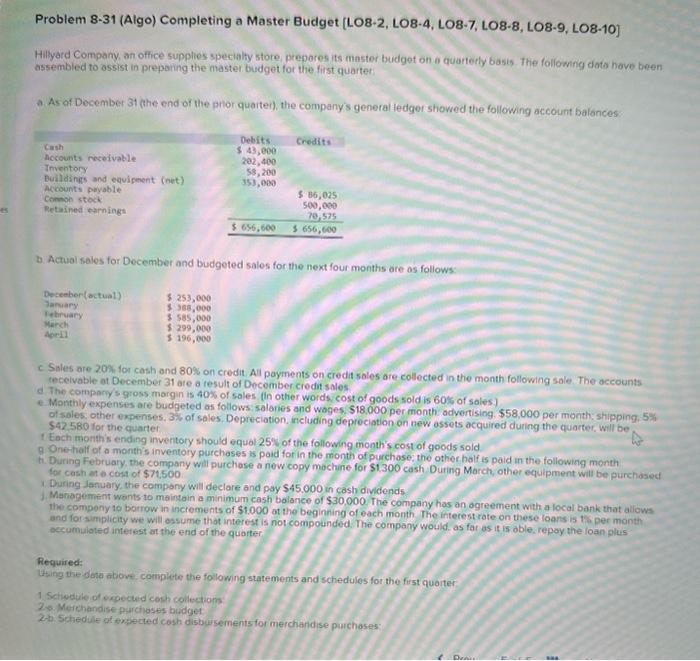

Question: Problem 8-31 (Algo) Completing a Master Budget [LO8-2, LO8-4, LO8-7, LO8-8, LO8-9, LO8-10] Hilyard Company, an office supplies specialiy store prepores its mastor budget on

![LO8-9, LO8-10] Hilyard Company, an office supplies specialiy store prepores its mastor](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e98b86599c0_63766e98b85d1a96.jpg)

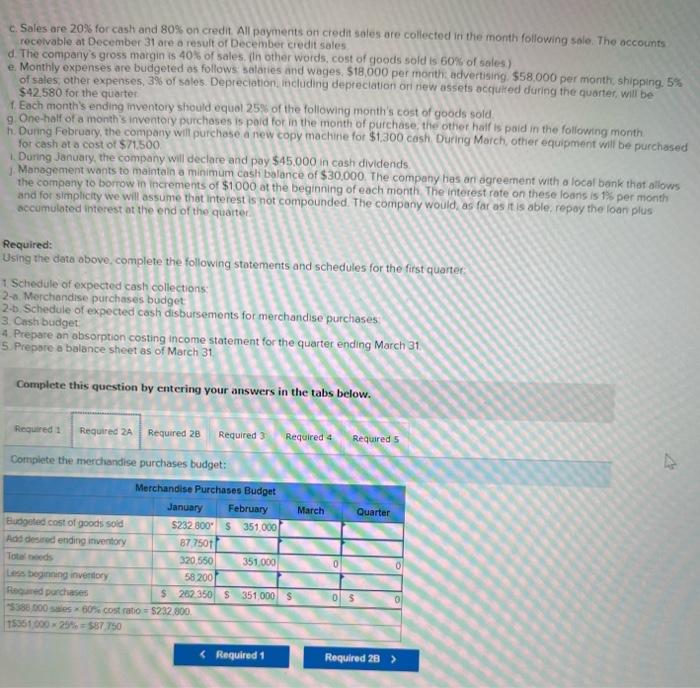

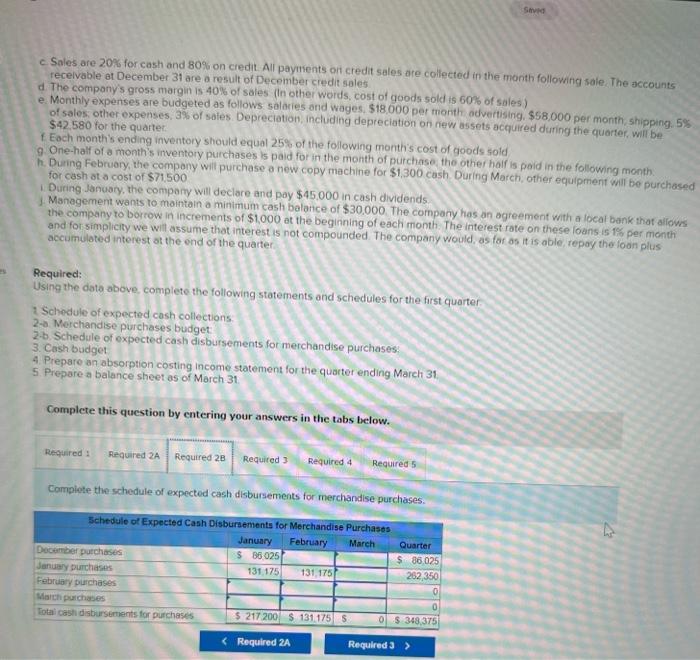

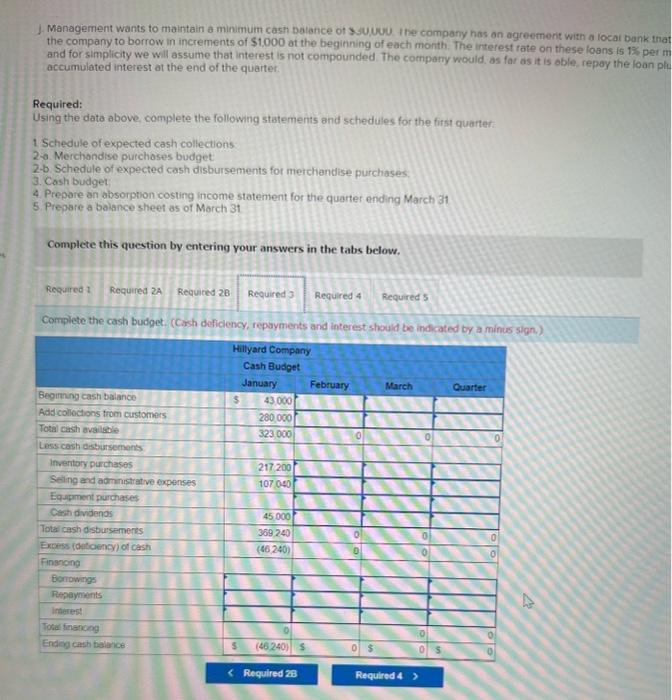

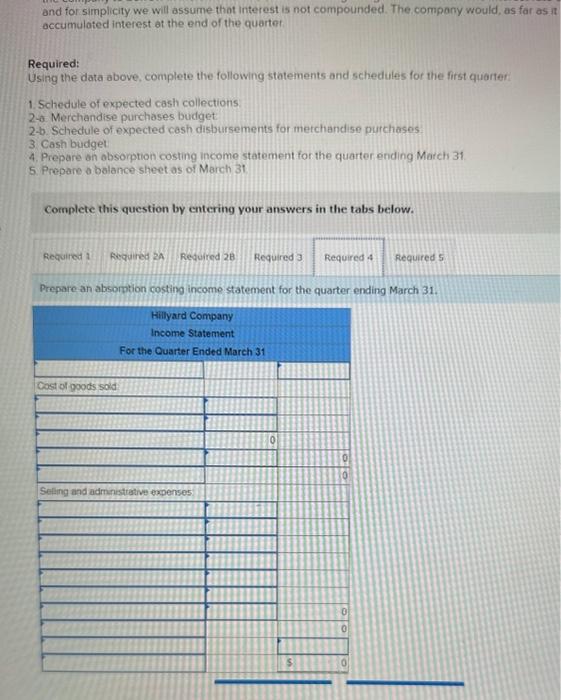

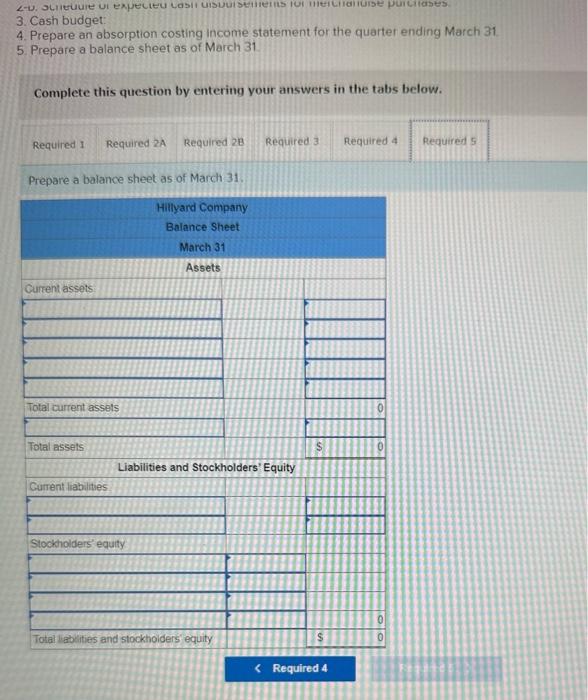

Problem 8-31 (Algo) Completing a Master Budget [LO8-2, LO8-4, LO8-7, LO8-8, LO8-9, LO8-10] Hilyard Company, an office supplies specialiy store prepores its mastor budget on a quarterly basis. The following dato hove been assembled to ossist in preparing the master budget for the first quarter a. As of December 31 (hhe end of the phor quaiter), the company's general ledger showed the following account 5alonces: b. Acrual sales for December and budgeted sales for the next four months are as follows: c Sales are 20% for cash and 80% on credit All payments on credit sales are collected in the month following sale. The accounts thecelvable at December 31 are a result of December credit sales a. The companyys gross margin is 405 of sales (in other words cost of goods sold is 60% of sales) e. Monthly expenses are budgeted as follows salanes and woges. $18,000 per month advertising. $58,000 per month; shipping, 53 : of sales. other expenses, 3% of sales. Depreciation, including depreciation on new assets acquired during the quarter, will be S42.580 for the quarter t Eoch monthis ending anveritory should equol 25% of the following month's cost of goods sold 9. One-ialf of a month's inventory purchases is paid for in the month of purchose, the other half is paid in the following month h. During February, the company will purchase a new copy machine for $1.300 cash. Duting March, other equipment will be purchased During lanuary, the company will declare and pay $45.000 in cash dividends 1. Management wants to maintain a minimum cash balance of $30.000 The company has an agreement with a local bank that aliows the compony 10 borrow in increments of $1.000 ot the beginning of each month The interest rate on these foans is tis per month and for simplicity we will essume thot interest is not compounded. The company would. as far as it is able, repay the loan plus escumuloted intetest at the end of the quorter E Soles are 20% for cash and 80% on credit. Ali payments on credit sales are collected in the month following sale. The accounts receivable ot December 31 are a result of December credit soles d. The company's gross margin is 40% of sales, (in other words, cost of goods sold is 60% of sales) e. Monthly expenses are budgeted as follows: salaries and wages, $18,000 por month advertising. $58,000 per morith, shipping, 5%5 of sales, other expenses. 39 of sales. Depreciation, including depreciation on new assets acquired during the quarter will be $42.580 for the quarter. t. Each month's ending inventory should equal 25% of the following month's cost of goods sold: 9. One-haif of a months inventory purchases is paid for in the month of purchase; the other hoif is poid in the following month h. Dunng February, the company will purchase a now copy machine for $1,300cash. During March, other equipment will be purchased for cash at a cost of $71,500 1. Duriog Jansary, the company will deciare and pay $45,000 in cash dividends. 1. Management wants to maintain a minimum cash balance of $30.000. The company has an agreement with a local bank that allows the company to borrow in increments of $1000 at the beginning of each month. The interest rate on these loans is is per month. and for simpliciy we will assume that interest is not compounded. The company would, as far as if is able, repoy the loan plus accumulated interest at the end of the quaiter Required: Using the dato above, complete the following statements and schedules for the first quarter: 1. Schedule of expected cash collections 2-n. Merchandise purchases budget 23 . Schedule of oxpected cash disbursements for merchandise purchases: 3. Cash budget 4. Prepare on absorption costing income statement for the quarter ending March 31 5. Prepare a balance sheet as of March 31 . Complete this question by entering your answers in the tabs below. Camplete the Schedule of expected cash collections: c. Sales are 20\% for cash and 80% on credit All payments on ciedit sales are collected in the month following sale. The occounts receivable at December 31 are a result or December credit sales d. The company's gross margin is 40% of sales. (In other words, cost of goods sold is 60\%s of sales) e. Monthly expenses are budgeted as follows' salaties and wages, $18,000 per month advertising. $58,000 per month, shipping. 5% 4. Each month's ending inventory should equol 25% of the following month's cost of goods sold. 9 One-half of a month's inventory purchases is poid for in the month of purchase, the other haif is paid in the following month. h. Durng february, the company will purchase a new copy machine for $1,300cash During March, other equipment will be purchased for cash ot a cost of $/1,500 1. During january, the company will declare and pay $45.000 in cash dividends. 1. Management wants to maintain a minimum cash bolance of $30.000. The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month. The interest rate on these loans is 1% per month and for simplicity we will assume that interest is not compounded. The company would, as far as it is able, repay the loan plus Required: Using the data obove, complete the following statements and schedules for the first quarter: 1. Schedule of expected cash collections: 2. Merchandise purchases budget 2.b. Schedule of expected cash disbursements for merchandise purchases: 3. Cish budget 4. Prepare an absorption costing income statement for the quarter ending March 31 5. Prepore a balance sheet as of March 31 . Complete this question by entering your answers in the tabs below. Complete the merchandise purchases budget: c. Sales are 20\% for cash and 80% on credit. All payments ori credit sales are collected in the month following sale. The accounts recelvable at December 31 are a result of December credit sales d The company's gross margin is 40m of sales (In other words, cost of goods sold is 60% of sales) e. Monthly expenses are budgeted as follows salaries ond wages. $18,000 per month advertising. $58,000 per month, shipping. 5% : of sales: other expenses, 3% of saies. Depreciation, including depreciation on rew assets acquired during the quarter, will be. f Each month's ending inventory should equal 25% of the following month's cost of goods sold 9 One-half of a month's inventory purchases is paid for in the month of purchase the other haif is poid in the following month. h. During February, the compony will purchase a new copy machine for $1,300cash. During March, other equipment will be purchased for cash at a cost of $77,500 i. During January, the company will declare and pay $45.000 in cash dividends. 1. Manegement wants to maintain a minimum cash balance of $30.000. The company has an agreement with a local bank that aliows the company to borrow in increments of $1,000 at the beginning of each month. The interest rate on these foans is tis per month accumulated interest of the end of the quarter Required: Using the data above, complete the following statements and schedules for the first quarter. 2 Schedule of expected cash collections. 2-o Merchandise purchases budget 2.b. Schedule of expected cash disbursements for merchandise purchases; 3. Cash budget 4. Prepare an absorption costing income statement for the quarter ending March 31 5 Prepare a balance sheet as of March 31 . Complete this question by entering your answers in the tabs below. Complete the schedule of expected cash disbursements for merchandise purchases. 1. Management wants to malntain a minimum cash balance ot ssuyuU the company has an agreement with a locat bank tha the company to borrow in increments of $1,000 at the beginning of each month. The interest rate on these loans is 13 per n and for simplicity we will assume that interest is not compounded. The company would. as far as it is oble, repoy the loan pli accumulated interest at the end of the quarter. Required: Using the data above complete the following statements and schedules for the first quarter: 1 Schedule of expected cash collections. 2 a. Merchandise purchases budget. 2.b. Schedule of expected cash disbursements for merchandise purchases: 3. Cash budget: 4. Prepare an absorption costing income statement for the quarter ending March 31 5. Prepare a balance sheet as of March 31 Complete this question by entering your answers in the tabs below. Complete the cash budget. (Cash deficlency, repoyments and interest should be indicated by a minus sign.). and for simplicity we will assume thot interest is not compounded. The company would, as far as it accumulated interest at the end of the quartet. Required: Using the data above, complete the following statements and schedules for the first quarter: 1. Schedule of expected cash collections: 2-0. Merchandise purchases budget 2-0. Sechedule of expected cash disbursements for merchandise purchasos 3 Cash budget 4. Prepare an obsorption costing income statement for the quarter ending March 31 5. Prepare a balance sheet as of March 31 Complete this question by entering your answers in the tabs below. Prepare an absomtion costing income statement for the quarter ending March 31. 3. Cash budget: 4. Prepare an absorption costing income statement for the quarter ending March 31. 5 Prepare a balance sheet as of March 31 Complete this question by entering your answers in the tabs below. Prenare a balance sheet as of March 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts