Question: Problem 8-29 (Algo) Completing a Master Budget [LO8-2, LO8-4, LO8-7, LO8-8, LO8-9, LO8-10] The following data relate to the operations of Shilow Company, a wholesale

Problem 8-29 (Algo) Completing a Master Budget [LO8-2, LO8-4, LO8-7, LO8-8, LO8-9, LO8-10]

The following data relate to the operations of Shilow Company, a wholesale distributor of consumer goods:

| Current assets as of March 31: | ||

| Cash | $ | 7,700 |

| Accounts receivable | $ | 20,800 |

| Inventory | $ | 40,800 |

| Building and equipment, net | $ | 129,600 |

| Accounts payable | $ | 24,300 |

| Common stock | $ | 150,000 |

| Retained earnings | $ | 24,600 |

-

The gross margin is 25% of sales.

-

Actual and budgeted sales data:

| March (actual) | $ | 52,000 |

| April | $ | 68,000 |

| May | $ | 73,000 |

| June | $ | 98,000 |

| July | $ | 49,000 |

-

Sales are 60% for cash and 40% on credit. Credit sales are collected in the month following sale. The accounts receivable at March 31 are a result of March credit sales.

-

Each months ending inventory should equal 80% of the following months budgeted cost of goods sold.

-

One-half of a months inventory purchases is paid for in the month of purchase; the other half is paid for in the following month. The accounts payable at March 31 are the result of March purchases of inventory.

-

Monthly expenses are as follows: commissions, 12% of sales; rent, $2,500 per month; other expenses (excluding depreciation), 6% of sales. Assume that these expenses are paid monthly. Depreciation is $972 per month (includes depreciation on new assets).

-

Equipment costing $1,700 will be purchased for cash in April.

-

Management would like to maintain a minimum cash balance of at least $4,000 at the end of each month. The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month, up to a total loan balance of $20,000. The interest rate on these loans is 1% per month and for simplicity we will assume that interest is not compounded. The company would, as far as it is able, repay the loan plus accumulated interest at the end of the quarter.

1.

2. ![LO8-10] The following data relate to the operations of Shilow Company, a](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6716448b375f4_5866716448a9d7c4.jpg)

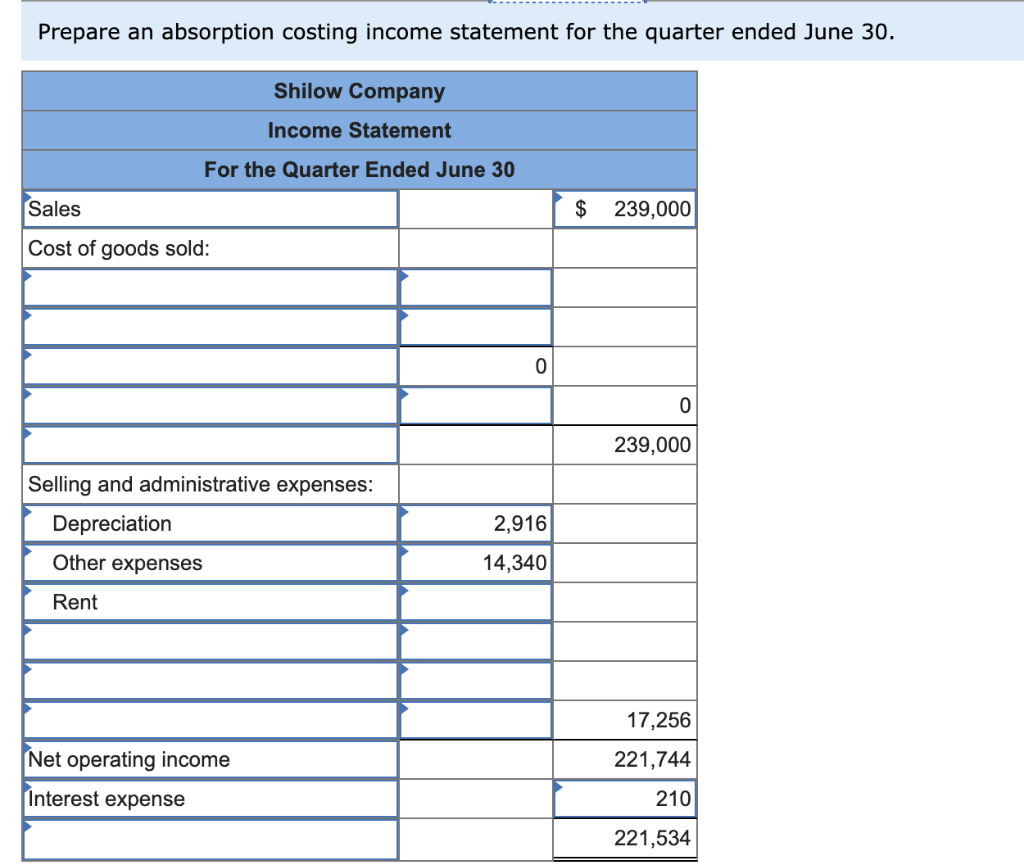

Prepare an absorption costing income statement for the quarter ended June 30. Shilow Company Income Statement For the Quarter Ended June 30 Sales $ 239,000 Cost of goods sold: 0 0 239,000 Selling and administrative expenses: Depreciation 2,916 Other expenses 14,340 Rent 17,256 Net operating income 221,744 Interest expense 210 221,534 Prepare a balance sheet as of June 30. Shilow Company Balance Sheet June 30 Assets Current assets: Cash $ 5,770 Accounts receivable 39,200 29,400 Inventory Building and equipment-net 128,384 Total current assets 202,754 Total assets $ 202,754 $ 22,050 Liabilities and Stockholders' Equity Accounts payable Retained earnings Stockholders' equity: Common stock $ 150,000 Note payable 150,000 Total liabilities and stockholders' equity $ 172,050

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts