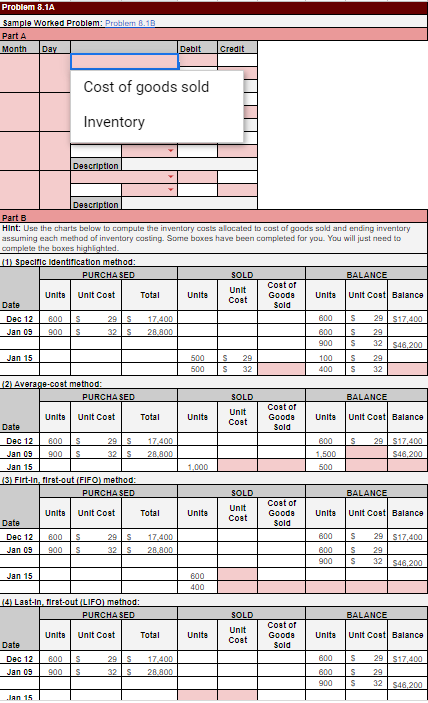

Question: Problem 8.1A. Please match boxes with boxes from the assignment with only answers from the drop down arrow options and proper credit/debit sides. Also please

Problem 8.1A. Please match boxes with boxes from the assignment with only answers from the drop down arrow options and proper credit/debit sides. Also please don't forget the dates and descriptions.

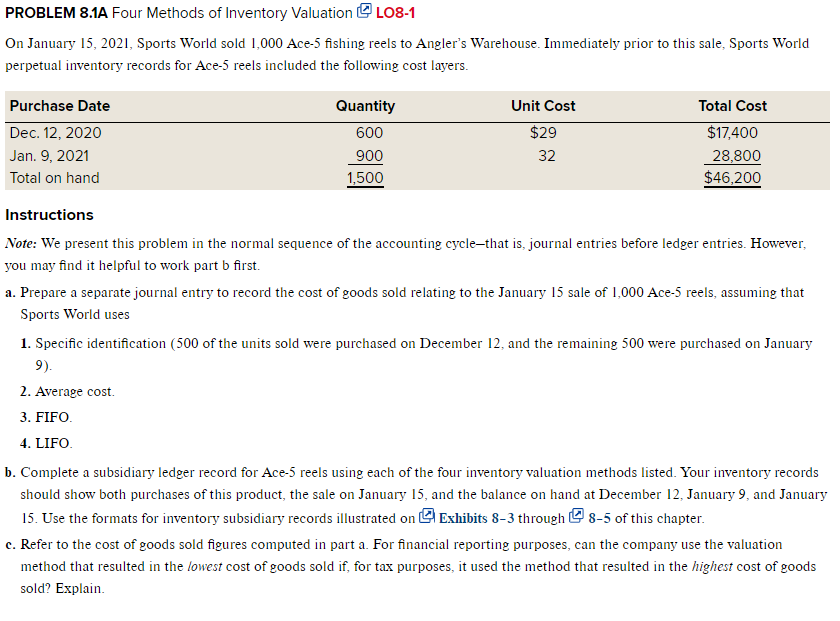

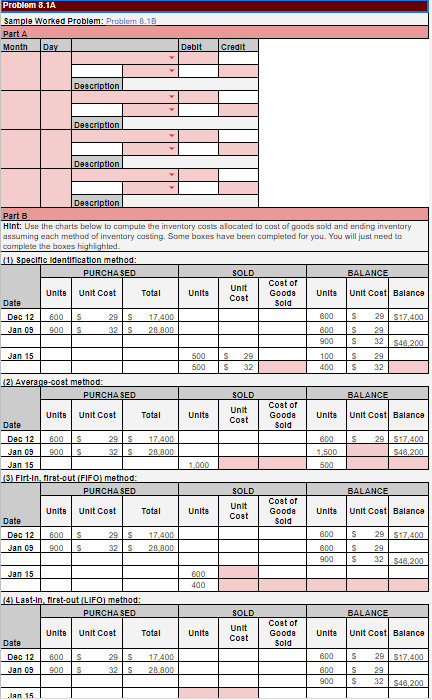

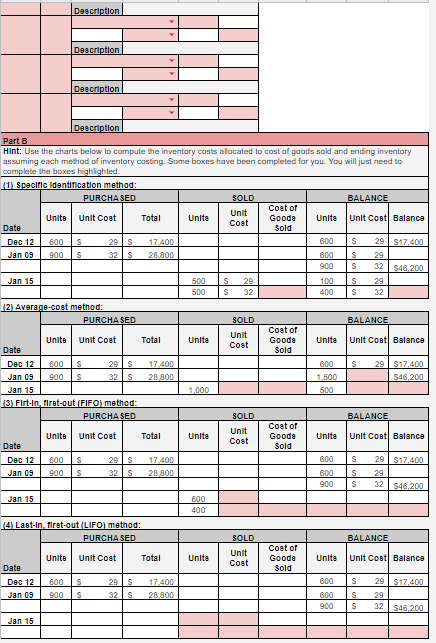

On January 15, 2021, Sports World sold 1,000 Ace-5 fishing reels to Angler's Warehouse. Immediately prior to this sale, Sports World perpetual inventory records for Ace-5 reels included the following cost layers. Instructions Note: We present this problem in the normal sequence of the accounting cycle-that is, journal entries before ledger entries. However, you may find it helpful to work part b first. a. Prepare a separate journal entry to record the cost of goods sold relating to the January 15 sale of 1,000 Ace-5 reels, assuming that Sports World uses 1. Specific identification ( 500 of the units sold were purchased on December 12 , and the remaining 500 were purchased on January 9). 2. Average cost. 3. FIFO. 4. LIFO. b. Complete a subsidiary ledger record for Ace-5 reels using each of the four inventory valuation methods listed. Your inventory records should show both purchases of this product, the sale on January 15, and the balance on hand at December 12, January 9 , and January 15. Use the formats for inventory subsidiary records illustrated on Exhibits 8-3 through 85 of this chapter. c. Refer to the cost of goods sold figures computed in part a. For financial reporting purposes, can the company use the valuation method that resulted in the lowest cost of goods sold if, for tax purposes, it used the method that resulted in the highest cost of goods sold? Explain. Hint: Use the charts below to compute the invertary costs alocated to cast af goods sold and ernting inveritary assuming each method of imvertary casting. Some boxes have been completed for you. You will just need to camplate the boxes highighted. (2) Average.cost method: (3) Firt-In, firat-out (FIFO) method: (4) Labt-In, first-out (LIFO) method: Hint: Use the charts below to compute the inverntary costs alocated to cost of goods sold and ernding inveritary assuming esch method of imentary costing. Some boxes have been completed for you. You will just need to complate the boxes highighted. On January 15, 2021, Sports World sold 1,000 Ace-5 fishing reels to Angler's Warehouse. Immediately prior to this sale, Sports World perpetual inventory records for Ace-5 reels included the following cost layers. Instructions Note: We present this problem in the normal sequence of the accounting cycle-that is, journal entries before ledger entries. However, you may find it helpful to work part b first. a. Prepare a separate journal entry to record the cost of goods sold relating to the January 15 sale of 1,000 Ace-5 reels, assuming that Sports World uses 1. Specific identification ( 500 of the units sold were purchased on December 12 , and the remaining 500 were purchased on January 9). 2. Average cost. 3. FIFO. 4. LIFO. b. Complete a subsidiary ledger record for Ace-5 reels using each of the four inventory valuation methods listed. Your inventory records should show both purchases of this product, the sale on January 15, and the balance on hand at December 12, January 9 , and January 15. Use the formats for inventory subsidiary records illustrated on Exhibits 8-3 through 85 of this chapter. c. Refer to the cost of goods sold figures computed in part a. For financial reporting purposes, can the company use the valuation method that resulted in the lowest cost of goods sold if, for tax purposes, it used the method that resulted in the highest cost of goods sold? Explain. Hint: Use the charts below to compute the invertary costs alocated to cast af goods sold and ernting inveritary assuming each method of imvertary casting. Some boxes have been completed for you. You will just need to camplate the boxes highighted. (2) Average.cost method: (3) Firt-In, firat-out (FIFO) method: (4) Labt-In, first-out (LIFO) method: Hint: Use the charts below to compute the inverntary costs alocated to cost of goods sold and ernding inveritary assuming esch method of imentary costing. Some boxes have been completed for you. You will just need to complate the boxes highighted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts