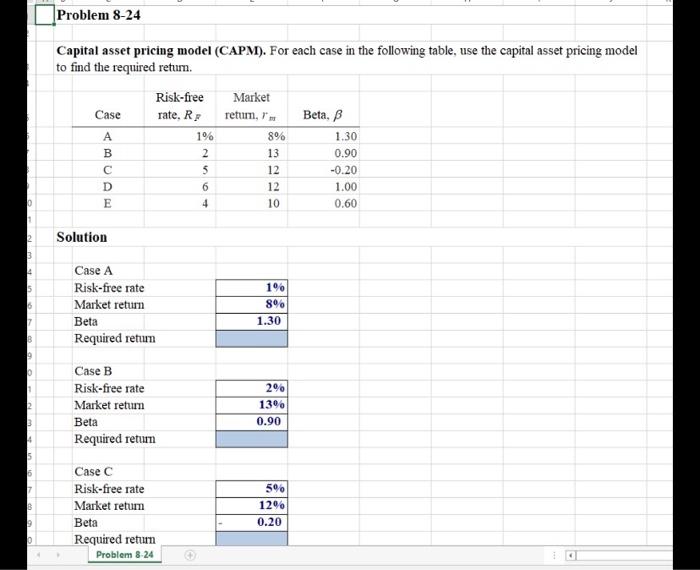

Question: Problem 8-24 Capital asset pricing model (CAPM). For each case in the following table, use the capital asset pricing model to find the required retum.

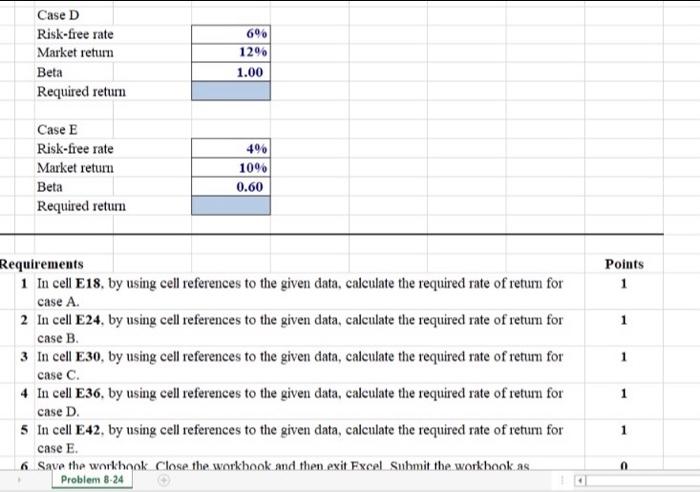

Problem 8-24 Capital asset pricing model (CAPM). For each case in the following table, use the capital asset pricing model to find the required retum. Risk-free Market Case rate, R, retum, Beta, B 1% 1.30 2 0.90 MUA 5 6 4 896 13 12 12 10 -0.20 1.00 0.60 Solution Case A Risk-free rate Market return Beta Required retuun 196 8% 1.30 B Case B Risk-free rate Market return Beta Required retum 29 13% 0.90 B Case C Risk-free rate Market retum Beta Required return Problem 8-24 596 12% 0.20 D 696 Case D Risk-free rate Market return Beta Required retum 1296 1.00 Case E Risk-free rate Market return Beta Required retum 1096 0.60 Points 1 1 Requirements 1 In cell E18, by using cell references to the given data, calculate the required rate of return for case A. 2 In cell E24. by using cell references to the given data, calculate the required rate of return for case B. 3 In cell E30, by using cell references to the given data, calculate the required rate of retum for case C. 4 In cell E36. by using cell references to the given data, calculate the required rate of return for case D. 5 In cell E42. by using cell references to the given data, calculate the required rate of return for case E. 6. Save the workbook close the workbook and then exit Excel Submit the workbook as Problem 8-24 1 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts