Question: Problem 9 - 1 7 Project Evaluation ( LO 2 ) Ilana Industries Incorporated needs a new lathe. It can buy a new high -

Problem Project Evaluation LO

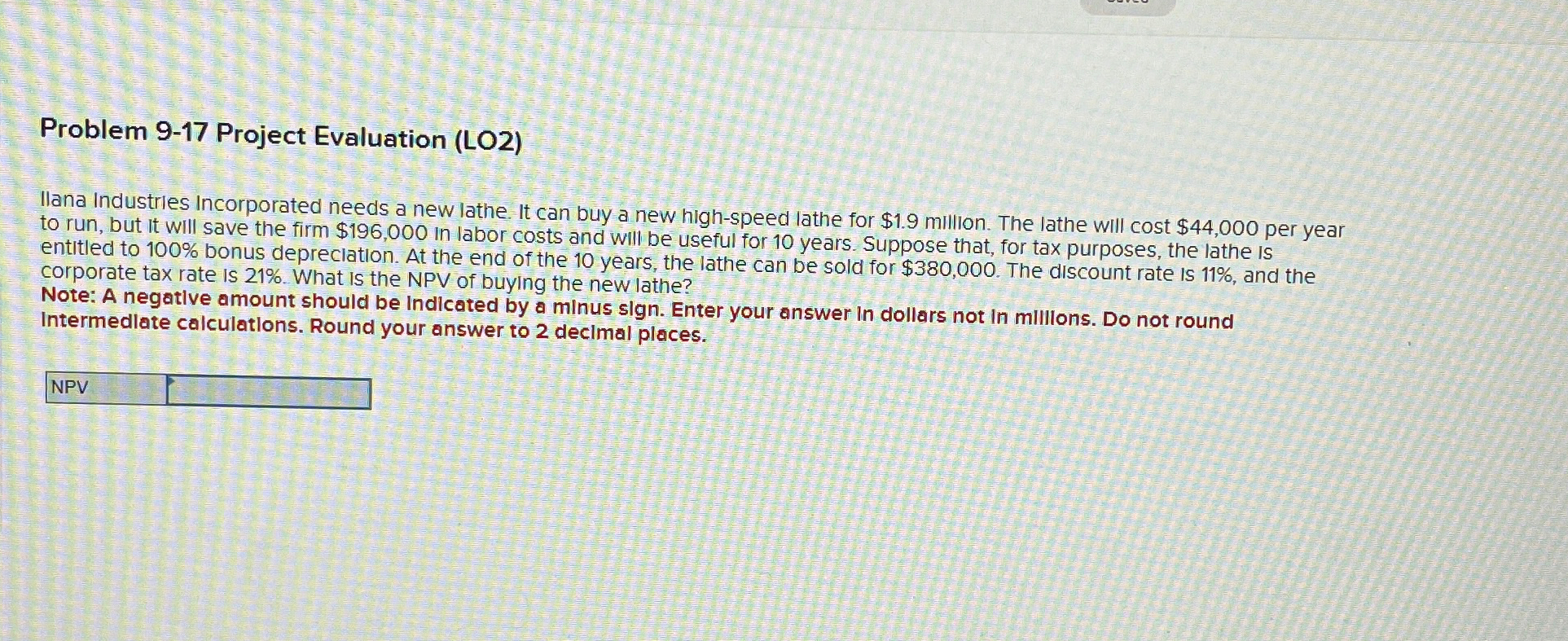

Ilana Industries Incorporated needs a new lathe. It can buy a new highspeed lathe for $ million. The lathe will cost $ per year to run, but it will save the firm $ in labor costs and will be useful for years. Suppose that, for tax purposes, the lathe is entitled to bonus depreciation. At the end of the years, the lathe can be sold for $ The discount rate is and the corporate tax rate is What Is the NPV of buying the new lathe?

Note: A negative amount should be Indlcated by a minus sign. Enter your answer In dollars not In millions. Do not round Intermedlate calculatlons. Round your answer to decimal places.

NPV

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock