Question: Problem 8-8 Performing a Comprehensive CVP Analysis (LO2 - CC5, 9) The Central Valley Company is a manufacturing firm that produces and sells a single

Problem 8-8 Performing a Comprehensive CVP Analysis (LO2 - CC5, 9)

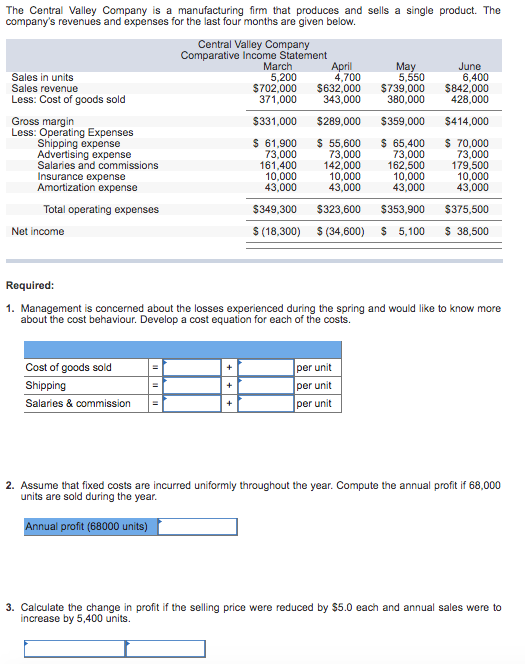

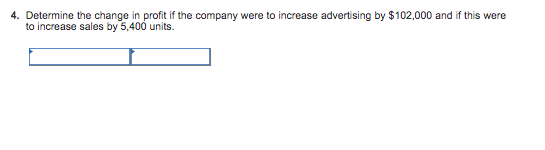

The Central Valley Company is a manufacturing firm that produces and sells a single product. The company's revenues and expenses for the last four months are given below. Central Valley Company Comparative Income Statement March 5,200 April 4,700 May 5,550 June 6,400 Sales in units Sales revenue Less: Cost of goods sold $702,000 $632,000 $739.000 $842,000 371,000 343,000 380,000 428,000 Gross margin Less: Operating Expenses $331.000 $289,000 $359.000 $414,000 Shipping expense Advertising expense Salaries and commissions Insurance expense Amortization expense S 61,900 S 55,600 S 65,400 73.000 162,500 10,000 43.000 73.000 161,400 10,000 43.000 73.000 142,000 10,000 43.000 70,000 73.000 179,500 10,000 43.000 Total operating expenses S349.300 $323,600 $353,900 $375,500 Net income S (18,300) S(34,600) S 5,100 S 38,500 Required: 1. Management is concerned about the losses experienced during the spring and would like to know more about the cost behaviour. Develop a cost equation for each of the costs. Cost of goods sold Shipping Salaries & commission per unit per unit per unit 2. Assume that fixed costs are incurred uniformly throughout the year. Compute the annual profit if 68,000 units are sold during the year l profit ( units) 3. Calculate the change in profit if the selling price were reduced by $5.0 each and annual sales were to increase by 5,400 units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts