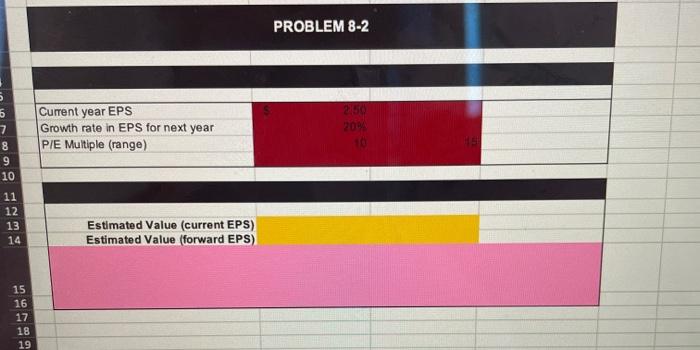

Question: PROBLEM 8-2 Current year EPS Growth rate in EPS for next year PIE Multiple (range) 2150 2004 10 5 7 8 9 10 11 12

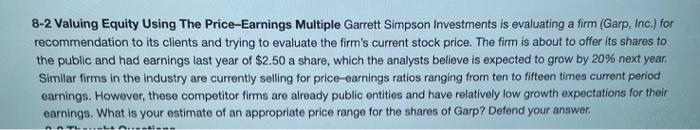

PROBLEM 8-2 Current year EPS Growth rate in EPS for next year PIE Multiple (range) 2150 2004 10 5 7 8 9 10 11 12 13 14 Estimated Value (current EPS) Estimated Value (forward EPS) 15 16 17 18 19 8-2 Valuing Equity Using The Price-Earnings Multiple Garrett Simpson Investments is evaluating a firm (Garp, Inc.) for recommendation to its clients and trying to evaluate the firm's current stock price. The firm is about to offer its shares to the public and had earnings last year of $2.50 a share, which the analysts believe is expected to grow by 20% next year. Similar firms in the industry are currently selling for price earnings ratios ranging from ten to fifteen times current period earnings. However, these competitor firms are already public entities and have relatively low growth expectations for their earnings. What is your estimate of an appropriate price range for the shares of Garp? Defend your answer. a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts