Question: Problem 8: Discontinued Operations (12 points) Ubu, Inc., has two operating divisions; one manufactures custom hunting gear and the other breeds and sells Labrador Retrievers.

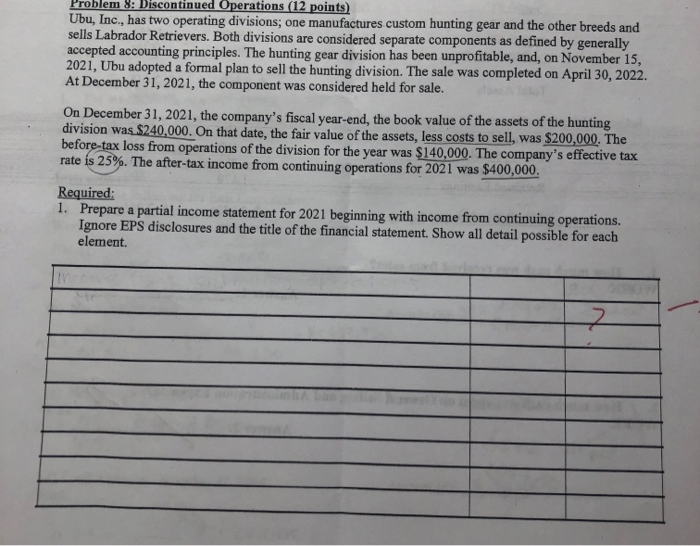

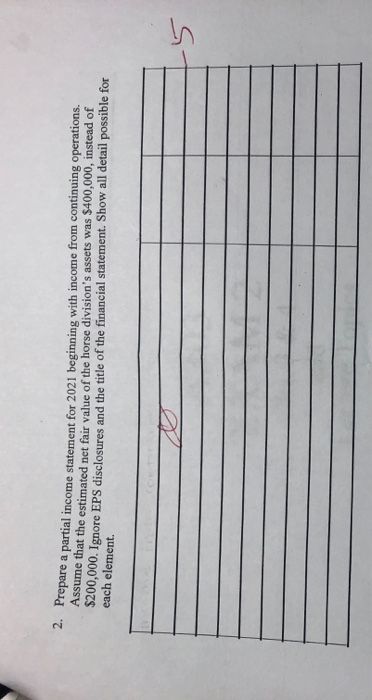

Problem 8: Discontinued Operations (12 points) Ubu, Inc., has two operating divisions; one manufactures custom hunting gear and the other breeds and sells Labrador Retrievers. Both divisions are considered separate components as defined by generally accepted accounting principles. The hunting gear division has been unprofitable, and, on November 15, 2021, Ubu adopted a formal plan to sell the hunting division. The sale was completed on April 30, 2022. At December 31, 2021, the component was considered held for sale. On December 31, 2021, the company's fiscal year-end, the book value of the assets of the hunting division was $240,000. On that date, the fair value of the assets, less costs to sell, was $200,000. The before-tax loss from operations of the division for the year was $140,000. The company's effective tax rate is 25%. The after-tax income from continuing operations for 2021 was $400,000 Required: 1. Prepare a partial income statement for 2021 beginning with income from continuing operations. Ignore EPS disclosures and the title of the financial statement. Show all detail possible for each element. 2. Prepare a partial income Frepare a partial income statement for 2021 beginning with income from continuing operations. Assume that the estimated net fair value of the horse division's assets was $400,000, instead of 3200,000. Ignore EPS disclosures and the title of the financial statement. Show all detail possible for each element

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts