Question: Problem 8: Given the following data: (Assume annual compounding or discounting) [Note: This is a graduated annuity problem where the inflation rate is also the

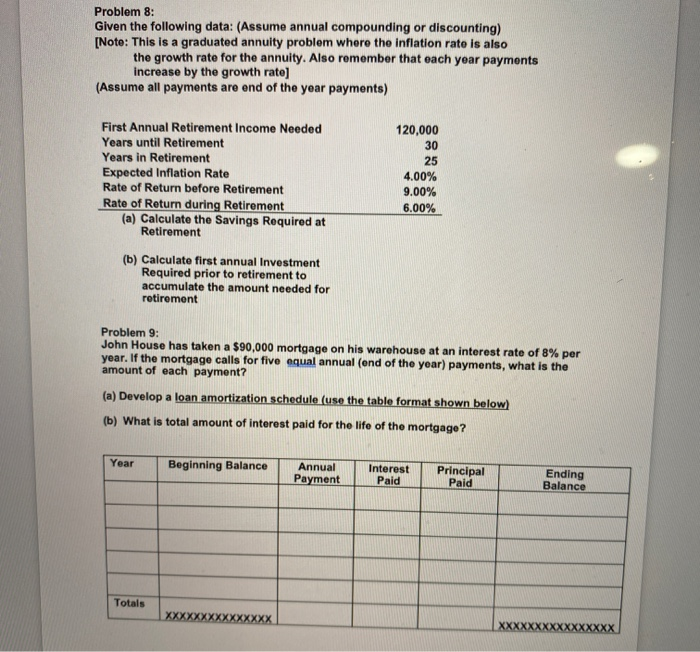

Problem 8: Given the following data: (Assume annual compounding or discounting) [Note: This is a graduated annuity problem where the inflation rate is also the growth rate for the annuity. Also remember that each year payments increase by the growth rato) (Assume all payments are end of the year payments) 120,000 30 25 First Annual Retirement Income Needed Years until Retirement Years in Retirement Expected Inflation Rate Rate of Return before Retirement Rate of Return during Retirement (a) Calculate the Savings Required at Retirement 4.00% 9.00% 6.00% (b) Calculate first annual Investment Required prior to retirement to accumulate the amount needed for retirement Problem 9: John House has taken a $90,000 mortgage on his warehouse at an interest rate of 8% per year. If the mortgage calls for five equal annual (end of the year) payments, what is the amount of each payment? (a) Develop a loan amortization schedule (use the table format shown below) (b) What is total amount of interest paid for the life of the mortgage? Year Beginning Balance Annual Payment Interest Paid Principal Paid Ending Balance Totals XX XXX XXXXX

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts