Question: Problem 8 >> . . Intro Due to high demand for wood, San Lorenzo Lumber is considering buying a new timber cutting machine to add

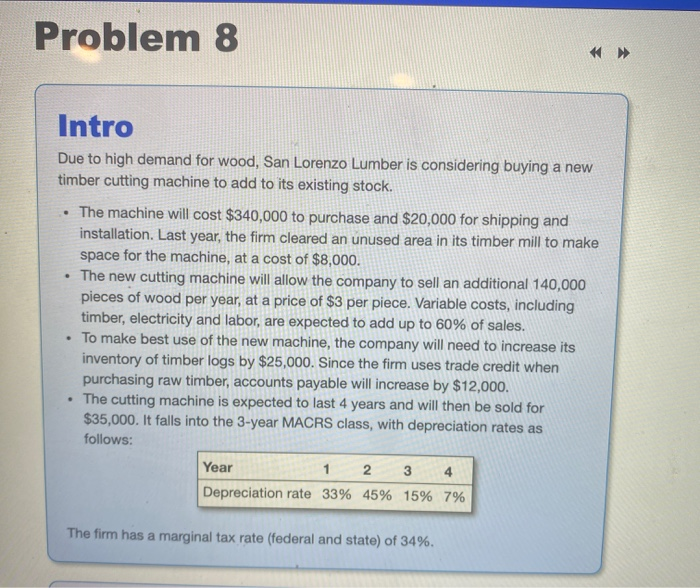

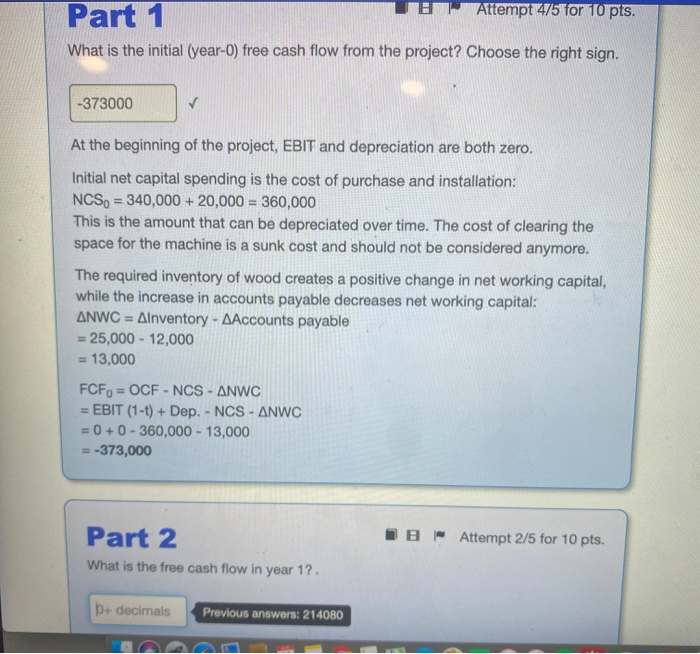

Problem 8 >> . . Intro Due to high demand for wood, San Lorenzo Lumber is considering buying a new timber cutting machine to add to its existing stock. The machine will cost $340,000 to purchase and $20,000 for shipping and installation. Last year, the firm cleared an unused area in its timber mill to make space for the machine, at a cost of $8,000. The new cutting machine will allow the company to sell an additional 140,000 pieces of wood per year, at a price of $3 per piece. Variable costs, including timber, electricity and labor, are expected to add up to 60% of sales. To make best use of the new machine, the company will need to increase its inventory of timber logs by $25,000. Since the firm uses trade credit when purchasing raw timber, accounts payable will increase by $12,000. The cutting machine is expected to last 4 years and will then be sold for $35,000. It falls into the 3-year MACRS class, with depreciation rates as follows: Year 1 2 Depreciation rate 33% 45% 15% 7% 3 The firm has a marginal tax rate (federal and state) of 34%. Part 1 Attempt 14/5 for 10 pts. What is the initial (year-o) free cash flow from the project? Choose the right sign. -373000 At the beginning of the project, EBIT and depreciation are both zero. Initial net capital spending is the cost of purchase and installation: NCS, = 340,000 + 20,000 = 360,000 This is the amount that can be depreciated over time. The cost of clearing the space for the machine is a sunk cost and should not be considered anymore. The required inventory of wood creates a positive change in net working capital, while the increase in accounts payable decreases net working capital: ANWC = Alnventory - Accounts payable = 25,000 - 12,000 = 13,000 FCF = OCF - NCS - ANWC = EBIT (1-t) + Dep. - NCS - ANWC = 0 + 0 - 360,000 - 13,000 = -373,000 IB Attempt 2/5 for 10 pts. Part 2 What is the free cash flow in year 1?. b+ decimals Previous answers: 214080 Suomit IB Attempt 1/5 for 10 pts. Part 3 What is the free cash flow in year 2? 0+ decimals Submit Te Attempt 1/5 for 10 pts. Part 4 What is the free cash flow in year 3? 0+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts