Question: Problem 8-23 Comprehensive Problem [LO8-1, LO8-2, LO8-3, LO8-5, LO8-6] Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one

Problem 8-23 Comprehensive Problem [LO8-1, LO8-2, LO8-3, LO8-5, LO8-6]

Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five-year period. His annual pay raises are determined by his divisions return on investment (ROI), which has exceeded 21% each of the last three years. He has computed the cost and revenue estimates for each product as follows:

| Product A | Product B | ||||

| Initial investment: | |||||

| Cost of equipment (zero salvage value) | $ | 210,000 | $ | 420,000 | |

| Annual revenues and costs: | |||||

| Sales revenues | $ | 290,000 | $ | 390,000 | |

| Variable expenses | $ | 136,000 | $ | 186,000 | |

| Depreciation expense | $ | 42,000 | $ | 84,000 | |

| Fixed out-of-pocket operating costs | $ | 74,000 | $ | 54,000 | |

|

| |||||

The companys discount rate is 19%.

Click here to view Exhibit 8B-1 and Exhibit 8B-2, to determine the appropriate discount factor using tables.

Required:

1. Calculate the payback period for each product. (Round your answers to 2 decimal places.)

![Problem 8-23 Comprehensive Problem [LO8-1, LO8-2, LO8-3, LO8-5, LO8-6] Lou Barlow, a](https://s3.amazonaws.com/si.experts.images/answers/2024/07/66923b572ed95_47866923b56d1db0.jpg)

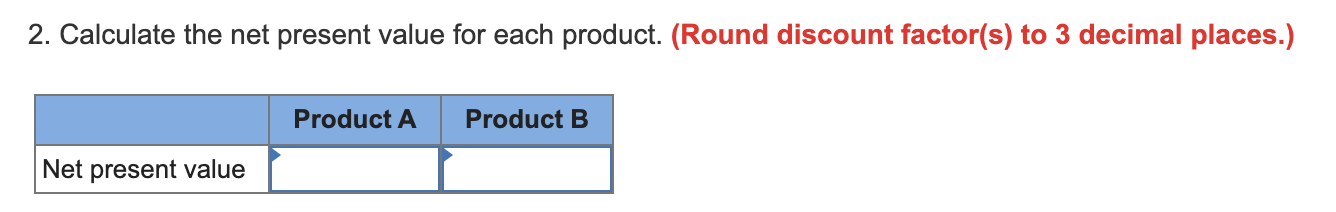

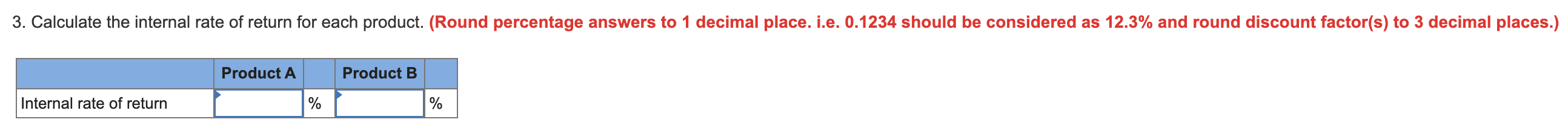

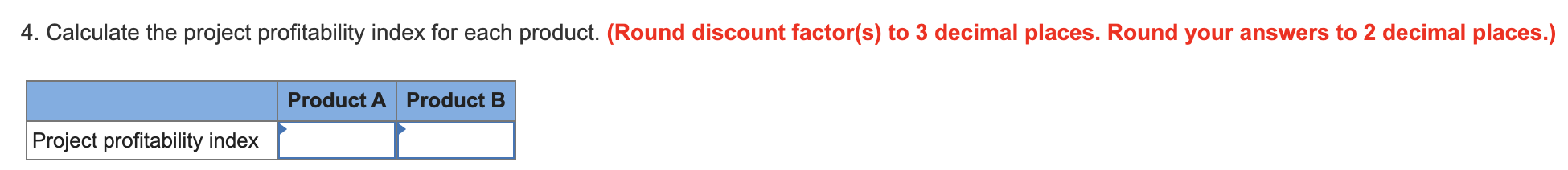

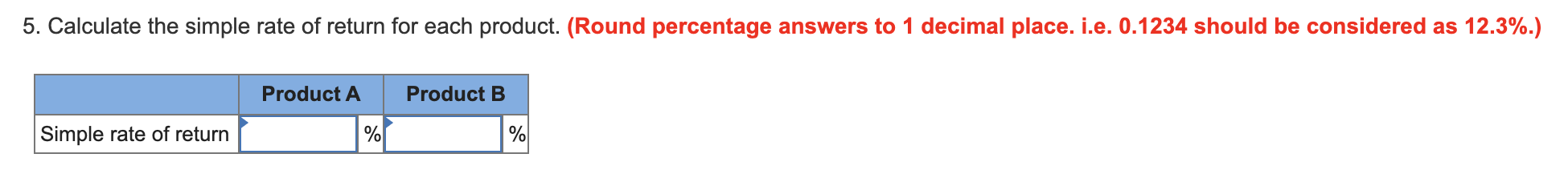

Product A Product B Payback period 2.63 years 2.80 years 2. Calculate the net present value for each product. (Round discount factor(s) to 3 decimal places.) Product A Product B Net present value 3. Calculate the internal rate of return for each product. (Round percentage answers to 1 decimal place. i.e. 0.1234 should be considered as 12.3% and round discount factor(s) to 3 decimal places.) Product A Product B Internal rate of return % % 4. Calculate the project profitability index for each product. (Round discount factor(s) to 3 decimal places. Round your answers to 2 decimal places.) Product A Product B Project profitability index 5. Calculate the simple rate of return for each product. (Round percentage answers to 1 decimal place. i.e. 0.1234 should be considered as 12.3%.) Product A Product B Simple rate of return % % 6a. For each measure, identify whether Product A or Product B is preferred. Net Present Value Profitability Index Payback Period Internal Rate of Return 6b. Based on the simple rate of return, Lou Barlow would likely: Accept Product A Accept Product B O Reject both products

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts