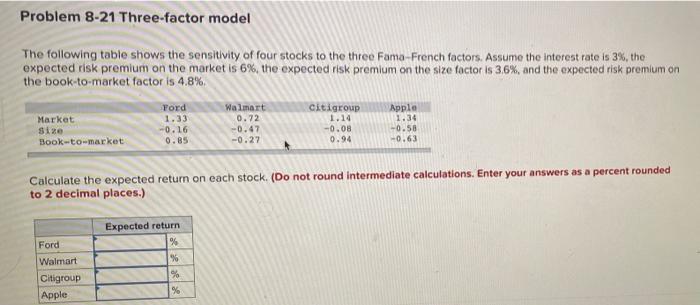

Question: Problem 8-21 Three-factor model The following table shows the sensitivity of four stocks to the three Fama - French factors. Assume the interest rate is

Problem 8-21 Three-factor model The following table shows the sensitivity of four stocks to the three Fama - French factors. Assume the interest rate is 3%, the expected risk premium on the market is 6%, the expected risk premium on the size factor is 3.6%, and the expected risk premium on the book-to-market factor is 4.8%. Market size Book-to-market Ford 1.33 -0.16 0.85 Walmart 0.72 -0.47 -0.27 Citigroup 1.14 -0.08 0.94 Apple 1.34 -0.58 -0.63 Calculate the expected return on each stock. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Expected return Ford Walmart Citigroup Apple ***** % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts