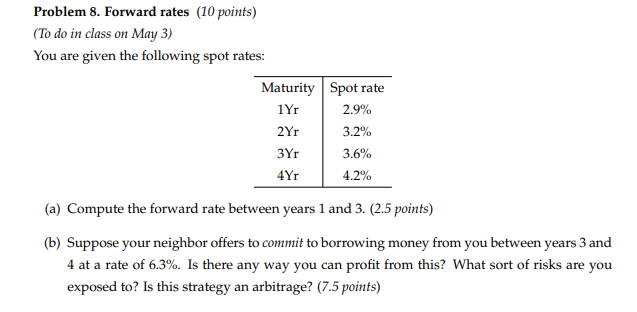

Question: Problem 8. Forward rates (10 points) (To do in class on May 3) You are given the following spot rates: Maturity Spot rate 1Yr 2.9%

Problem 8. Forward rates (10 points) (To do in class on May 3) You are given the following spot rates: Maturity Spot rate 1Yr 2.9% 2Yr 3.2% r 3.6% 4Yr 4.2% (a) Compute the forward rate between years 1 and 3. (2.5 points) (b) Suppose your neighbor offers to commit to borrowing money from you between years 3 and 4 at a rate of 6.3%. Is there any way you can profit from this? What sort of risks are you exposed to? Is this strategy an arbitrage? (7.5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts