Question: Problem 8 - 6 3 Part a ( Algo ) Assessment Tool iFrame Required information Problem 8 - 6 3 ( LO 8 - 1

Problem Part a Algo Assessment Tool iFrame

Required information

Problem LO LO Algo

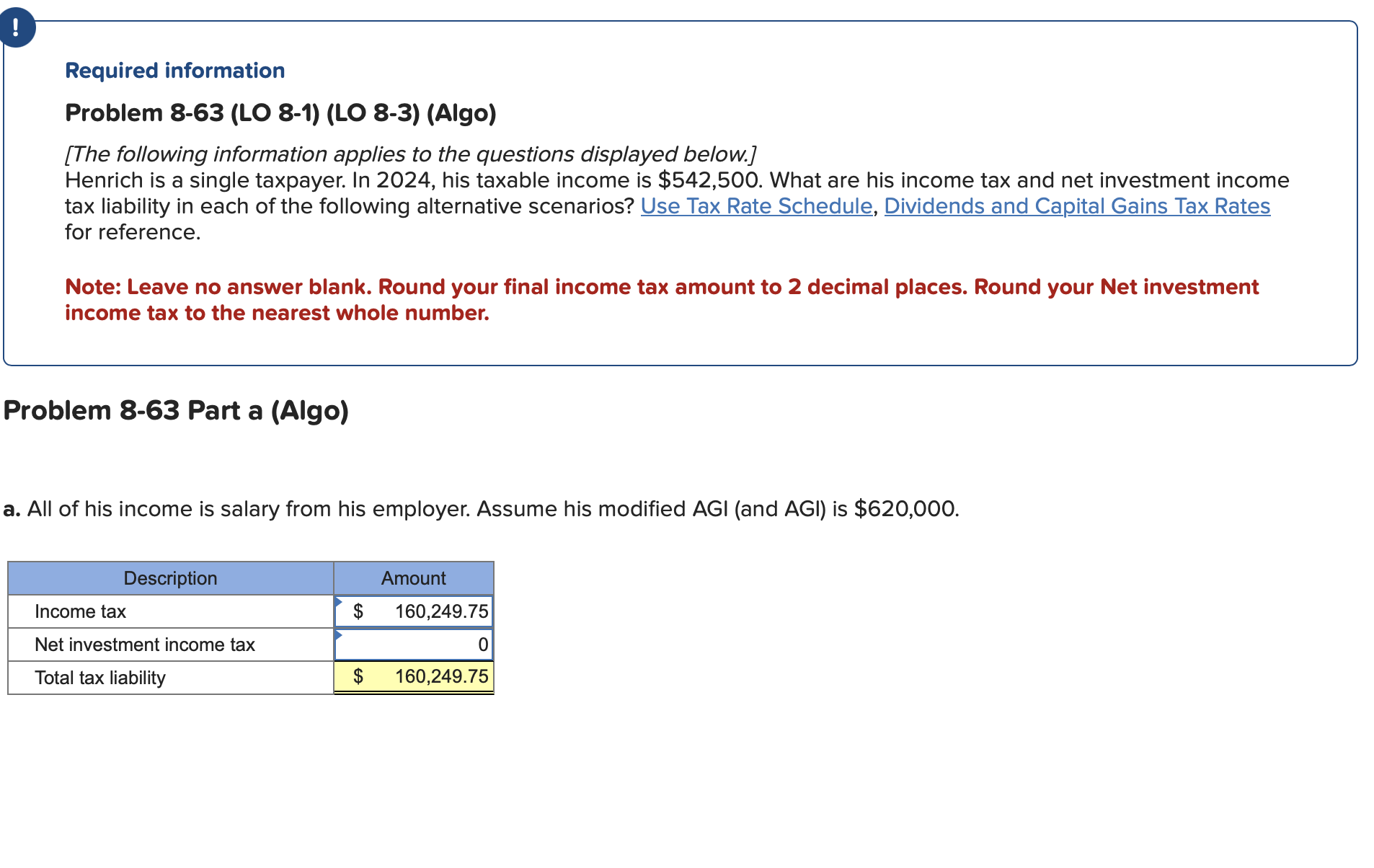

The following information applies to the questions displayed below.

Henrich is a single taxpayer. In his taxable income is $ What are his income tax and net investment income

tax liability in each of the following alternative scenarios? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates

for reference.

Note: Leave no answer blank. Round your final income tax amount to decimal places. Round your Net investment

income tax to the nearest whole number.

Problem Part b Algo

b His $ of taxable income includes $ of longterm capital gain that is taxed at preferential rates, and $ of

deductible state income taxes. Assume his modified AGI and AGI is $ Problem Part c Algo

c His $ of taxable income includes $ of longterm capital gain that is taxed at preferential rates, and $ of

deductible state income taxes. Assume his modified AGI and AGI is $ Required information

Problem LO LO Algo

The following information applies to the questions displayed below.

Henrich is a single taxpayer. In his taxable income is $ What are his income tax and net investment income

tax liability in each of the following alternative scenarios? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates

for reference.

Note: Leave no answer blank. Round your final income tax amount to decimal places. Round your Net investment

income tax to the nearest whole number.

Problem Part d Algo

d Henrich has $ of taxable income, which includes $ of longterm capital gain that is taxed at preferential rates, and

$ of deductible state income taxes. Assume his modified AGI and AGI is $

a All of his income is salary from his employer. Assume his modified AGI and AGI is $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock