his only business asset purchase of Assume that the inclusion dollar amounts from the IRS table for the next five years are $ $ $ $ and $

Dennis wants to know the effect on his adjusted gross income of purchasing versus leasing the car for the next five years. He does not claim any available additional firstyear depreciation.

Click here to access the limits for certain automobiles. Click here to access the depreciation table to use for this problem.

If required, round your answers to the nearest dollar.

Complete the letter to Dennis.

SWFT LLP

Natorp Boulevard

Mason, OH

December

Mr Dennis Harding

Avenue I

Memphis, TN

Dear Mr Harding:

I am writing in response to your request concerning the tax consequences of purchasing versus leasing an automobile. Our December

Mr Dennis Harding

Avenue I

Memphis, TN

Dear Mr Harding:

I am writing in response to your request concerning the tax consequences of purchasing versus leasing an automobile. Our calculations are based on the data you provided in our telephone conversation.

If the automobile is purchased, the total cost recovery deductions for the five years will be $ X If the automobile is leased, lease payment deductions will total ddagger checkmark In addition, you also must include a total $ mathbfX in your gross income.

If you need additional information or clarification of our calculations, please contact us

Sincerely yours,

Ishita J Jones, CPA

Partner TAX FILE MEMORANDUM

DATE: December

FROM: Ishita J Jones

SUBJECT: Dennis Harding: Calculation of lease versus purchase

Facts Dennis Harding is considering purchasing or leasing an automobile on January The purchase price of the automobile is $ The lease payments for five years would be $ per month. Dennis wants to know the effect on his adjusted gross income for purchasing versus leasing the automobile for five years. Calculations

Purchase: Cost recovery deductions

Total cost recovery deductions

If leased:

Total lease payments

Inclusion dollar amounts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock