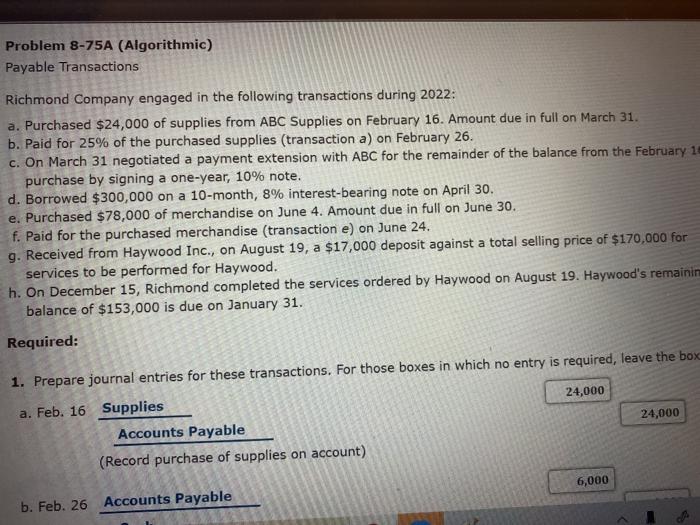

Question: Problem 8-75A (Algorithmic) Payable Transactions Richmond Company engaged in the following transactions during 2022: a. Purchased $24,000 of supplies from ABC Supplies on February 16.

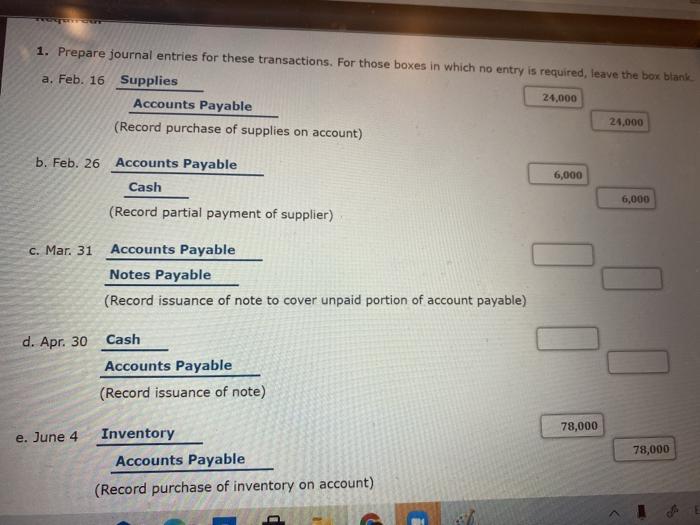

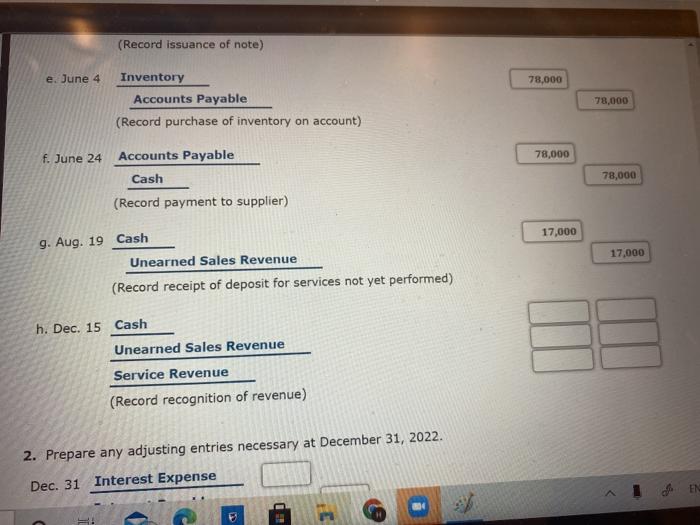

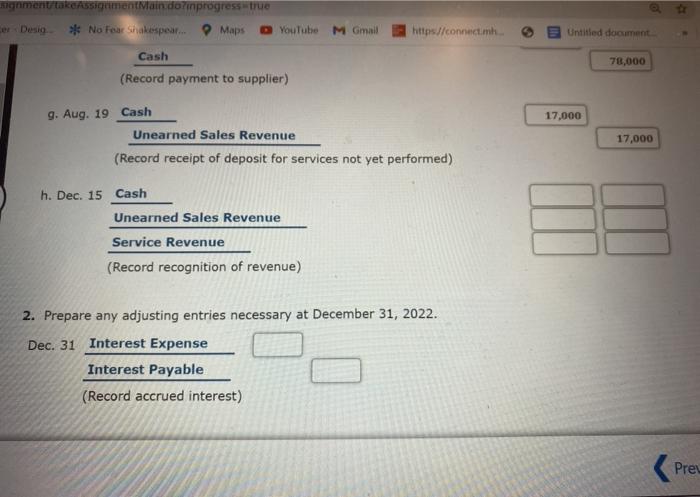

Problem 8-75A (Algorithmic) Payable Transactions Richmond Company engaged in the following transactions during 2022: a. Purchased $24,000 of supplies from ABC Supplies on February 16. Amount due in full on March 31. b. Paid for 25% of the purchased supplies (transaction a) on February 26. c. On March 31 negotiated a payment extension with ABC for the remainder of the balance from the February 10 purchase by signing a one-year, 10% note. d. Borrowed $300,000 on a 10-month, 8% interest-bearing note on April 30. e. Purchased $78,000 of merchandise on June 4. Amount due in full on June 30. f. Paid for the purchased merchandise (transaction e) on June 24. g. Received from Haywood Inc., on August 19, a $17,000 deposit against a total selling price of $170,000 for services to be performed for Haywood. h. On December 15, Richmond completed the services ordered by Haywood on August 19. Haywood's remainin balance of $153,000 is due on January 31. Required: 1. Prepare journal entries for these transactions. For those boxes in which no entry is required, leave the box a. Feb. 16 Supplies 24,000 Accounts Payable 24,000 (Record purchase of supplies on account) 6,000 b. Feb. 26 Accounts Payable 1. Prepare journal entries for these transactions. For those boxes in which no entry is required, leave the box blank a. Feb. 16 Supplies 24,000 Accounts Payable 24.000 (Record purchase of supplies on account) b. Feb. 26 Accounts Payable Cash 6,000 6,000 (Record partial payment of supplier) c. Mar. 31 Accounts Payable Notes Payable (Record issuance of note to cover unpaid portion of account payable) II d. Apr. 30 Cash Accounts Payable (Record issuance of note) 78,000 e. June 4 78,000 Inventory Accounts Payable (Record purchase of inventory on account) (Record issuance of note) e. June 4 78,000 Inventory Accounts Payable (Record purchase of inventory on account) 78,000 f. June 24 Accounts Payable 78,000 Cash 78,000 (Record payment to supplier) 17,000 17,000 9. Aug. 19 Cash Unearned Sales Revenue (Record receipt of deposit for services not yet performed) h. Dec. 15 Cash Unearned Sales Revenue Service Revenue (Record recognition of revenue) 2. Prepare any adjusting entries necessary at December 31, 2022. Dec. 31 Interest Expense signment takeassument Main dorinprogress true ex Desio * No Fear Shakespear... Maps YouTube M Gmail https://connect.mh Untitled document 78,000 Cash (Record payment to supplier) 9. Aug. 19 Cash 17,000 Unearned Sales Revenue 17,000 (Record receipt of deposit for services not yet performed) h. Dec. 15 Cash Unearned Sales Revenue Service Revenue (Record recognition of revenue) 2. Prepare any adjusting entries necessary at December 31, 2022. Dec. 31 Interest Expense Interest Payable (Record accrued interest) (Preu

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts