Question: Problem 8-34 (LO. 2) Weston acquires a new office machine (seven-year class asset) on August 2, 2017, for $75,000. This is the only asset Weston

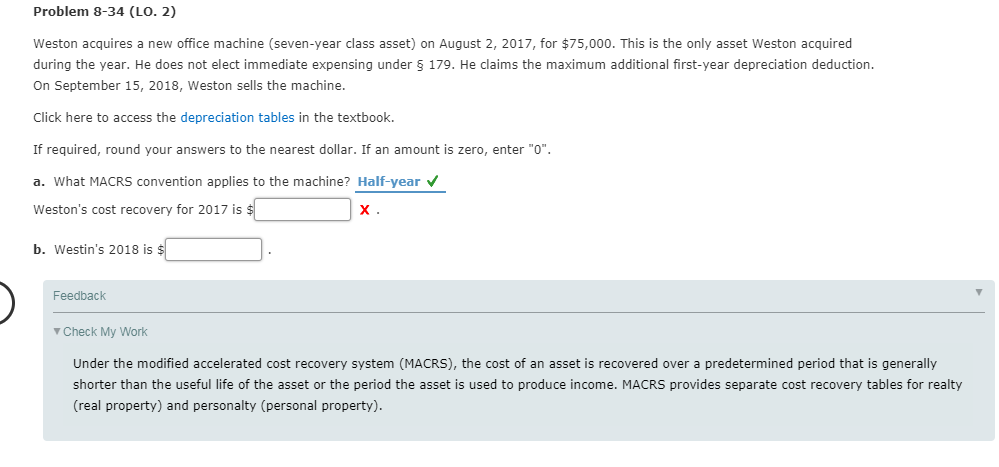

Problem 8-34 (LO. 2) Weston acquires a new office machine (seven-year class asset) on August 2, 2017, for $75,000. This is the only asset Weston acquired 179. He claims the maximum additional first-year depreciation deduction during the year. He does not elect immediate expensing under On September 15, 2018, Weston sells the machine. Click here to access the depreciation tables in the textbook. If required, round your answers to the nearest dollar. If an amount is zero, enter "0". a. What MACRS convention applies to the machine? Half-year Weston's cost recovery for 2017 is $ b. Westin's 2018 is $ Feedback Check My Work Under the modified accelerated cost recovery system (MACRS), the cost of an asset is recovered over a predetermined period that is generally shorter than the useful life of the asset or the period the asset is used to produce income. MACRS provides separate cost recovery tables for realty (real property) and personalty (personal property)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts