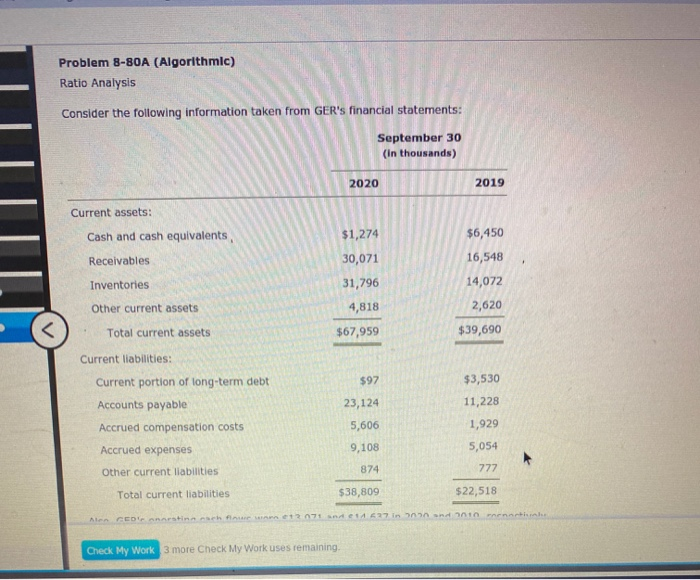

Question: Problem 8-80A (Algorithmic) Ratio Analysis Consider the following information taken from GER's financial statements: September 30 (in thousands) 2020 2019 Current assets: Cash and cash

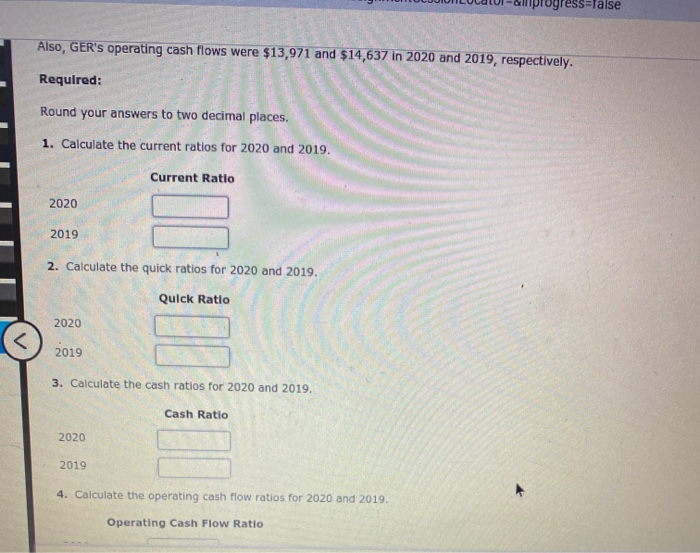

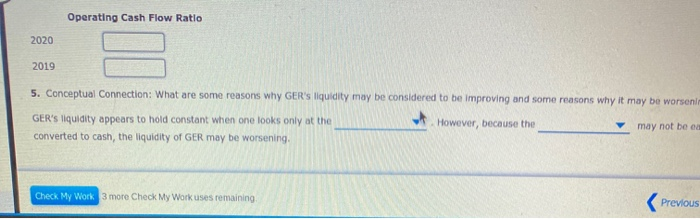

Problem 8-80A (Algorithmic) Ratio Analysis Consider the following information taken from GER's financial statements: September 30 (in thousands) 2020 2019 Current assets: Cash and cash equivalents $1,274 $6,450 Receivables 16,548 30,071 31,796 Inventories 14,072 Other current assets 4,818 2,620 $39,690 Total current assets $67,959 Current liabilities: Current portion of long-term debt Accounts payable $97 23,124 5,606 9,108 874 $3,530 11,228 1,929 Accrued compensation costs Accrued expenses 5,054 777 Other current liabilities Total current liabilities $38,809 $22,518 14 627 in 1 Check My Work 3 more Check My Work uses remaining. MUCUJIUILUCIUI-a progress=false Also, GER's operating cash flows were $13,971 and $14,637 in 2020 and 2019, respectively. Required: Round your answers to two decimal places. 1. Calculate the current ratios for 2020 and 2019. Current Ratio 2020 2019 2. Calculate the quick ratios for 2020 and 2019. Quick Ratio 2020 2019 3. Calculate the cash ratios for 2020 and 2019. Cash Ratio 2020 2019 4. Calculate the operating cash flow ratios for 2020 and 2019. Operating Cash Flow Ratio Operating Cash Flow Ratio 2020 2019 5. Conceptual Connection: What are some reasons why GER's liquidity may be considered to be improving and some reasons why it may be worsenin However, because the GER's liquidity appears to hold constant when one looks only at the converted to cash, the liquidity of GER may be worsening. may not be ca Check My Work 3 more Check My Work uses remaining Previous

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts