Question: Problem 8 US GAAP addresses the Going Concern Assumption at ASC 2 0 5 - 4 0 . Among other items, ASC 2 0 5

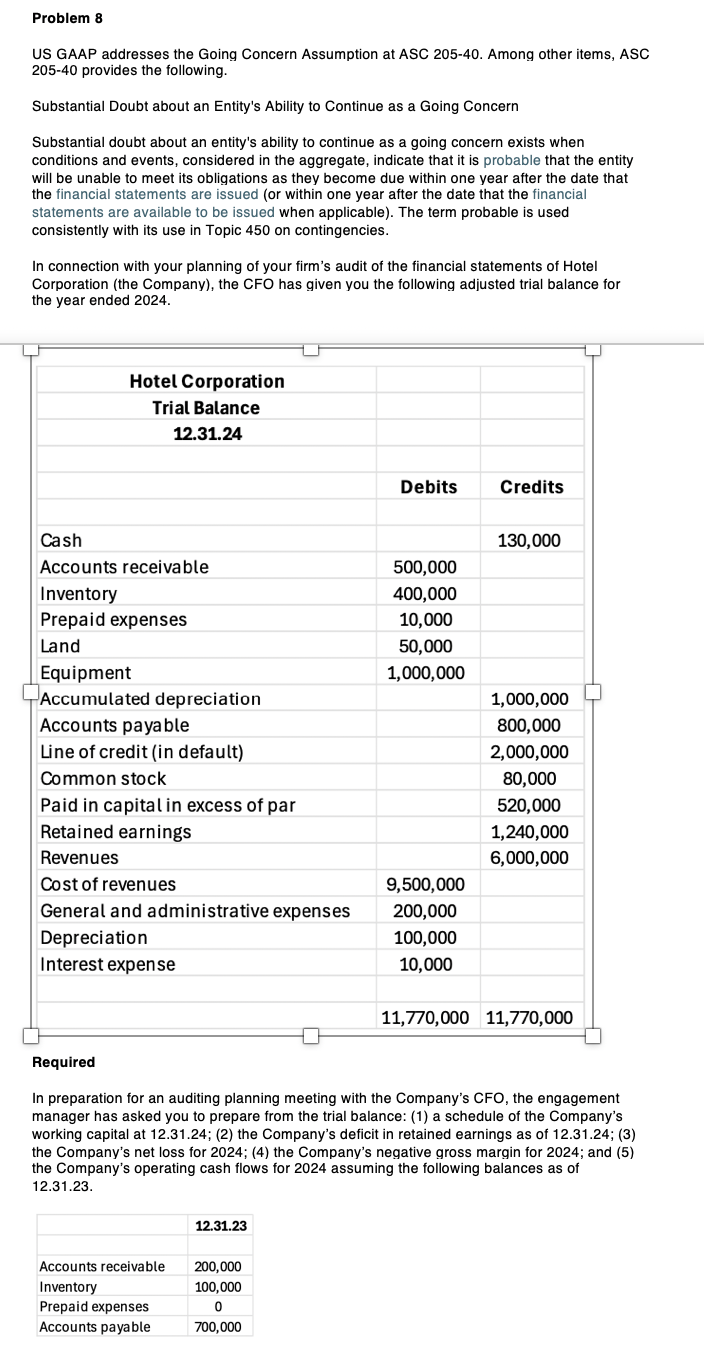

Problem US GAAP addresses the Going Concern Assumption at ASC Among other items, ASC provides the following. Substantial Doubt about an Entity's Ability to Continue as a Going Concern Substantial doubt about an entity's ability to continue as a going concern exists when conditions and events, considered in the aggregate, indicate that it is probable that the entity will be unable to meet its obligations as they become due within one year after the date that the financial statements are issued or within one year after the date that the financial statements are available to be issued when applicable The term probable is used consistently with its use in Topic on contingencies. In connection with your planning of your firms audit of the financial statements of Hotel Corporation the Company the CFO has given you the following adjusted trial balance for the year ended Required In preparation for an auditing planning meeting with the Companys CFO, the engagement manager has asked you to prepare from the trial balance: a schedule of the Companys working capital at ; the Companys deficit in retained earnings as of ; the Companys net loss for ; the Companys negative gross margin for ; and the Companys operating cash flows for assuming the following balances as of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock