Question: Problem 9 - 2 8 Stock Valuation and Cash Flows Full Boat Manufacturing has projected sales of $ 1 1 6 . 5 million next

Problem Stock Valuation and Cash Flows

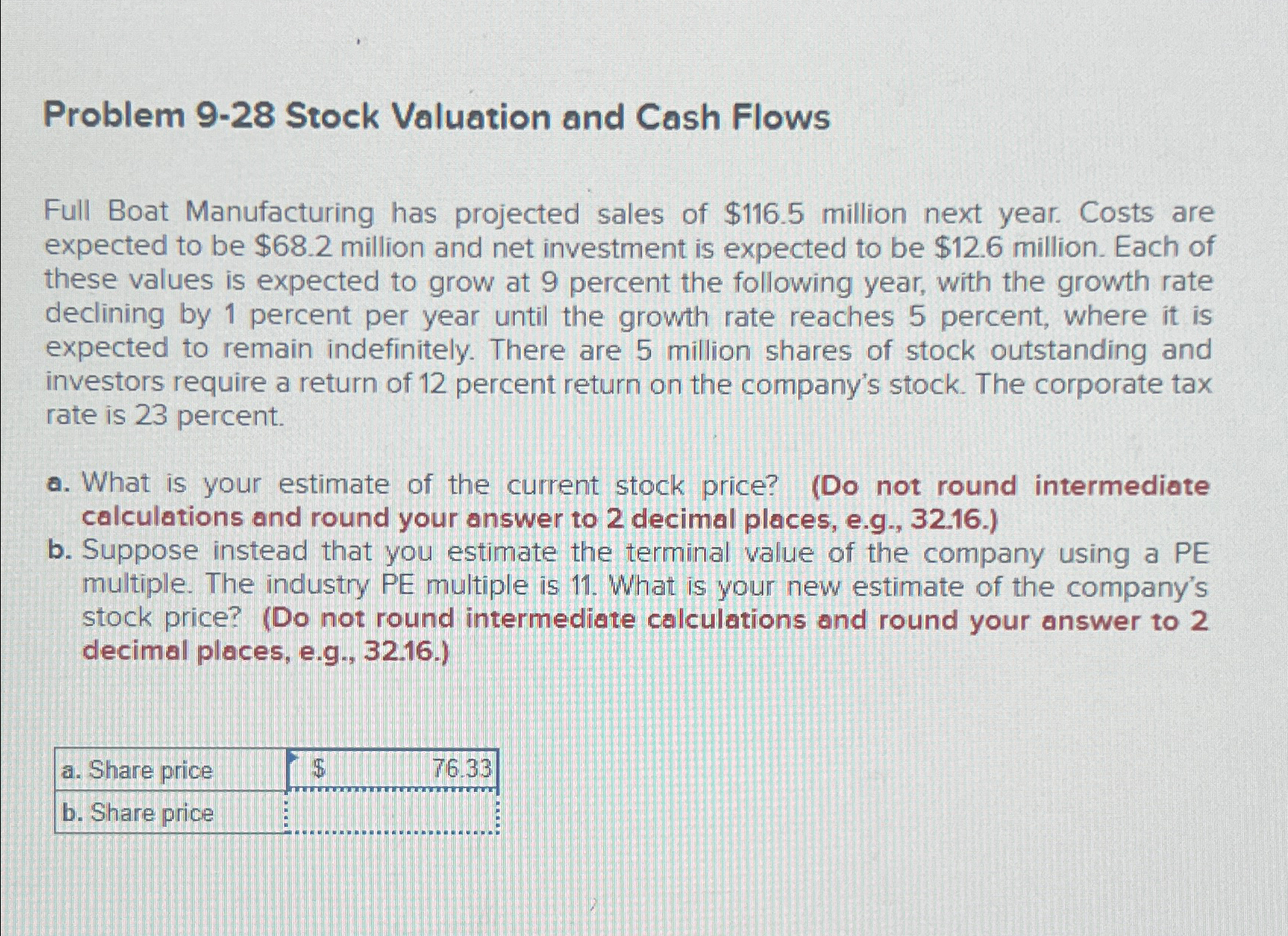

Full Boat Manufacturing has projected sales of $ million next year. Costs are expected to be $ million and net investment is expected to be $ million. Each of these values is expected to grow at percent the following year, with the growth rate declining by percent per year until the growth rate reaches percent, where it is expected to remain indefinitely. There are million shares of stock outstanding and investors require a return of percent return on the company's stock. The corporate tax rate is percent.

a What is your estimate of the current stock price? Do not round intermediate calculations and round your answer to decimal places, eg

b Suppose instead that you estimate the terminal value of the company using a PE multiple. The industry PE multiple is What is your new estimate of the company's stock price? Do not round intermediate calculations and round your answer to decimal places, eg

tablea Share price,$b Share price,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock