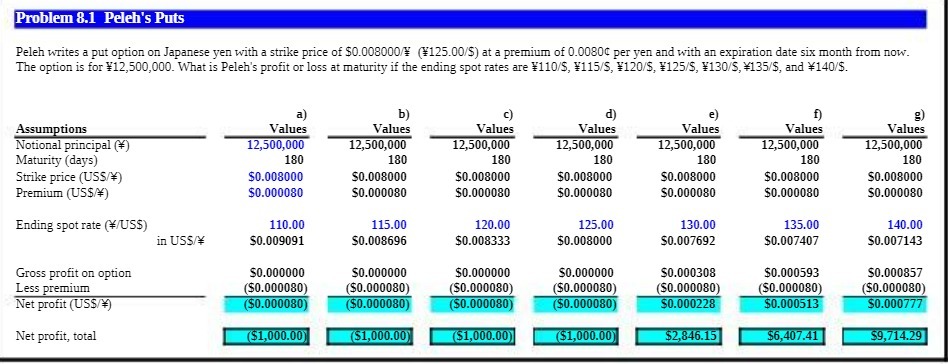

Question: Problem 8.1 Peleh's Puts Peleh writes a put option on Japanese yen with a strike price of $0.008000/Y (V125.00/$) at a premium of 0.00804 per

Problem 8.1 Peleh's Puts Peleh writes a put option on Japanese yen with a strike price of $0.008000/Y (V125.00/$) at a premium of 0.00804 per yen and with an expiration date six month from now. The option is for V12,500,000. What is Peleh's profit or loss at maturity if the ending spot rates are V110/$, V115/5, Y120/$, V125/$, V130/5, *135/$, and *140/$. a) b) c) d) e f) Assumptions Values Values Values Values Values Values Values Notional principal (#) 12,500,000 12,500,000 12,500,000 12,500,000 12,500,000 12,500,000 12,500,000 Maturity (days) 180 180 180 180 180 180 180 Strike price (USS/!) $0.008000 $0.008000 $0.008000 $0.008000 $0.008000 $0.008000 $0.008000 Premium (US$/#) $0.000080 $0.000080 $0.000080 $0.000080 $0.000080 $0.000080 $0.000080 Ending spot rate (#/US$) 110.00 115.00 120.00 125.00 130.00 135.00 140.00 in USS/Y $0.009091 $0.008696 $0.008333 $0.008000 $0.007692 $0.007407 $0.007143 Gross profit on option $0.000000 $0.000000 $0.000000 $0.000000 $0.000308 $0.000593 $0.000857 Less premium ($0.000080) ($0.000080 ($0.000080) ($0.000080) ($0.000080) ($0.000080) ($0.000080) Net profit (USS/#) ($0.000080) ($0.000080) ($0.000080) ($0.000080) $0.000228 $0.000513 $0.000777 Net profit, total $1,000.00) $1,000.00) ($1,000.00) ($1,000.00) $2,846.15 $6,407.41 $9,714.29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts