Question: Problem 8-8 (Algorithmic) Modified Accelerated Cost Recovery System (MACRS), Election to Expense, Listed Property, Limitation on Depreciation of Luxury Automobiles (LO 8.2, 8.3, 8.4, 8.5)

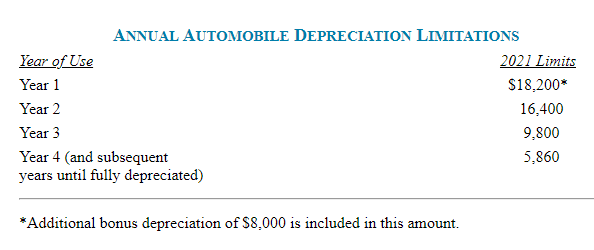

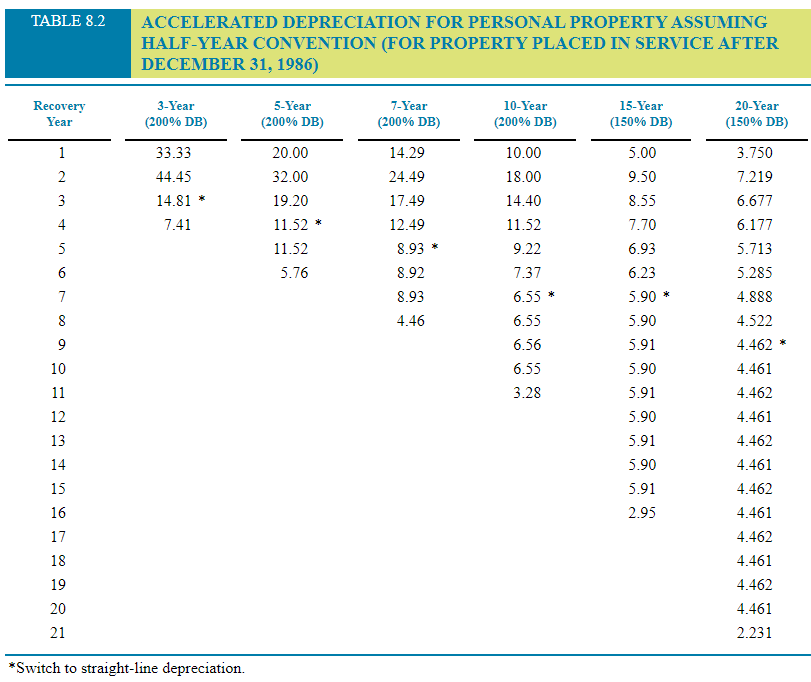

Problem 8-8 (Algorithmic) Modified Accelerated Cost Recovery System (MACRS), Election to Expense, Listed Property, Limitation on Depreciation of Luxury Automobiles (LO 8.2, 8.3, 8.4, 8.5) During 2021, William purchases the following capital assets for use in his catering business: accelerated method to calculate depreciation but elects out of bonus depreciation. Assume he has adequate taxable income. Click here to access the depreciation table and click here to access the annual automobile depreciation limitations. Calculate William's maximum depreciation deduction for 2021, assuming he uses the automobile 100 percent in his business. *Additional bonus depreciation of $8,000 is included in this amount. TABLE 8.2 ACCELERATED DEPRECIATION FOR PERSONAL PROPERTY ASSUMING *Switch to straight-line depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts