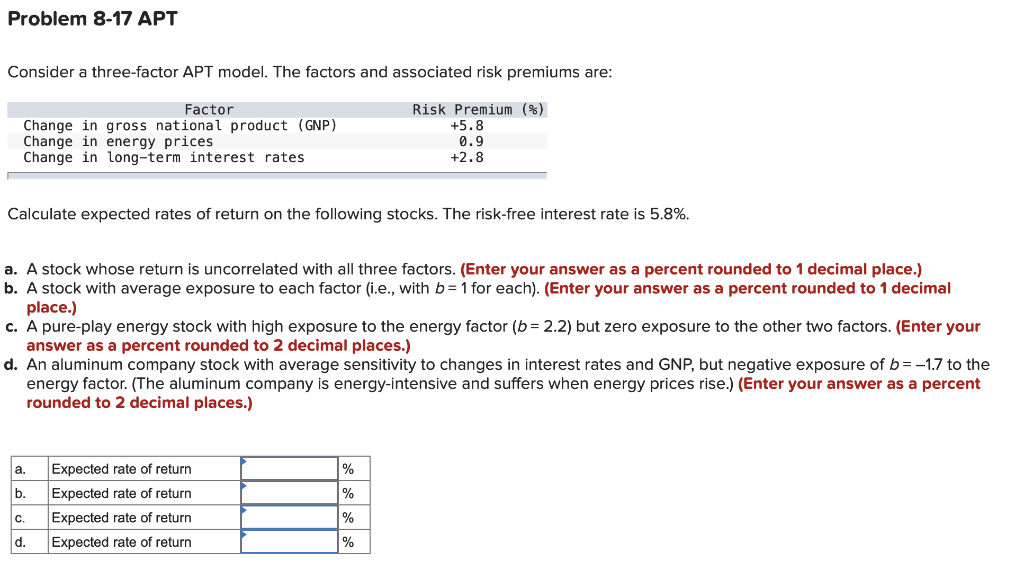

Question: Problem 8-17 APT Consider a three-factor APT model. The factors and associated risk premiums are: Factor Change in gross national product (GNP) Change in energy

Problem 8-17 APT Consider a three-factor APT model. The factors and associated risk premiums are: Factor Change in gross national product (GNP) Change in energy prices Change in long-term interest rates Risk Premium (%) +5.8 0.9 +2.8 Calculate expected rates of return on the following stocks. The risk-free interest rate is 5.8%. a. A stock whose return is uncorrelated with all three factors. (Enter your answer as a percent rounded to 1 decimal place.) b. A stock with average exposure to each factor (i.e., with b= 1 for each). (Enter your answer as a percent rounded to 1 decimal place.) c. A pure-play energy stock with high exposure to the energy factor (b = 2.2) but zero exposure to the other two factors. (Enter your answer as a percent rounded to 2 decimal places.) d. An aluminum company stock with average sensitivity to changes in interest rates and GNP, but negative exposure of b= -1.7 to the energy factor. (The aluminum company is energy-intensive and suffers when energy prices rise.) (Enter your answer as a percent rounded to 2 decimal places.) a. % b. % Expected rate of return Expected rate of return Expected rate of return Expected rate of return C. % % d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts