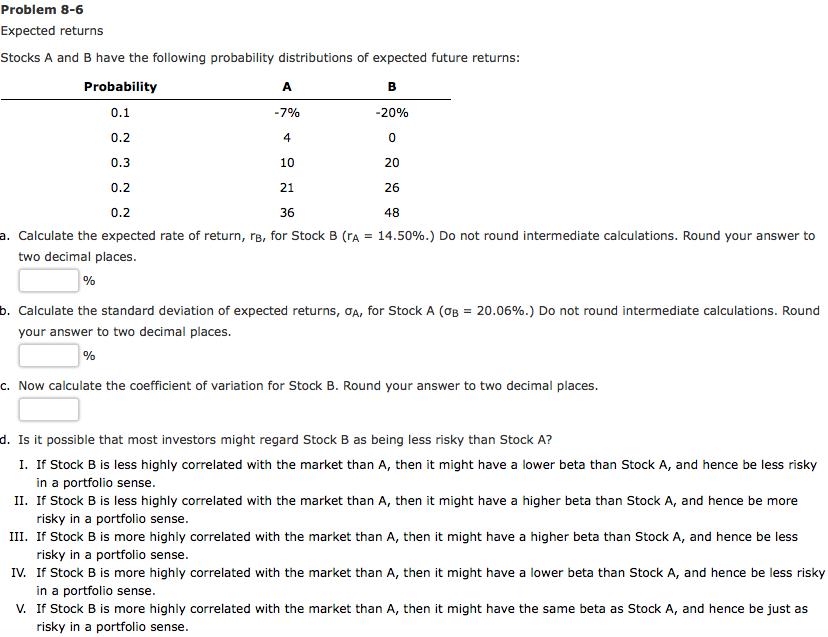

Question: Problem 8-6 Expected returns Stocks A and B have the following probability distributions of expected future returns: Probability -20% 0.2 0.2 a. Calculate the expected

Problem 8-6 Expected returns Stocks A and B have the following probability distributions of expected future returns: Probability -20% 0.2 0.2 a. Calculate the expected rate of return, rb, for Stock B (rA = 14.50%.) Do not round intermediate calculations. Round your answer to two decimal places. b. Calculate the standard deviation of expected returns, OA, for Stock A (OB = 20.06%.) Do not round intermediate calculations. Round your answer to two decimal places. C. Now calculate the coefficient of variation for Stock B. Round your answer to two decimal places. d. Is it possible that most investors might regard Stock B as being less risky than Stock A? I. If Stock B is less highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense. II. If Stock B is less highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be more risky in a portfolio sense. III. If Stock B is more highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be less risky in a portfolio sense. IV. If Stock B is more highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense. V. If Stock B is more highly correlated with the market than A, then it might have the same beta as Stock A, and hence be just as risky in a portfolio sense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts