Question: Problem 8A Non-Resident Alien Ms. Camellia is an alien employed by Cadence Corp., a regional headquarter (RHO) of a multinational company. She received compensation income

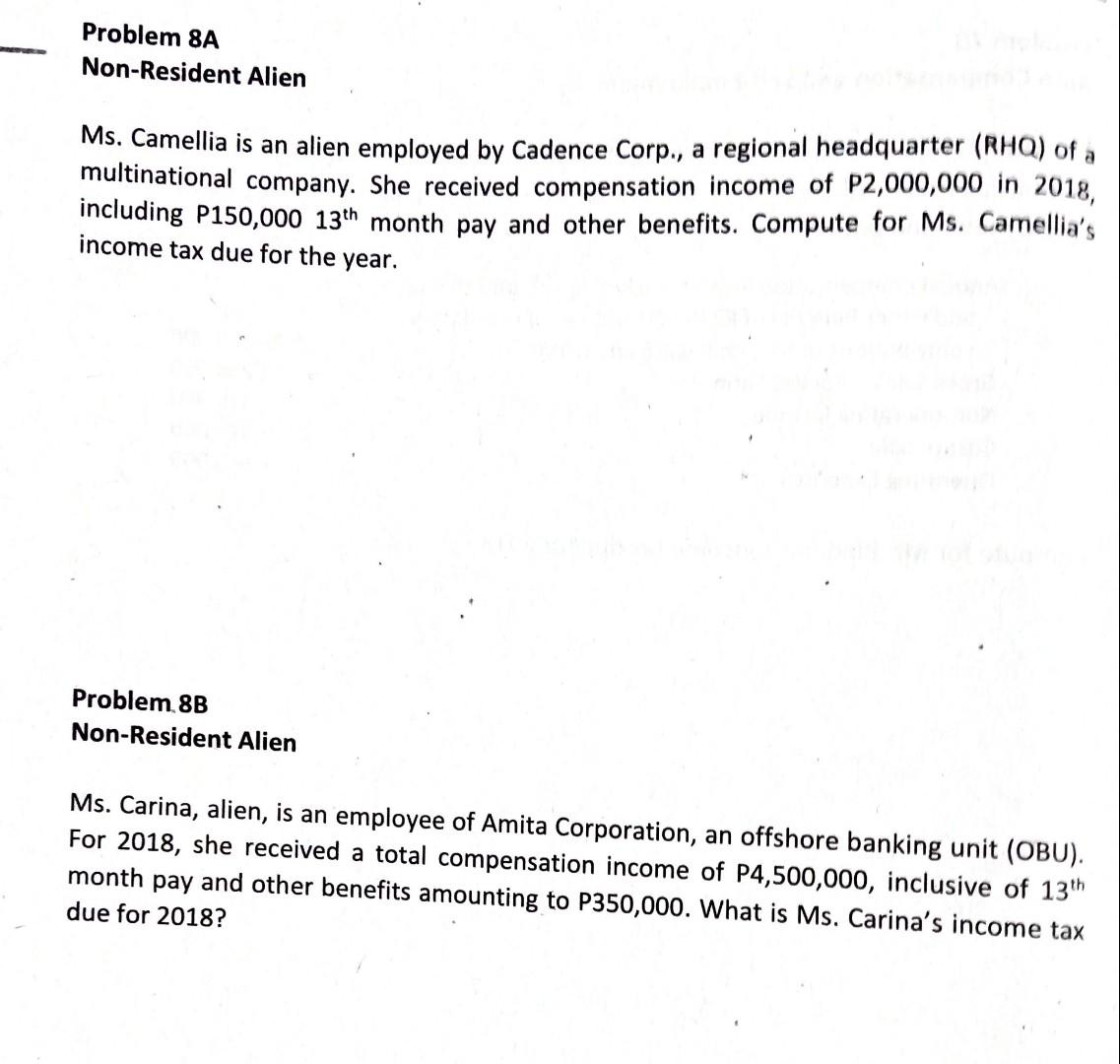

Problem 8A Non-Resident Alien Ms. Camellia is an alien employed by Cadence Corp., a regional headquarter (RHO) of a multinational company. She received compensation income of P2,000,000 in 2018, including P150,000 13th month pay and other benefits. Compute for Ms. Camellia's income tax due for the year. Problem 8B Non-Resident Alien Ms. Carina, alien, is an employee of Amita Corporation, an offshore banking unit (OBU). For 2018, she received a total compensation income of P4,500,000, inclusive of 13th month pay and other benefits amounting to P350,000. What is Ms. Carina's income tax due for 2018? Problem 8A Non-Resident Alien Ms. Camellia is an alien employed by Cadence Corp., a regional headquarter (RHO) of a multinational company. She received compensation income of P2,000,000 in 2018, including P150,000 13th month pay and other benefits. Compute for Ms. Camellia's income tax due for the year. Problem 8B Non-Resident Alien Ms. Carina, alien, is an employee of Amita Corporation, an offshore banking unit (OBU). For 2018, she received a total compensation income of P4,500,000, inclusive of 13th month pay and other benefits amounting to P350,000. What is Ms. Carina's income tax due for 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts