Question: Problem 8-29A (Algo) Computing and recording units-of-production depreciation LO 8-4, 8-5 Sable Company paid cash for assembly equipment for $648,000 on January 1 , Year

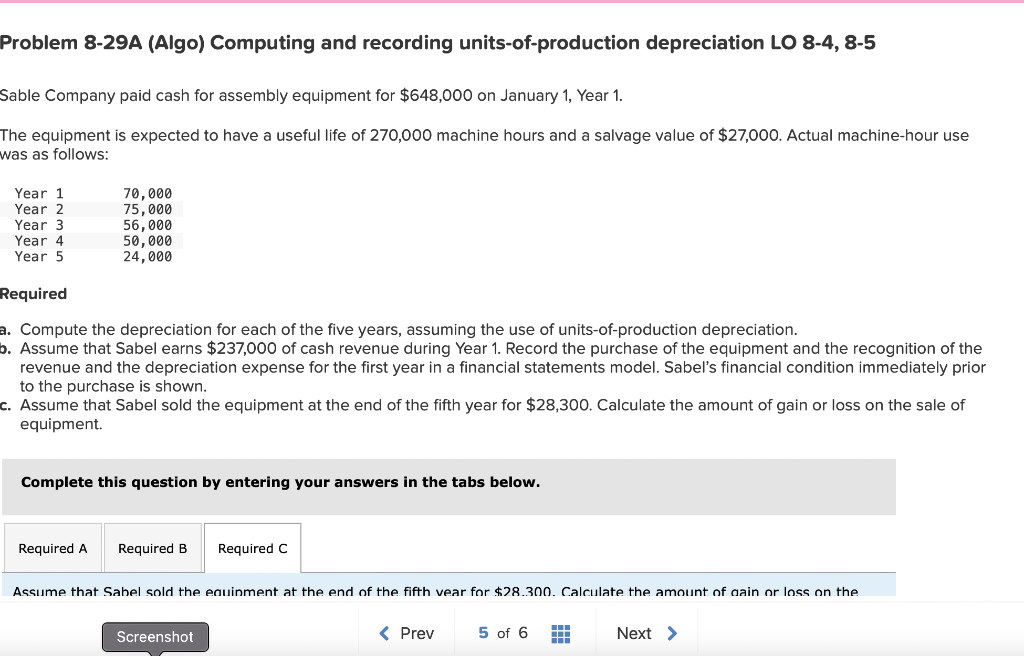

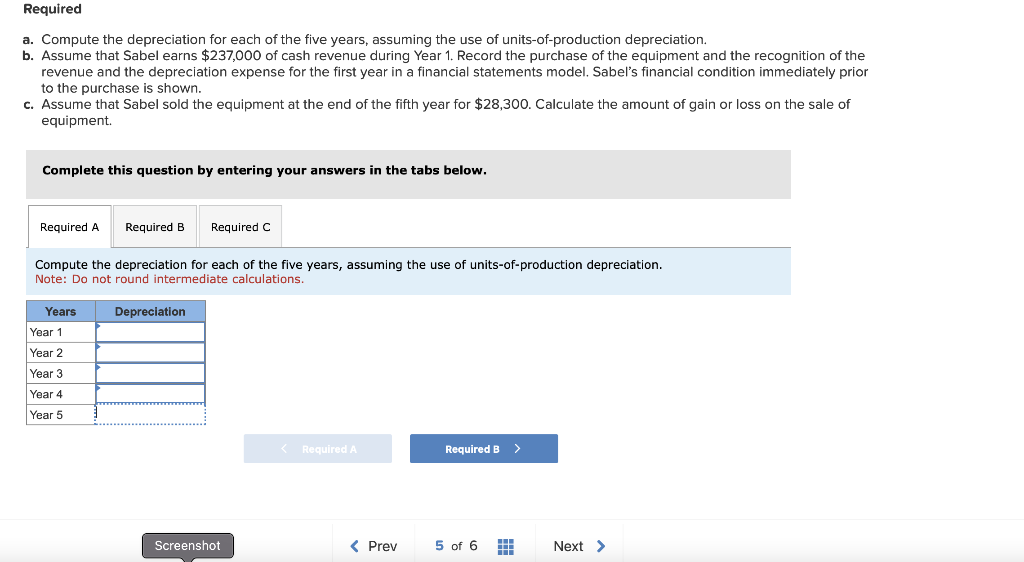

Problem 8-29A (Algo) Computing and recording units-of-production depreciation LO 8-4, 8-5 Sable Company paid cash for assembly equipment for $648,000 on January 1 , Year 1. The equipment is expected to have a useful life of 270,000 machine hours and a salvage value of $27,000. Actual machine-hour use was as follows: Required a. Compute the depreciation for each of the five years, assuming the use of units-of-production depreciation. b. Assume that Sabel earns $237,000 of cash revenue during Year 1 . Record the purchase of the equipment and the recognition of the revenue and the depreciation expense for the first year in a financial statements model. Sabel's financial condition immediately prior to the purchase is shown. c. Assume that Sabel sold the equipment at the end of the fifth year for $28,300. Calculate the amount of gain or loss on the sale of equipment. Complete this question by entering your answers in the tabs below. Required a. Compute the depreciation for each of the five years, assuming the use of units-of-production depreciation. b. Assume that Sabel earns $237,000 of cash revenue during Year 1 . Record the purchase of the equipment and the recognition of the revenue and the depreciation expense for the first year in a financial statements model. Sabel's financial condition immediately prior to the purchase is shown. c. Assume that Sabel sold the equipment at the end of the fifth year for $28,300. Calculate the amount of gain or loss on the sale of equipment. Complete this question by entering your answers in the tabs below. Compute the depreciation for each of the five years, assuming the use of units-of-production depreciation. Note: Do not round intermediate calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts