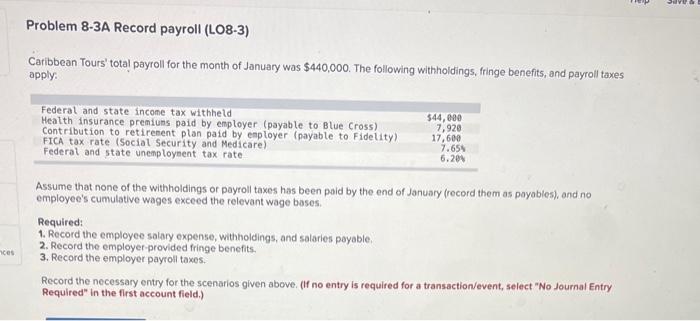

Question: Problem 8-3A Record payroll (LO8-3) Caribbean Tours' total payroll for the month of January was $440,000. The following withholdings, fringe benefits, and payroll taxes apply:

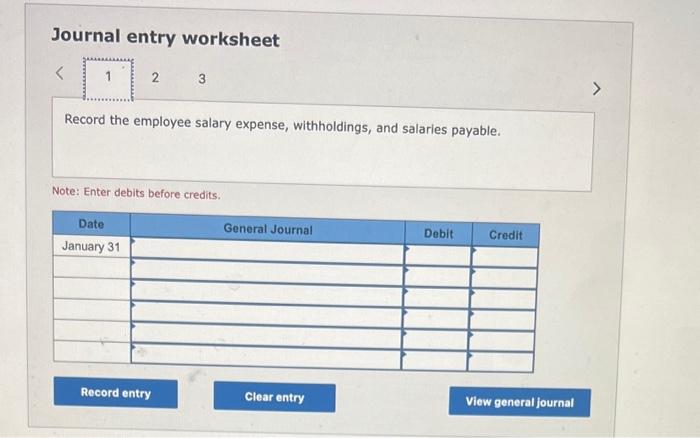

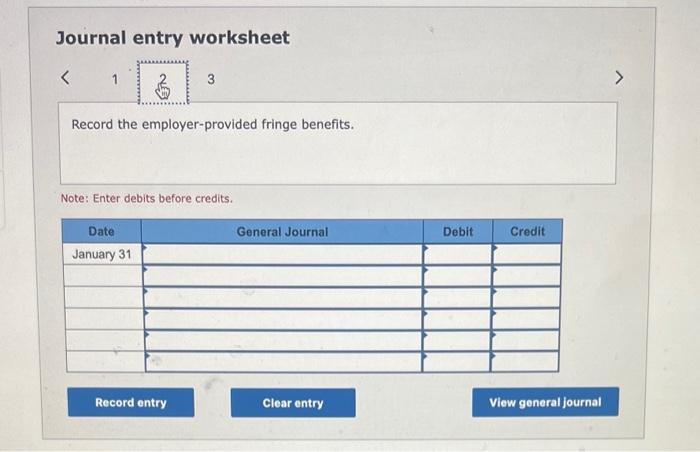

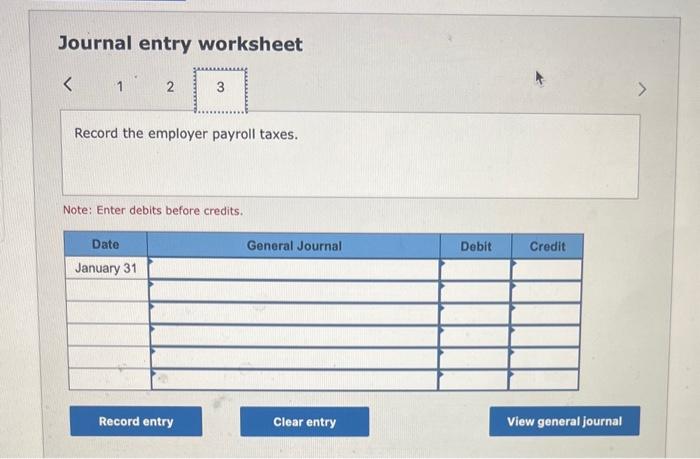

Problem 8-3A Record payroll (LO8-3) Caribbean Tours' total payroll for the month of January was $440,000. The following withholdings, fringe benefits, and payroll taxes apply: Assume that none of the withholdings or payroll taxes has been paid by the end of January (record them as payables), and no employee's cumulative wages exceed the relevant wage bases. Required: 1. Record the employee salary expense, withholdings, and salaries poyable. 2. Record the employer-provided fringe benefits. 3. Record the employer payroll taxes. Record the necessary entry for the scenarios given above. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the employee salary expense, withholdings, and salaries payable. Note: Enter debits before credits. Journal entry worksheet Record the employer-provided fringe benefits. Note: Enter debits before credits. Journal entry worksheet Record the employer payroll taxes. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts