Question: Problem 9 . 2 0 ( Corporate Value Model ) eBook Assume that today is December 3 1 , 2 0 2 1 , and

Problem Corporate Value Model

eBook

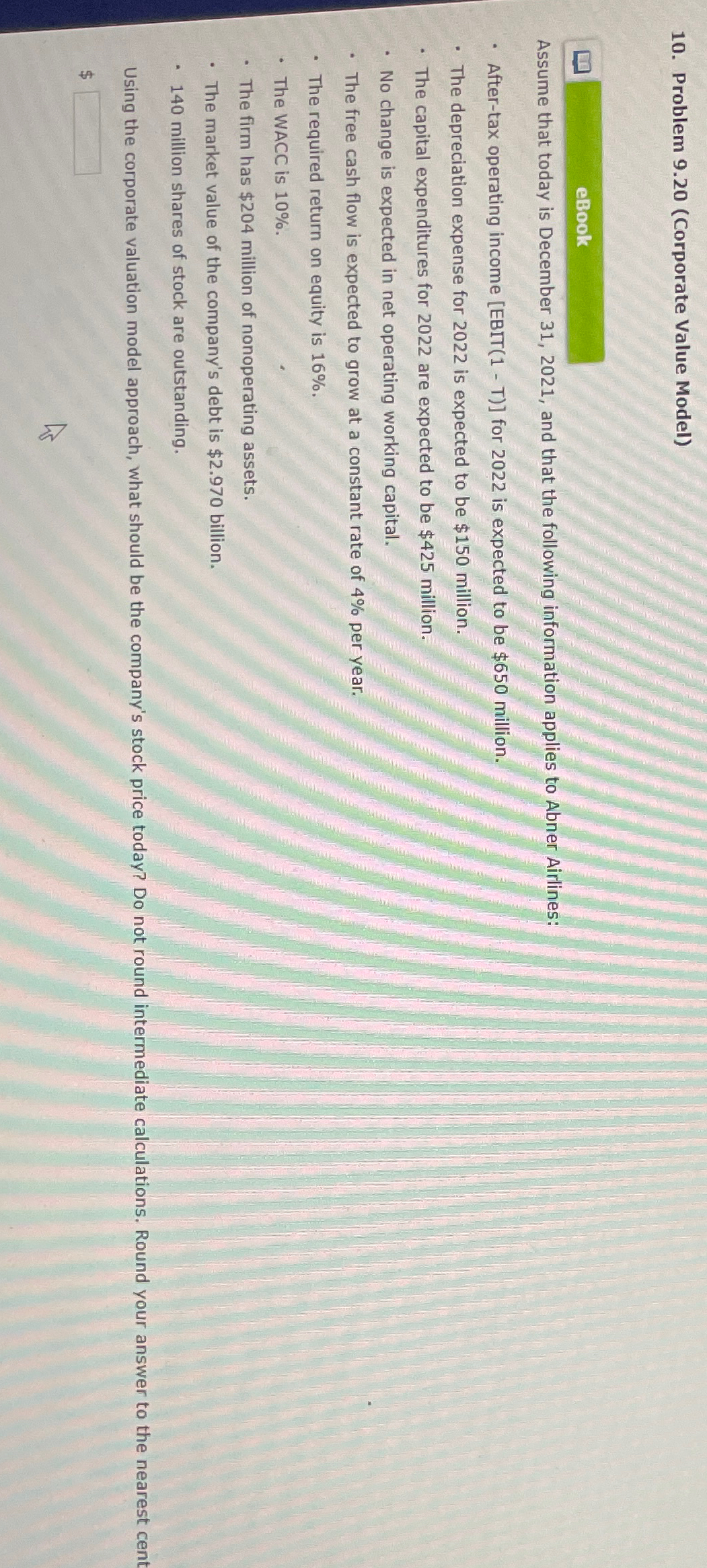

Assume that today is December and that the following information applies to Abner Airlines:

Aftertax operating income EBIT T for is expected to be $ million.

The depreciation expense for is expected to be $ million.

The capital expenditures for are expected to be $ million.

No change is expected in net operating working capital.

The free cash flow is expected to grow at a constant rate of per year.

The required return on equity is

The WACC is

The firm has $ million of nonoperating assets.

The market value of the company's debt is $ billion.

million shares of stock are outstanding.

Using the corporate valuation model approach, what should be the company's stock price today? Do not round intermediate calculations. Round your answer to the nearest cent $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock