Question: Problem 8-35 Fixed Asset Transactions and Reporting A partial portion of the balance sheet at December 31, 2012, for the Gusto Corporation is presented below:

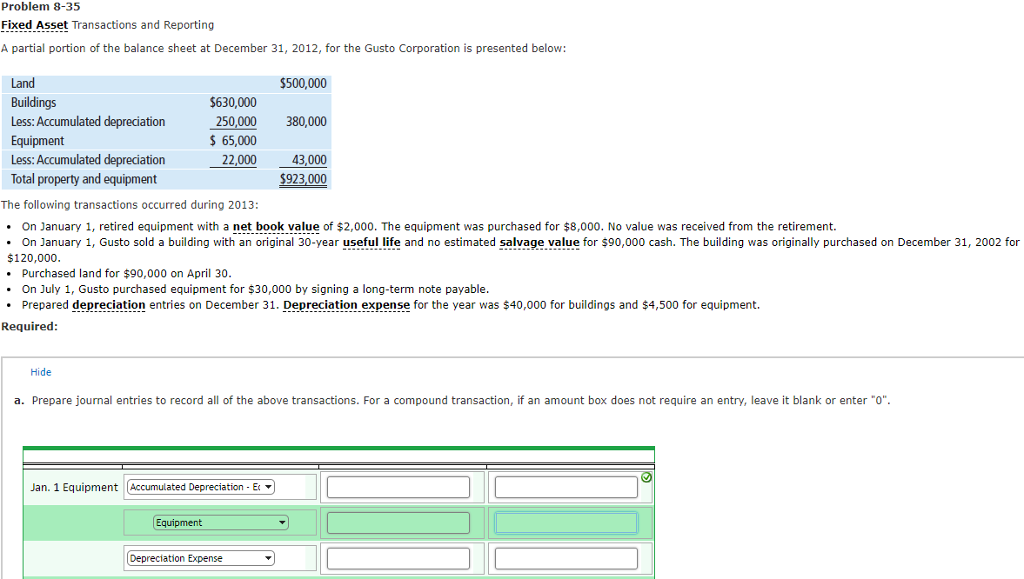

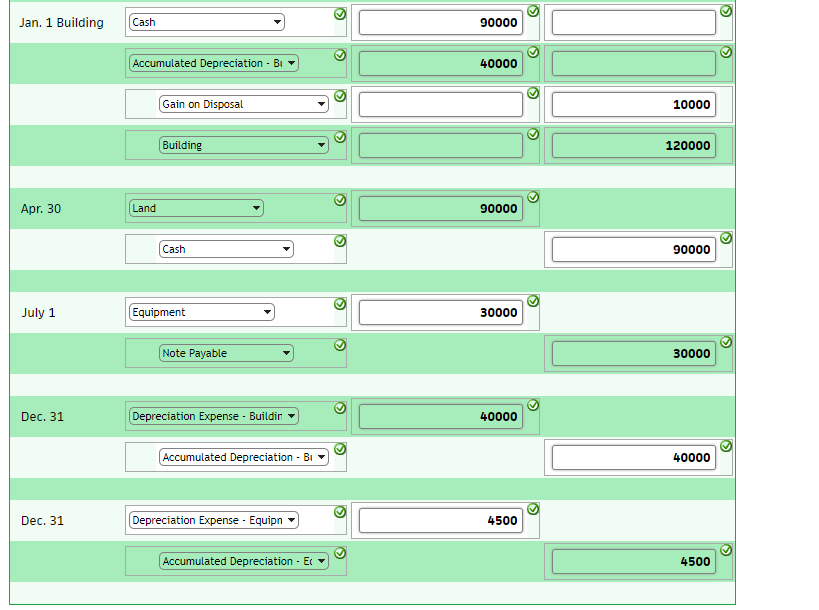

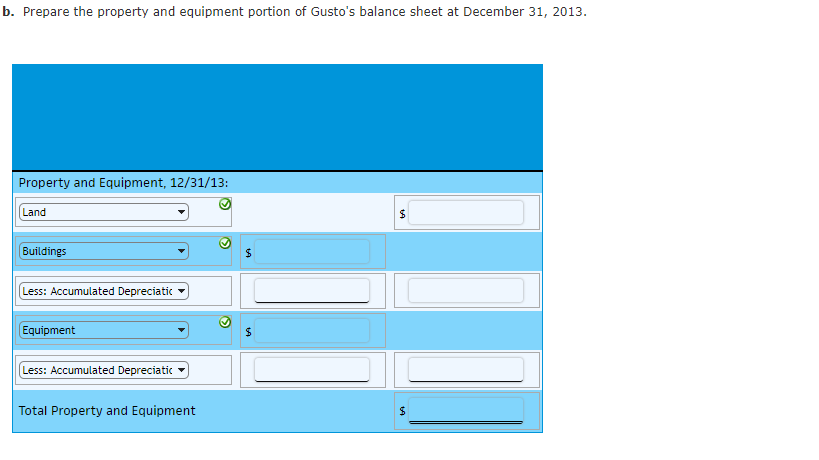

Problem 8-35 Fixed Asset Transactions and Reporting A partial portion of the balance sheet at December 31, 2012, for the Gusto Corporation is presented below: Land Buildings Less: Accumulated depreciation Equipment Less: Accumulated depreciation Total property and equipment $500,000 $630,000 250,000 380,000 65,000 22,000 43,000 923,000 The following transactions occurred during 2013: .On January 1, retired equipment with a net book value of $2,000. The equipment was purchased for $8,000. No value was received from the retirement. On January 1, Gusto sold a building with an original 30-year useful life and no estimated salvage value for $90,000 cash. The building was originally purchased on December 31, 2002 for $120,000 .Purchased land for $90,000 on April 30 .On July 1, Gusto purchased equipment for $30,000 by signing a long-term note payable . Prepared depreciation entries on December 31. Depreciation expense for the year was $40,000 for buildings and $4,500 for equipment. Required Hide a. Prepare journal entries to record all of the above transactions. For a compound transaction, if an amount box does not require an entry, leave it blank or enter O Jan. 1 Equipment Accumulated Depreciation-Ec Equipment Depreciation Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts