Question: Problem 8.29 a-d (Part Level Submission) (Excel Video) The Cullumber Department of Transportation has issued 25-year bonds that make semiannual coupon payments at a rate

Problem 8.29 a-d (Part Level Submission) (Excel Video)

The Cullumber Department of Transportation has issued 25-year bonds that make semiannual coupon payments at a rate of 9.575 percent. The current market rate for similar securities is 10.6 percent. Assume that the face value of the bond is $1,000.

Need help with part C

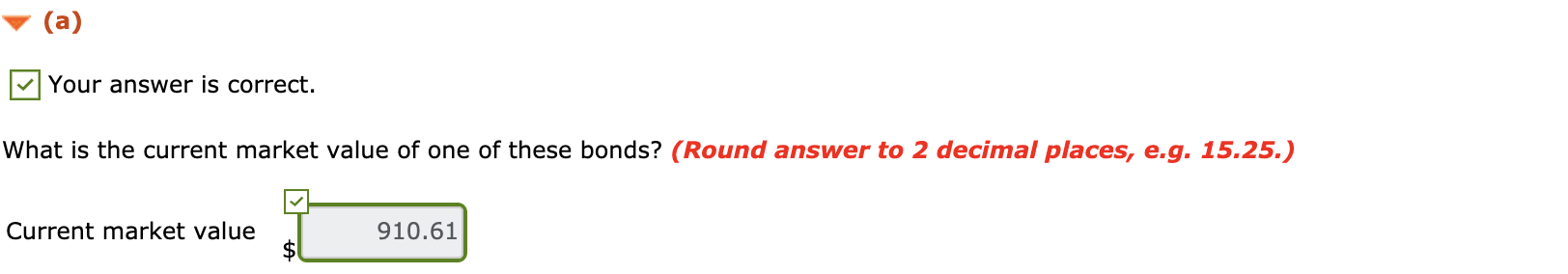

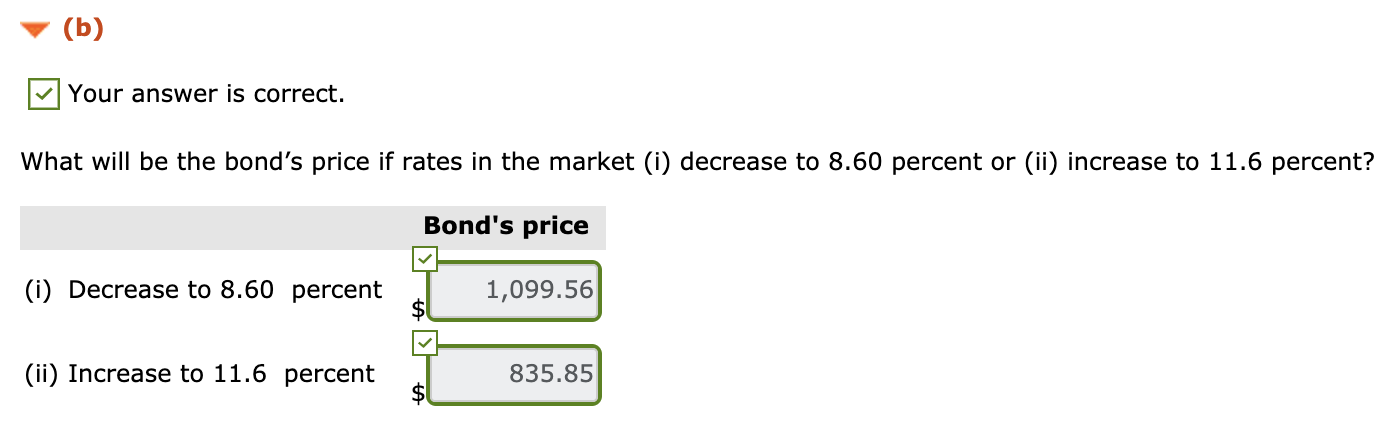

(a) Your answer is correct. What is the current market value of one of these bonds? (Round answer to 2 decimal places, e.g. 15.25.) Current market value 910.61 (b) Your answer is correct. What will be the bond's price if rates in the market (i) decrease to 8.60 percent or (ii) increase to 11.6 percent? Bond's price (i) Decrease to 8.60 percent $1 1,099.56 (ii) Increase to 11.6 percent $1 835.85 (c) How do the interest rate changes affect premium bonds and discount bonds? * in price when interest rates go up. When interest rates decrease, bond prices Bonds, in general

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts