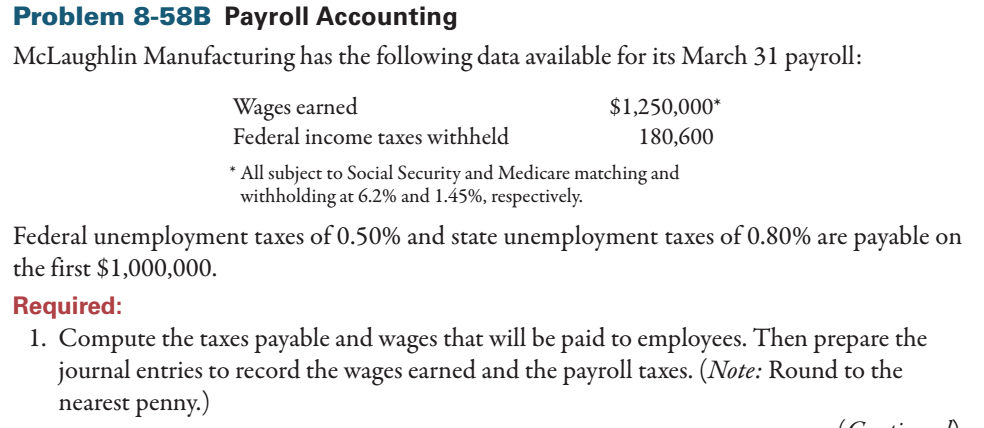

Question: Problem 8-58B Payroll Accounting McLaughlin Manufacturing has the following data available for its March 31 payroll: * All subject to Social Security and Medicare matching

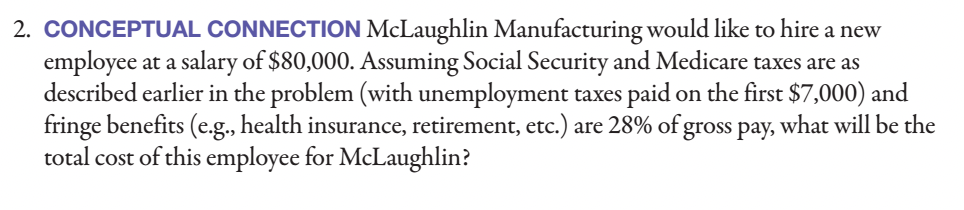

Problem 8-58B Payroll Accounting McLaughlin Manufacturing has the following data available for its March 31 payroll: * All subject to Social Security and Medicare matching and withholding at 6.2% and 1.45%, respectively. Federal unemployment taxes of 0.50% and state unemployment taxes of 0.80% are payable on the first $1,000,000. Required: 1. Compute the taxes payable and wages that will be paid to employees. Then prepare the journal entries to record the wages earned and the payroll taxes. (Note: Round to the nearest penny.) 2. CONCEPTUAL CONNECTION McLaughlin Manufacturing would like to hire a new employee at a salary of $80,000. Assuming Social Security and Medicare taxes are as described earlier in the problem (with unemployment taxes paid on the first $7,000 ) and fringe benefits (e.g., health insurance, retirement, etc.) are 28% of gross pay, what will be the total cost of this employee for McLaughlin? Problem 8-58B Payroll Accounting McLaughlin Manufacturing has the following data available for its March 31 payroll: * All subject to Social Security and Medicare matching and withholding at 6.2% and 1.45%, respectively. Federal unemployment taxes of 0.50% and state unemployment taxes of 0.80% are payable on the first $1,000,000. Required: 1. Compute the taxes payable and wages that will be paid to employees. Then prepare the journal entries to record the wages earned and the payroll taxes. (Note: Round to the nearest penny.) 2. CONCEPTUAL CONNECTION McLaughlin Manufacturing would like to hire a new employee at a salary of $80,000. Assuming Social Security and Medicare taxes are as described earlier in the problem (with unemployment taxes paid on the first $7,000 ) and fringe benefits (e.g., health insurance, retirement, etc.) are 28% of gross pay, what will be the total cost of this employee for McLaughlin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts