Question: Problem 8.21 (Solution Video) Cullumber Corp. has five-year semi-annual bonds outstanding that pay a coupon rate of 9.0 percent, these bonds are priced at $1,066.86.

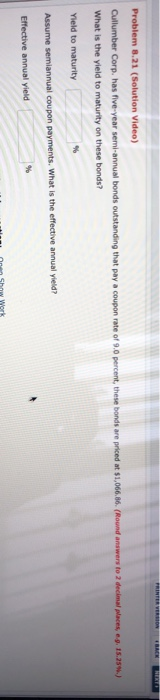

Problem 8.21 (Solution Video) Cullumber Corp. has five-year semi-annual bonds outstanding that pay a coupon rate of 9.0 percent, these bonds are priced at $1,066.86. (Round answers to 2 decimal places, e.. 15.259.) What is the yield to maturity on these bonds? Yield to maturity Assume semiannual coupon payments. What is the effective annual yield? Effective annual yield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts