Question: Problem 8-3A Part 3 3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were

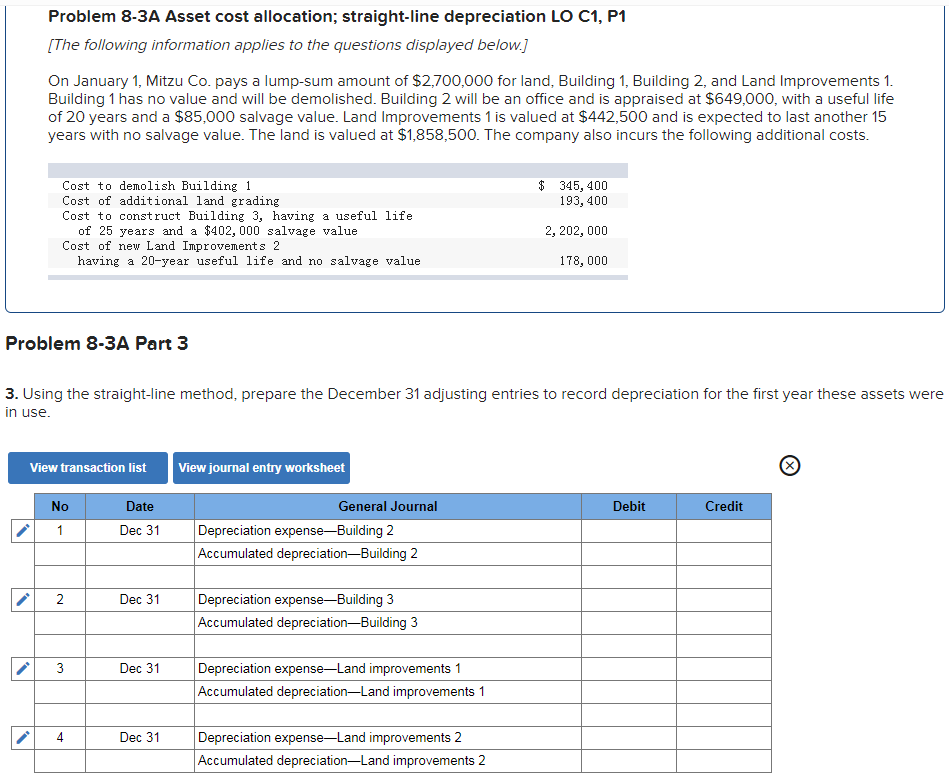

Problem 8-3A Part 3 3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were in use.

Problem 8-3A Part 3 3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were in use.

Problem 8-3A Asset cost allocation; straight-line depreciation LO C1, P1 [The following information applies to the questions displayed below.] On January 1, Mitzu Co. pays a lump-sum amount of $2,700,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $649,000, with a useful life of 20 years and a $85,000 salvage value. Land Improvements 1 is valued at $442,500 and is expected to last another 15 years with no salvage value. The land is valued at $1,858,500. The company also incurs the following additional costs. $ 345,400 193,400 Cost to demolish Building 1 Cost of additional land grading Cost to construct Building 3, having a useful life of 25 years and 000 age value Cost of new Land Improvements 2 having a 20-year useful life and no salvage value 2, 202, 000 178,000 Problem 8-3A Part 3 3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were in use. View transaction list View journal entry worksheet No Debit Credit Date Dec 31 1 General Journal Depreciation expenseBuilding 2 Accumulated depreciation-Building 2 N Dec 31 Depreciation expense-Building 3 Accumulated depreciationBuilding 3 3 Dec 31 Depreciation expense-Land improvements 1 Accumulated depreciationLand improvements 1 4 Dec 31 Depreciation expenseLand improvements 2 Accumulated depreciationLand improvements 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts