Question: Problem 8 * Part 3 IB Attempt 1/5 for 10 pts. What is the net operating profit after taxes in year 3 (in 5 million)?

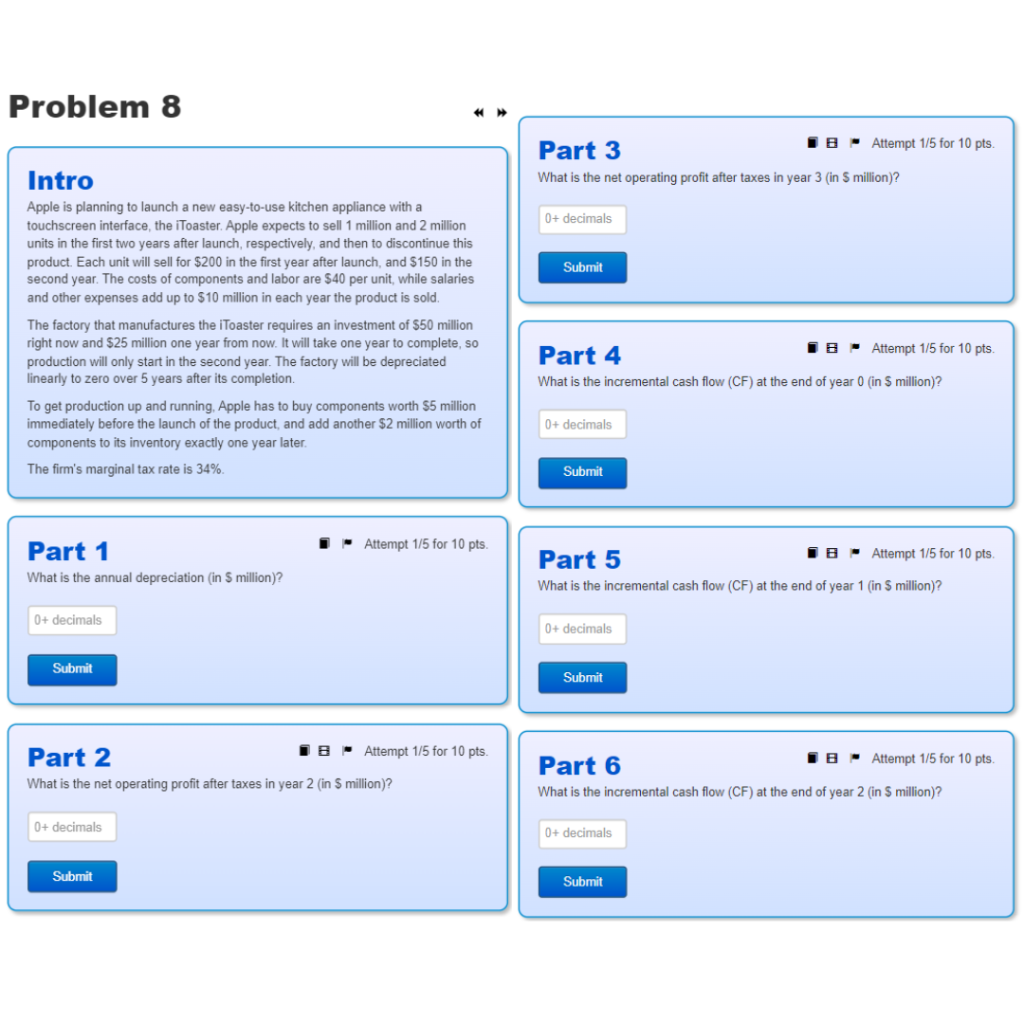

Problem 8 * Part 3 IB Attempt 1/5 for 10 pts. What is the net operating profit after taxes in year 3 (in 5 million)? 0+ decimals Submit Intro Apple is planning to launch a new easy-to-use kitchen appliance with a touchscreen interface, the iToaster. Apple expects to sell 1 million and 2 million units in the first two years after launch, respectively, and then to discontinue this product. Each unit will sell for $200 in the first year after launch, and $150 in the second year. The costs of components and labor are 540 per unit, while salaries and other expenses add up to $10 million in each year the product is sold. The factory that manufactures the Toaster requires an investment of $50 million right now and $25 million one year from now. It will take one year to complete, so production will only start in the second year. The factory will be depreciated linearly to zero over 5 years after its completion. To get production up and running, Apple has to buy components worth $5 million immediately before the launch of the product, and add another $2 million worth of components to its inventory exactly one year later. The firm's marginal tax rate is 34%. IB Attempt 175 for 10 pts. Part 4 What is the incremental cash flow (CF) at the end of year 0 in 5 million)? 0+ decimals Submit Attempt 1/5 for 10 pts. Part 1 What is the annual depreciation (in S million)? Part 5 IB- Attempt 1/5 for 10 pts What is the incremental cash flow (CF) at the end of year 1 (in 5 million)? 0+ decimals 0+ decimals Submit Submit B - Attempt 1/5 for 10 pts. Part 2 What is the net operating profit after taxes in year 2 (in 5 million)? B- Attempt 1/5 for 10 pts Part 6 What is the incremental cash flow (CF) at the end of year 2 in 5 million)? 0+ decimals 0+ decimals Submit Submit Problem 8 * Part 3 IB Attempt 1/5 for 10 pts. What is the net operating profit after taxes in year 3 (in 5 million)? 0+ decimals Submit Intro Apple is planning to launch a new easy-to-use kitchen appliance with a touchscreen interface, the iToaster. Apple expects to sell 1 million and 2 million units in the first two years after launch, respectively, and then to discontinue this product. Each unit will sell for $200 in the first year after launch, and $150 in the second year. The costs of components and labor are 540 per unit, while salaries and other expenses add up to $10 million in each year the product is sold. The factory that manufactures the Toaster requires an investment of $50 million right now and $25 million one year from now. It will take one year to complete, so production will only start in the second year. The factory will be depreciated linearly to zero over 5 years after its completion. To get production up and running, Apple has to buy components worth $5 million immediately before the launch of the product, and add another $2 million worth of components to its inventory exactly one year later. The firm's marginal tax rate is 34%. IB Attempt 175 for 10 pts. Part 4 What is the incremental cash flow (CF) at the end of year 0 in 5 million)? 0+ decimals Submit Attempt 1/5 for 10 pts. Part 1 What is the annual depreciation (in S million)? Part 5 IB- Attempt 1/5 for 10 pts What is the incremental cash flow (CF) at the end of year 1 (in 5 million)? 0+ decimals 0+ decimals Submit Submit B - Attempt 1/5 for 10 pts. Part 2 What is the net operating profit after taxes in year 2 (in 5 million)? B- Attempt 1/5 for 10 pts Part 6 What is the incremental cash flow (CF) at the end of year 2 in 5 million)? 0+ decimals 0+ decimals Submit Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts