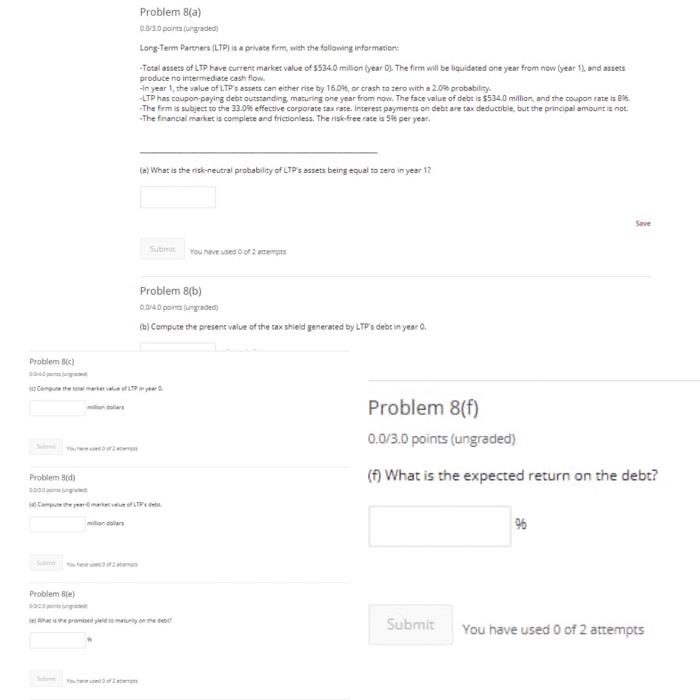

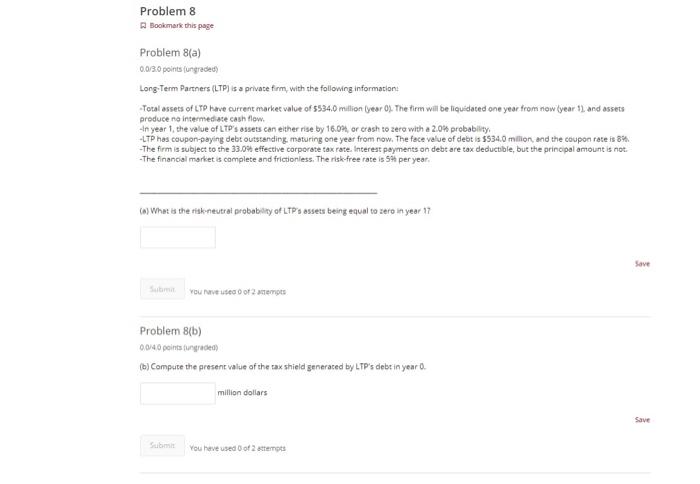

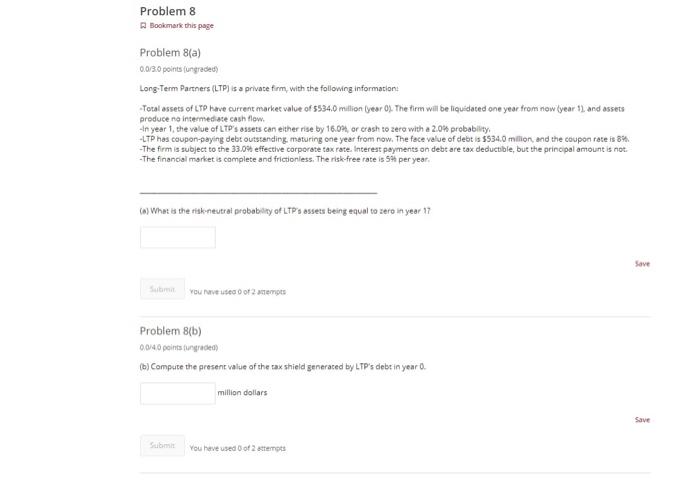

Question: Problem 8 Bookmark this page Problem 8(a) 0.0/3.0 points (ungraded Long-Term Partners (LTP) is a private firm, with the following information: -Total assets of LTP

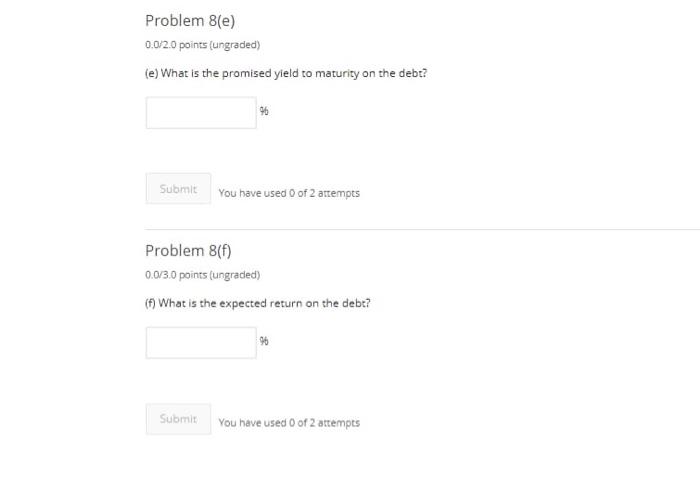

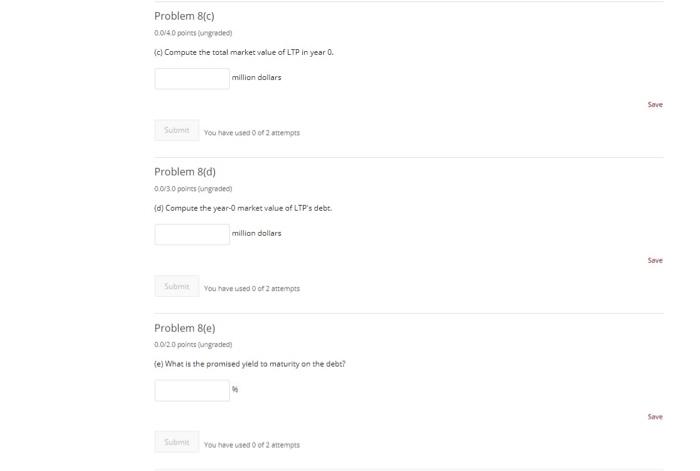

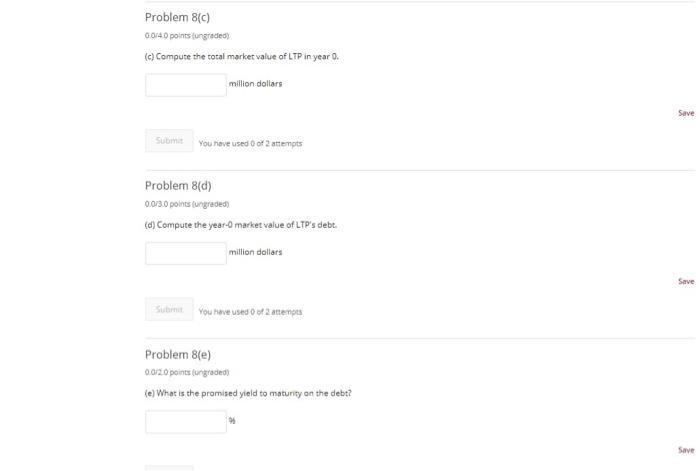

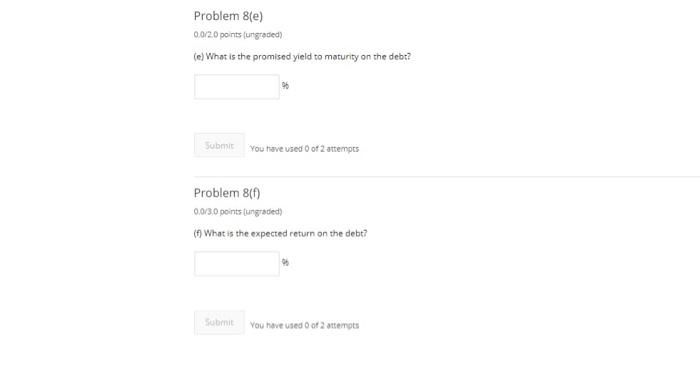

Problem 8(a) 0.0/3.0 points graded Long-Term Partners (LTP) is a private tirm, with the following information: -Total assets of LTP have current market value of 534.0 milion year Oj. The firm will be liquidated one year from now (year 1). and assets produce no intermediate cash flow. -in year 1, the value of LTP's assets can either rise by 16.04, or crash to zero with a 2.0% probability. -LTP has coupon paying debt outstanding maturing one year from now. The face value of debt is $534.0 million, and the coupon rate is 8% -The firm is subject to the 33.0% effective corporate tax rate. Interest payments on debt are tax deductible, but the principal amount is not -The financial market is complete and frictionless. The risk-free race is 5ie per year. (a) What is the risk-neutral probability of LTP's assets being equal to zero in year 17 Save Sum You have used forms Problem 8(b) 0.0HD points ungrades (b) Compute the present value of the tax shield generated by LTP's debe in year , Problem 8c) no Problem 8(f) 0.0/3.0 points (ungraded) (f) What is the expected return on the debt? Problem (d) C Cemeye 96 Problem Ble) der Woche promised lety on the debe Submit You have used 0 of 2 attempts Problem 8(e) 0.0/2.0 points (ungraded) (e) What is the promised yield to maturity on the debt? 96 Submit You have used of 2 attempts Problem 8(f) 0.0/3.0 points (ungraded) (f) What is the expected return on the debt? 96 Submit You have used 0 of 2 attempts Problem 8(c) 0.014 points onde (c) Compute the total market value of LTP in year 0. million dollars Save You have used of attempts Problem 8(d) 0.0/3.0 points ungraded (0) Compute the year market value of LTP's debt million dollars Save You have used of attempts Problem 8(e) 00:25 points ungrade (e) What is the promised yield to maturity on the debt? Save You have used of 2 temps Problem 8 Bookmark this page Problem 8(a) 0.0/3.0 points fungraded Long-Term Partners (LTP) is a private firm, with the following information: Total assets of LT have current market value of 5534.0 million (year (). The firm will be liquidated one year from now year 1). and assets produce no intermediate cash flow. In year 1, the value of LTP's assets can either rise by 16.09, or crash to zero with a 2.0% probability -LTP has coupon-paying debt outstanding, maturing one year from now. The face value of debt is $534.0 million, and the coupon rate is 8 -The firm is subject to the 33.0% effective corporate tax rate. Interest payments on debt are tax deductible, but the principal amount is not -The financial market is complete and frictionless. The risk-free rate is 5% per year. (a) What is the risk neutrai probability of LTP's assets being equal to zero in year 17 Save Som You are use of 2 temps Problem 8(b) 00140 points ingredie (b) Compute the present value of the tax shield generated by LTP's debt in your million dollars Save You have used of 2 tots Problem 8 Bookmark this page Problem 8(a) 0.0/3.0 points fungraded Long-Term Partners (LTP) is a private firm, with the following information: Total assets of LT have current market value of 5534.0 million (year (). The firm will be liquidated one year from now year 1). and assets produce no intermediate cash flow. In year 1, the value of LTP's assets can either rise by 16.09, or crash to zero with a 2.0% probability -LTP has coupon-paying debt outstanding, maturing one year from now. The face value of debt is $534.0 million, and the coupon rate is 8 -The firm is subject to the 33.0% effective corporate tax rate. Interest payments on debt are tax deductible, but the principal amount is not -The financial market is complete and frictionless. The risk-free rate is 5% per year. (a) What is the risk neutrai probability of LTP's assets being equal to zero in year 17 Save Som You are use of 2 temps Problem 8(b) 00140 points ingredie (b) Compute the present value of the tax shield generated by LTP's debt in your million dollars Save You have used of 2 tots Problem 8(c) 0.0/40 points ungraded) (c) Compute the total market value of LTP in year 0. million dollars Save Suome You have used 0 of 2 attempts Problem 8(d) 0.0/3.0 points ungraded (d) Compute the year market value of LTP's debt. million dollars Save Sube You have use of attempts Problem 8(e) 0.0/2.0 points ungraded (e) What is the promised yield to maturity on the debt? Save Problem 8(e) 0.0/2.0 points (ungraded (e) What is the promised yield to maturity on the debt? Submit You have used 0 of 2 attempts Problem 8(f 0.0/3.0 points ungraded ( What is the expected return on the debt? Submit You have used of attempts Problem 8(a) 0.0/3.0 points graded Long-Term Partners (LTP) is a private tirm, with the following information: -Total assets of LTP have current market value of 534.0 milion year Oj. The firm will be liquidated one year from now (year 1). and assets produce no intermediate cash flow. -in year 1, the value of LTP's assets can either rise by 16.04, or crash to zero with a 2.0% probability. -LTP has coupon paying debt outstanding maturing one year from now. The face value of debt is $534.0 million, and the coupon rate is 8% -The firm is subject to the 33.0% effective corporate tax rate. Interest payments on debt are tax deductible, but the principal amount is not -The financial market is complete and frictionless. The risk-free race is 5ie per year. (a) What is the risk-neutral probability of LTP's assets being equal to zero in year 17 Save Sum You have used forms Problem 8(b) 0.0HD points ungrades (b) Compute the present value of the tax shield generated by LTP's debe in year , Problem 8c) no Problem 8(f) 0.0/3.0 points (ungraded) (f) What is the expected return on the debt? Problem (d) C Cemeye 96 Problem Ble) der Woche promised lety on the debe Submit You have used 0 of 2 attempts Problem 8(e) 0.0/2.0 points (ungraded) (e) What is the promised yield to maturity on the debt? 96 Submit You have used of 2 attempts Problem 8(f) 0.0/3.0 points (ungraded) (f) What is the expected return on the debt? 96 Submit You have used 0 of 2 attempts Problem 8(c) 0.014 points onde (c) Compute the total market value of LTP in year 0. million dollars Save You have used of attempts Problem 8(d) 0.0/3.0 points ungraded (0) Compute the year market value of LTP's debt million dollars Save You have used of attempts Problem 8(e) 00:25 points ungrade (e) What is the promised yield to maturity on the debt? Save You have used of 2 temps Problem 8 Bookmark this page Problem 8(a) 0.0/3.0 points fungraded Long-Term Partners (LTP) is a private firm, with the following information: Total assets of LT have current market value of 5534.0 million (year (). The firm will be liquidated one year from now year 1). and assets produce no intermediate cash flow. In year 1, the value of LTP's assets can either rise by 16.09, or crash to zero with a 2.0% probability -LTP has coupon-paying debt outstanding, maturing one year from now. The face value of debt is $534.0 million, and the coupon rate is 8 -The firm is subject to the 33.0% effective corporate tax rate. Interest payments on debt are tax deductible, but the principal amount is not -The financial market is complete and frictionless. The risk-free rate is 5% per year. (a) What is the risk neutrai probability of LTP's assets being equal to zero in year 17 Save Som You are use of 2 temps Problem 8(b) 00140 points ingredie (b) Compute the present value of the tax shield generated by LTP's debt in your million dollars Save You have used of 2 tots Problem 8 Bookmark this page Problem 8(a) 0.0/3.0 points fungraded Long-Term Partners (LTP) is a private firm, with the following information: Total assets of LT have current market value of 5534.0 million (year (). The firm will be liquidated one year from now year 1). and assets produce no intermediate cash flow. In year 1, the value of LTP's assets can either rise by 16.09, or crash to zero with a 2.0% probability -LTP has coupon-paying debt outstanding, maturing one year from now. The face value of debt is $534.0 million, and the coupon rate is 8 -The firm is subject to the 33.0% effective corporate tax rate. Interest payments on debt are tax deductible, but the principal amount is not -The financial market is complete and frictionless. The risk-free rate is 5% per year. (a) What is the risk neutrai probability of LTP's assets being equal to zero in year 17 Save Som You are use of 2 temps Problem 8(b) 00140 points ingredie (b) Compute the present value of the tax shield generated by LTP's debt in your million dollars Save You have used of 2 tots Problem 8(c) 0.0/40 points ungraded) (c) Compute the total market value of LTP in year 0. million dollars Save Suome You have used 0 of 2 attempts Problem 8(d) 0.0/3.0 points ungraded (d) Compute the year market value of LTP's debt. million dollars Save Sube You have use of attempts Problem 8(e) 0.0/2.0 points ungraded (e) What is the promised yield to maturity on the debt? Save Problem 8(e) 0.0/2.0 points (ungraded (e) What is the promised yield to maturity on the debt? Submit You have used 0 of 2 attempts Problem 8(f 0.0/3.0 points ungraded ( What is the expected return on the debt? Submit You have used of attempts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts