Question: Problem 8 - 4 B Preparing a bank reconciliation and recording entries P 3 The following information is available to reconcile Severino Co . s

Problem B

Preparing a bank reconciliation and recording entries

P

The following information is available to reconcile Severino Cos book balance of cash with its bank statement cash balance as of December

a The December cash balance according to the accounting records is $ and the bank statement cash balance for that date is $

b Check No for $ Check No for $ and Check No for $ are outstanding checks as of December

c Check No had been correctly drawn for $ to pay for office supplies but was erroneously entered in the accounting records as $

d The bank statement shows a $ NSF check received from a customer, Titus Industries, in payment of its account. The statement also shows a $ bank fee in miscellaneous expenses for check printing. Severino had not yet recorded these transactions.

e The bank statement shows that the bank collected $ cash on a note receivable for the company. Severino did not record this transaction before receiving the statement.

f Severinos December daily cash receipts of $ were placed in the banks night depository on that date but do not appear on the December bank statement.

Required!!!

Prepare the bank reconciliation for this company as of December

Prepare the journal entries necessary to make the companys book balance of cash equal to the reconciled cash balance as of December

Check Reconciled balance, $; Cr Notes Receivable, $ Alexander ImageShutterstock

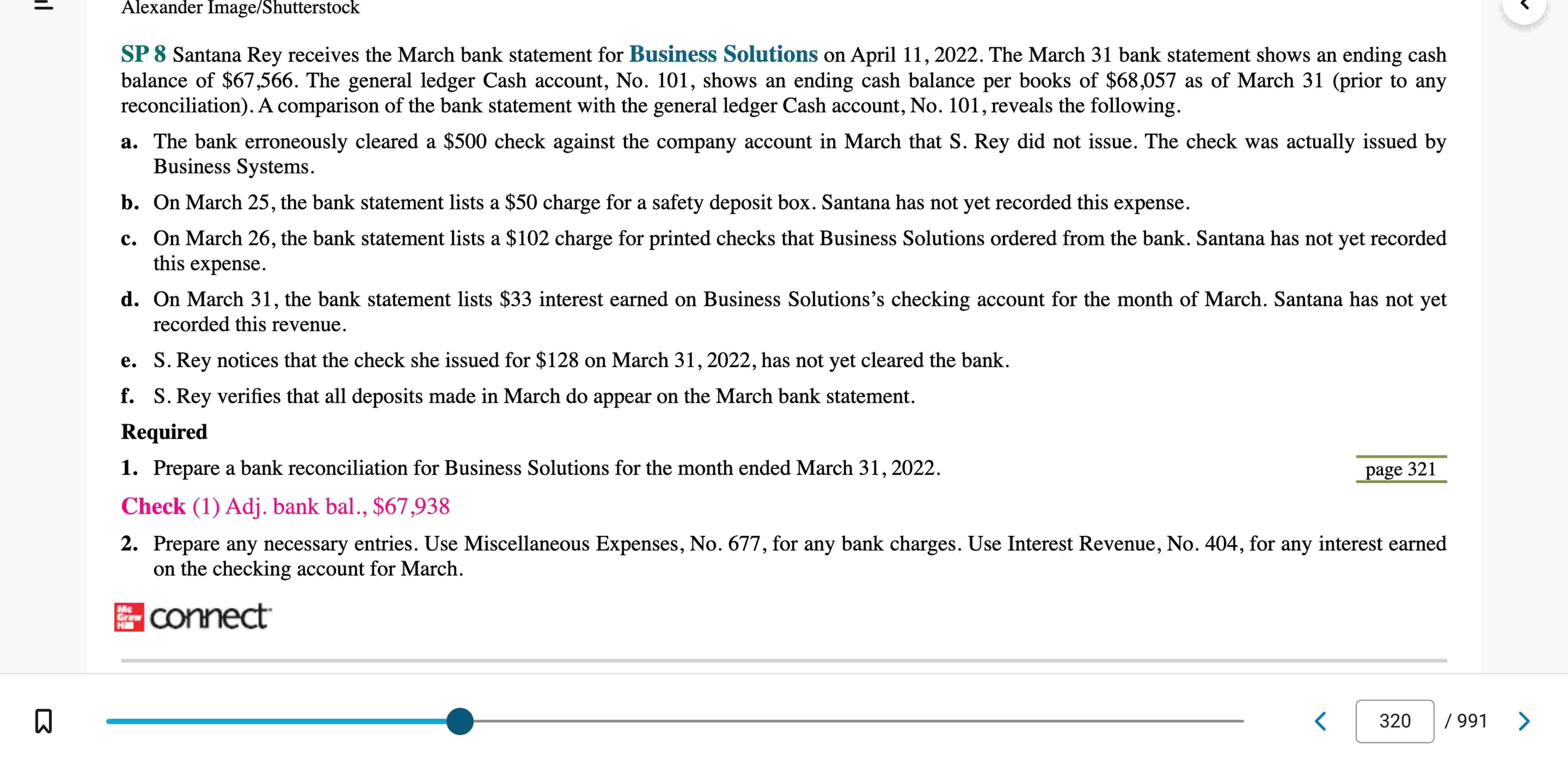

SP Santana Rey receives the March bank statement for Business Solutions on April The March bank statement shows an ending cash balance of $ The general ledger Cash account, No shows an ending cash balance per books of $ as of March prior to any reconciliation A comparison of the bank statement with the general ledger Cash account, No reveals the following.

a The bank erroneously cleared a $ check against the company account in March that S Rey did not issue. The check was actually issued by Business Systems.

b On March the bank statement lists a $ charge for a safety deposit box. Santana has not yet recorded this expense.

c On March the bank statement lists a $ charge for printed checks that Business Solutions ordered from the bank. Santana has not yet recorded this expense.

d On March the bank statement lists $ interest earned on Business Solutions's checking account for the month of March. Santana has not yet recorded this revenue.

e S Rey notices that the check she issued for $ on March has not yet cleared the bank.

f S Rey verifies that all deposits made in March do appear on the March bank statement.

Required

Prepare a bank reconciliation for Business Solutions for the month ended March

Check Adj. bank bal., $

Prepare any necessary entries. Use Miscellaneous Expenses, No for any bank charges. Use Interest Revenue, No for any interest earned on the checking account for March.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock