Question: Problem 8: You entered a covered call strategy holding a long position of 1000 shares of PG (=Procter & Gamble Inc.) and a short position

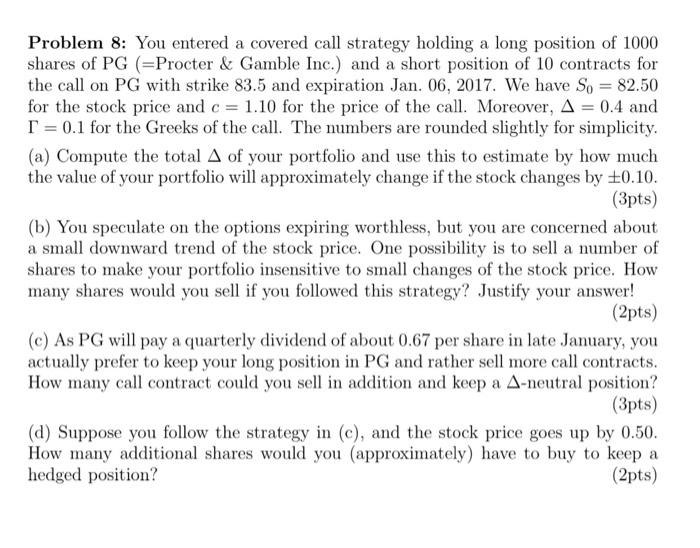

Problem 8: You entered a covered call strategy holding a long position of 1000 shares of PG (=Procter & Gamble Inc.) and a short position of 10 contracts for the call on PG with strike 83.5 and expiration Jan. 06, 2017. We have So = 82.50 for the stock price and c = 1.10 for the price of the call. Moreover, A = 0.4 and T = 0.1 for the Greeks of the call. The numbers are rounded slightly for simplicity. (a) Compute the total A of your portfolio and use this to estimate by how much the value of your portfolio will approximately change if the stock changes by +0.10. (3pts) (b) You speculate on the options expiring worthless, but you are concerned about a small downward trend of the stock price. One possibility is to sell a number of shares to make your portfolio insensitive to small changes of the stock price. How many shares would you sell if you followed this strategy? Justify your answer! (2pts) (c) As PG will pay a quarterly dividend of about 0.67 per share in late January, you actually prefer to keep your long position in PG and rather sell more call contracts. How many call contract could you sell in addition and keep a A-neutral position? (3pts) (d) Suppose you follow the strategy in (c), and the stock price goes up by 0.50. How many additional shares would you (approximately have to buy to keep a hedged position? (2pts) Problem 8: You entered a covered call strategy holding a long position of 1000 shares of PG (=Procter & Gamble Inc.) and a short position of 10 contracts for the call on PG with strike 83.5 and expiration Jan. 06, 2017. We have So = 82.50 for the stock price and c = 1.10 for the price of the call. Moreover, A = 0.4 and T = 0.1 for the Greeks of the call. The numbers are rounded slightly for simplicity. (a) Compute the total A of your portfolio and use this to estimate by how much the value of your portfolio will approximately change if the stock changes by +0.10. (3pts) (b) You speculate on the options expiring worthless, but you are concerned about a small downward trend of the stock price. One possibility is to sell a number of shares to make your portfolio insensitive to small changes of the stock price. How many shares would you sell if you followed this strategy? Justify your answer! (2pts) (c) As PG will pay a quarterly dividend of about 0.67 per share in late January, you actually prefer to keep your long position in PG and rather sell more call contracts. How many call contract could you sell in addition and keep a A-neutral position? (3pts) (d) Suppose you follow the strategy in (c), and the stock price goes up by 0.50. How many additional shares would you (approximately have to buy to keep a hedged position? (2pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts