Question: Problem 8-20 (LO. 2, 3, 4) Mac, an inventor, obtained a patent on a chemical process to clean old aluminum siding so that it

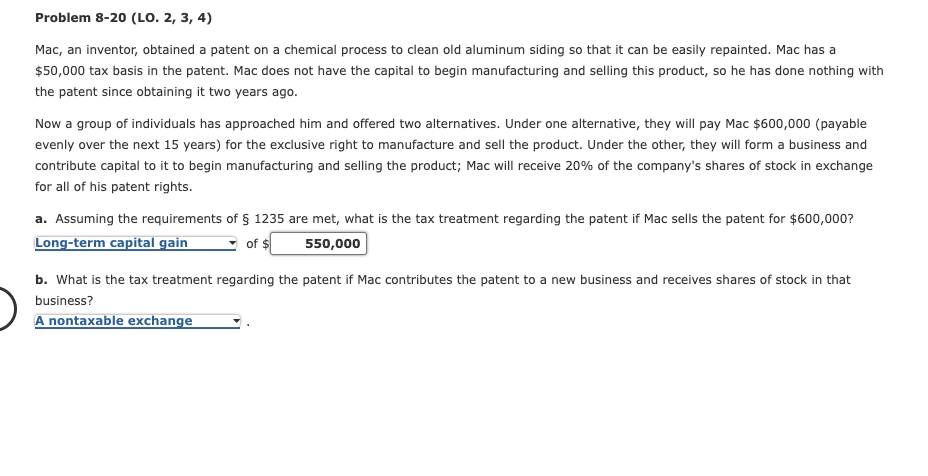

Problem 8-20 (LO. 2, 3, 4) Mac, an inventor, obtained a patent on a chemical process to clean old aluminum siding so that it can be easily repainted. Mac has a $50,000 tax basis in the patent. Mac does not have the capital to begin manufacturing and selling this product, so he has done nothing with the patent since obtaining it two years ago. Now a group of individuals has approached him and offered two alternatives. Under one alternative, they will pay Mac $600,000 (payable evenly over the next 15 years) for the exclusive right to manufacture and sell the product. Under the other, they will form a business and contribute capital to it to begin manufacturing and selling the product; Mac will receive 20% of the company's shares of stock in exchange for all of his patent rights. a. Assuming the requirements of 1235 are met, what is the tax treatment regarding the patent if Mac sells the patent for $600,000? Long-term capital gain of $ 550,000 b. What is the tax treatment regarding the patent if Mac contributes the patent to a new business and receives shares of stock in that business? A nontaxable exchange

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts