Question: Problem 8-43 (algorithmic) Question Help A certain engine lathe can be purchased for $150,000 and depreciated over three years to a zero salvage value with

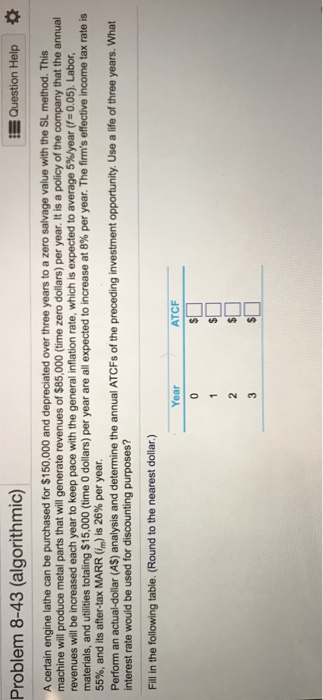

Problem 8-43 (algorithmic) Question Help A certain engine lathe can be purchased for $150,000 and depreciated over three years to a zero salvage value with the SL method. This machine will produce metal parts that will generate revenues of $85,000 (time zero dollars) per year. It is a policy of the company that the annual revenues will be increased each year to keep pace with the general inflation rate, which is expected to average 5%/year -0.05). Labor, materials, and utilities totaling $15,000 time 0 dollars per year are all expected to increase at 8% per year. The firm's effective income tax rate is 55%, and its after-tax MARR (im) is 26% per year. Perform an actual-dollar (AS) analysis and determine the annual ATCFs of the preceding investment opportunity. Use a life of three years. What interest rate would be used for discounting purposes? Fill in the following table. (Round to the nearest dollar.) Year ATCF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts