Question: Problem 8-13 Modified Accelerated Cost Recovery System (MACRS), Election to Expense (LO 8.2, 8.3) Tom has a successful business with $100,000 of taxable income before

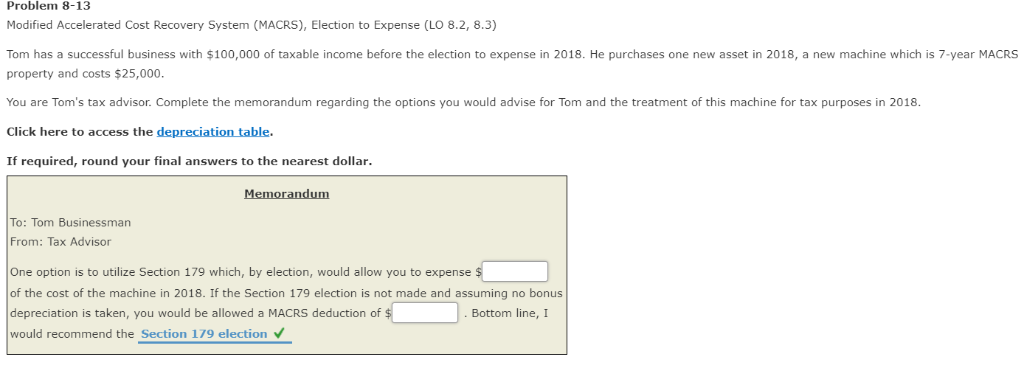

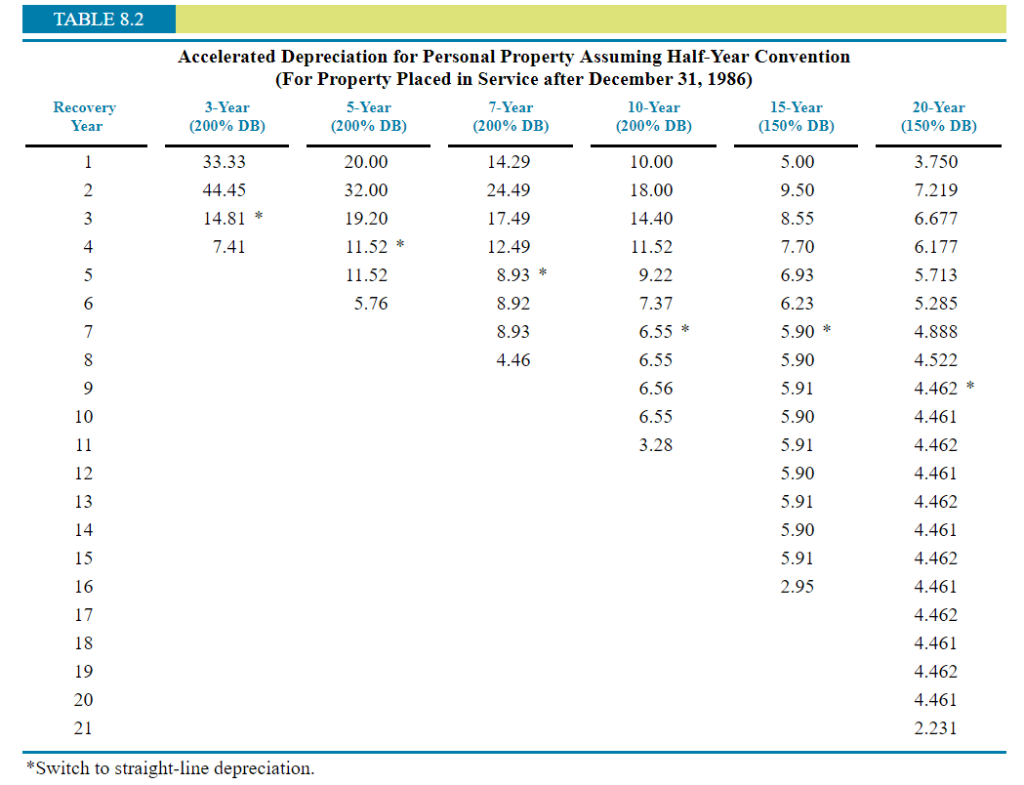

Problem 8-13 Modified Accelerated Cost Recovery System (MACRS), Election to Expense (LO 8.2, 8.3) Tom has a successful business with $100,000 of taxable income before the election to expense in 2018. He purchases one new asset in 2018, a new machine which is 7-year MACRS property and costs $25,000. You are Tom's tax advisor. Complete the memorandum regarding the options you would advise for Tom and the treatment of this machine for tax purposes in 2018. Click here to access the depreciation table. If required, round your final answers to the nearest dollar. Memorandum To: Tom Businessman From: Tax Advisor One option is to utilize Section 179 which, by election, would allow you to expense $ of the cost of the machine in 2018. If the Section 179 election is not made and assuming no bonus depreciation is taken, you would be allowed a MACRS deduction of $ . Bottom line, I would recommend the Section 179 election TABLE 8.2 Recovery Year 20-Year (150% DB) 6.93 Accelerated Depreciation for Personal Property Assuming Half-Year Convention (For Property Placed in Service after December 31, 1986) 3-Year 5-Year 7-Year 10-Year 15-Year (200% DB) (200% DB) (200% DB) (200% DB) (150% DB) 33.33 20.00 14.29 10.00 5.00 44.45 32.00 24.49 18.00 9.50 14.81 * 19.20 17.49 14.40 8.55 7.41 11.52 * 12.49 11.52 7.70 11.52 8.93 * 9.22 5.76 8.92 7.37 6.23 8.93 6.55 * 5.90 * 4.46 6.55 5.90 6.56 5.91 6.55 5.90 3.28 5.91 5.90 5.91 5.90 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 * 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231 5.91 2.95 *Switch to straight-line depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts