Question: Problem 8-13 Discounted Payback (L03) A project that costs $3,000 to install will provide annual cash flows of $800 for each of the next 6

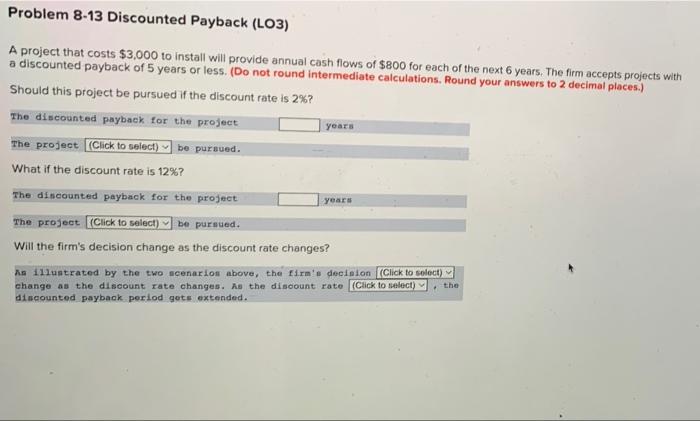

Problem 8-13 Discounted Payback (L03) A project that costs $3,000 to install will provide annual cash flows of $800 for each of the next 6 years. The firm accepts projects with a discounted payback of 5 years or less. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Should this project be pursued if the discount rate is 2%? The discounted payback for the project years The project (Click to select) be pursued. What if the discount rate is 12%? The discounted payback for the project The project [Click to select) be pursued. Will the firm's decision change as the discount rate changes? is illustrated by the two scenarios above, the firm's decision (Click to select) change as the discount rate changes. As the discount rate (Click to select) discounted payback period gets extended. years . the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts