Question: Problem 8-1 (algorithmic) T-Bill Yields 2009. The interest yields on U.S. Treasury securities in early 2009 fell to very low levels as a result of

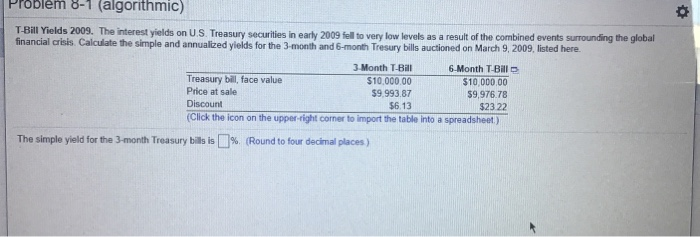

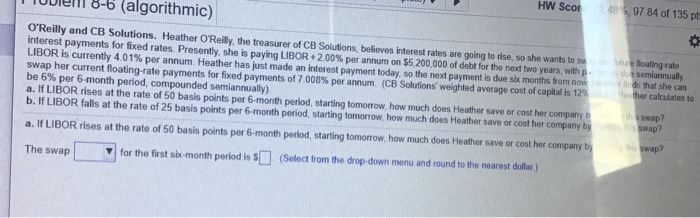

Problem 8-1 (algorithmic) T-Bill Yields 2009. The interest yields on U.S. Treasury securities in early 2009 fell to very low levels as a result of the combined events surrounding the global financial crisis. Calculate the simple and annualized yields for the 3-month and 6-month Tresury bills auctioned on March 9, 2009, listed here. 3 Month T-Ball 6-Month T-Bill Treasury bill, face value $10,000.00 $10,000.00 Price at sale $9.993.87 $9,976.78 Discount $6.13 $2322 (Click the icon on the upper right corner to import the table into a spreadsheet) The simple yield for the 3-month Treasury bills is 1 % (Round to four decimal places) HW Scor 48 5,97 84 of 135 pt- 8-6 (algorithmic) O'Reilly and CB Solutions. Heather O'Reilly, the treasurer of CB Solutions, believes interest rates are going to rise, so she wants to see floating-rate interest payments for fixed rates Presently, she is paying LIBOR +2.00% per annum on $5,200,000 of debt for the next two years with pasemiannually LIBOR is currently 4.01% per annum Heather has just made an interest payment today, so the next payment is due sibx months from now that she can swap her current floating-rate payments for fored payments of 7.008% per annum. (CB Solutions weighted average cost of capital is 12% other calculates to be 6% per 6-month period, compounded semiannually) a. If LIBOR rises at the rate of 50 basis points per 6-month period, starting tomorrow, how much does Heather save or cost her company Swap? b. If LIBOR falls at the rate of 25 basis points per 6-month period, starting tomorrow, how much does Heather save or cost her company by swap? a. If LIBOR rises at the rate of 50 basis points per 6-month period, starting tomorrow how much does Heather save or cost her company by die swap? The swap for the first see-month period is $(Select from the drop-down menu and round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts