Question: Problem 8-3 Calculating Payback [LO 1) Stenson, Inc., imposes a payback cutoff of three years for its international investment projects. Assume the company has the

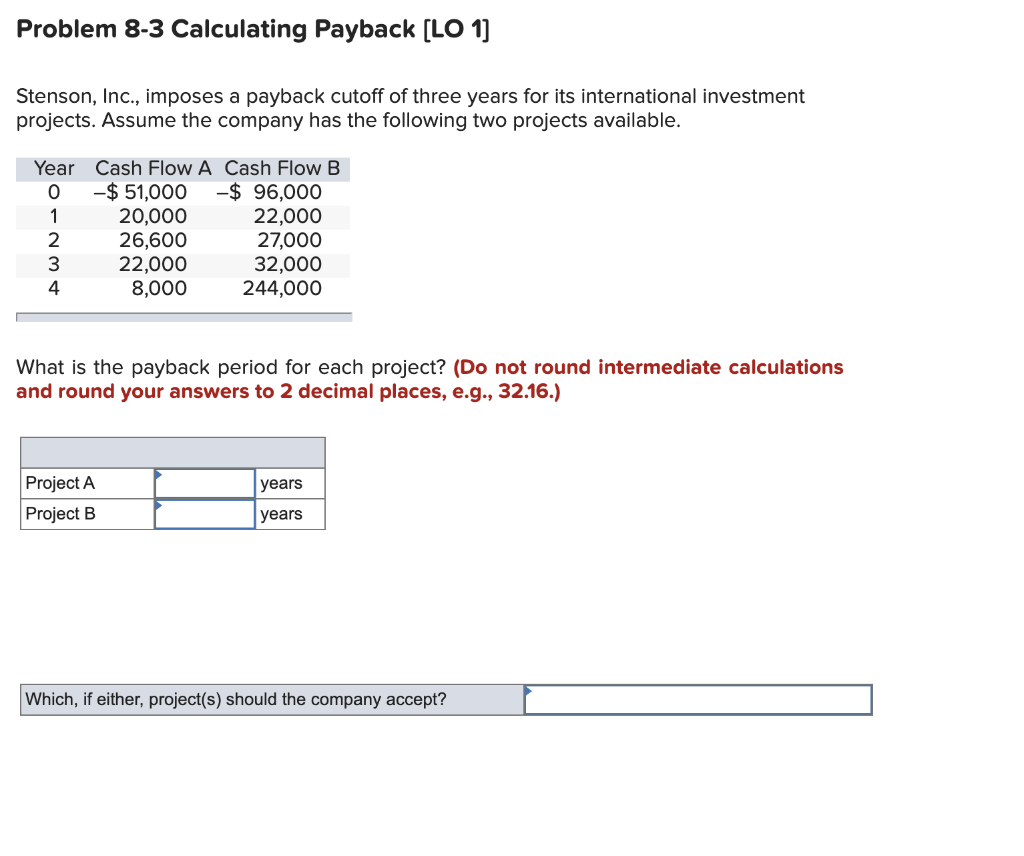

Problem 8-3 Calculating Payback [LO 1) Stenson, Inc., imposes a payback cutoff of three years for its international investment projects. Assume the company has the following two projects available. Year Cash Flow A Cash Flow B 0 -$ 51,000 -$ 96,000 1 20,000 22,000 2 26,600 27,000 3 22,000 32,000 4. 8,000 244,000 What is the payback period for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) years Project A Project B years Which, if either, project(s) should the company accept

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts