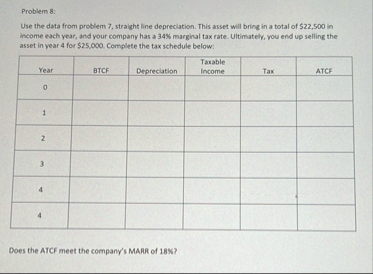

Question: Problem 8 : Use the data from problem 7 , straight line depreciation. This asset will bring in a total of $ 2 2 ,

Problem :

Use the data from problem straight line depreciation. This asset will bring in a total of $ in income each year, and your company has a marginal tax rate. Ultimately, you end up selling the asset in year for $ Complete the tax schedule below:

Does the ATCF meet the companys MARR of

UPDATED INFO:

Problem :

Your company is purchasing a piece of equipment for $ which will have a salvage value of $ after years. You have been asked to compare MACSS with Straightline depreciation. Complete the depreciation schedule below note that the equipment is considered a year asset with MACRSA What is the book value for the asset at the end of year using each method?

B What is the present value of the of the straight line depreciation assuming an interest rate

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock