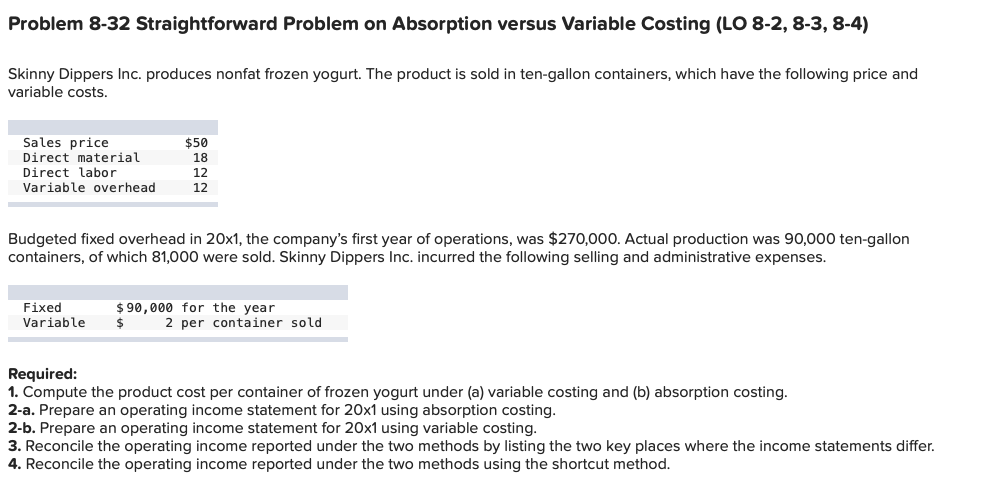

Question: Problem 8-32 Straightforward Problem on Absorption versus Variable Costing (LO 8-2, 8-3, 8-4) Skinny Dippers Inc. produces nonfat frozen yogurt. The product is sold in

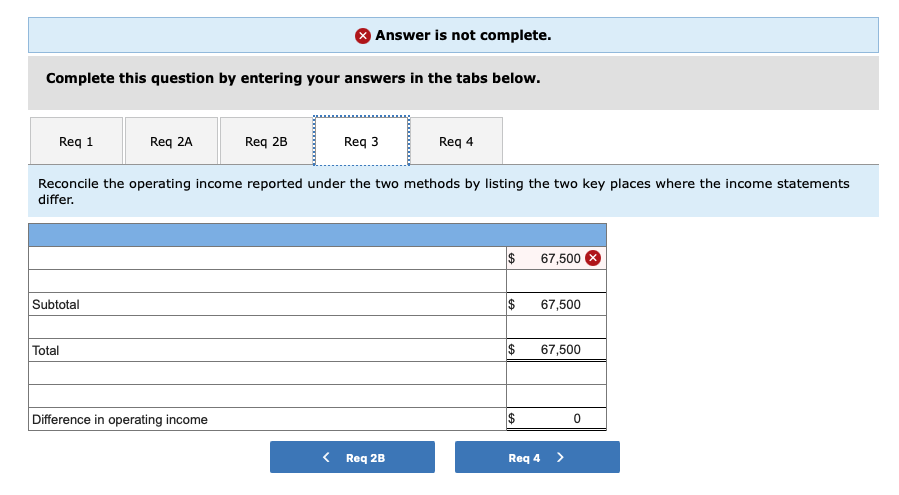

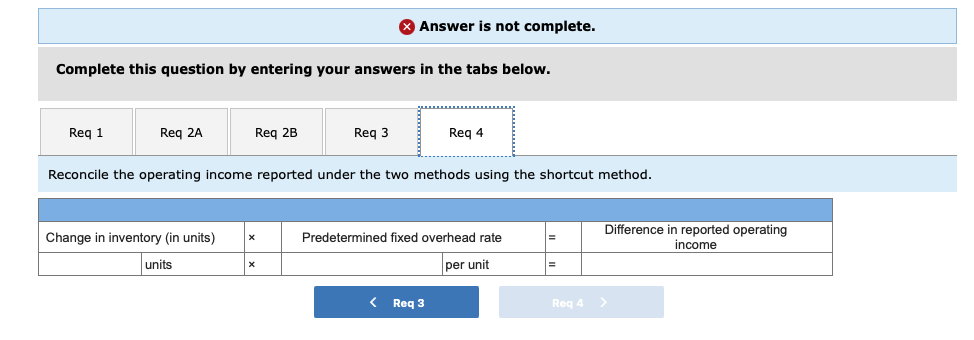

Problem 8-32 Straightforward Problem on Absorption versus Variable Costing (LO 8-2, 8-3, 8-4) Skinny Dippers Inc. produces nonfat frozen yogurt. The product is sold in ten-gallon containers, which have the following price and variable costs. Sales price $50 Direct material 18 Direct labor 12 Variable overhead 12 Budgeted xed overhead in 20x1, the company's first year of operations. was $270,000. Actual production was 90.000 ten-gallon containers. of which 81,000 were sold. Skinny Dippers Inc. incurred the following selling and administrative expenses. Fixed $99,030 for the year Variable s 2 per container sold Requlred: 1. Compute the product cost per container of frozen yogurt under {a} variable costing and {b} absorption costing. 2-a. Prepare an operating income statement for 203.1 using absorption costing. 2-D. Prepare an operating income statement for 20x1 using variable costing. 3. Reconcile the operating income reported under the two methods by listing the two key places where the income statements differ. 4. Reconcile the operating income reported under the two methods using the shortcut method. X Answer is not complete. Complete this question by entering your answers in the tabs below. Reg 1 Req 2A Req 2B Req 3 Reg 4 Reconcile the operating income reported under the two methods by listing the two key places where the income statements differ. 67,500 X Subtotal $ 67,500 Total $ 67,500 Difference in operating income $ 0 x Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Req 3 Req 4 Reconcile the operating income reported under the two methods using the shortcut method. Change in inventory (in units) Predetermined fixed overhead rate Difference in reported operating income units per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts