Question: Problem 9 - 4 3 ( L 0 . 1 , 3 , 5 ) Oasis Co . , a U . S . shareholder,

Problem L

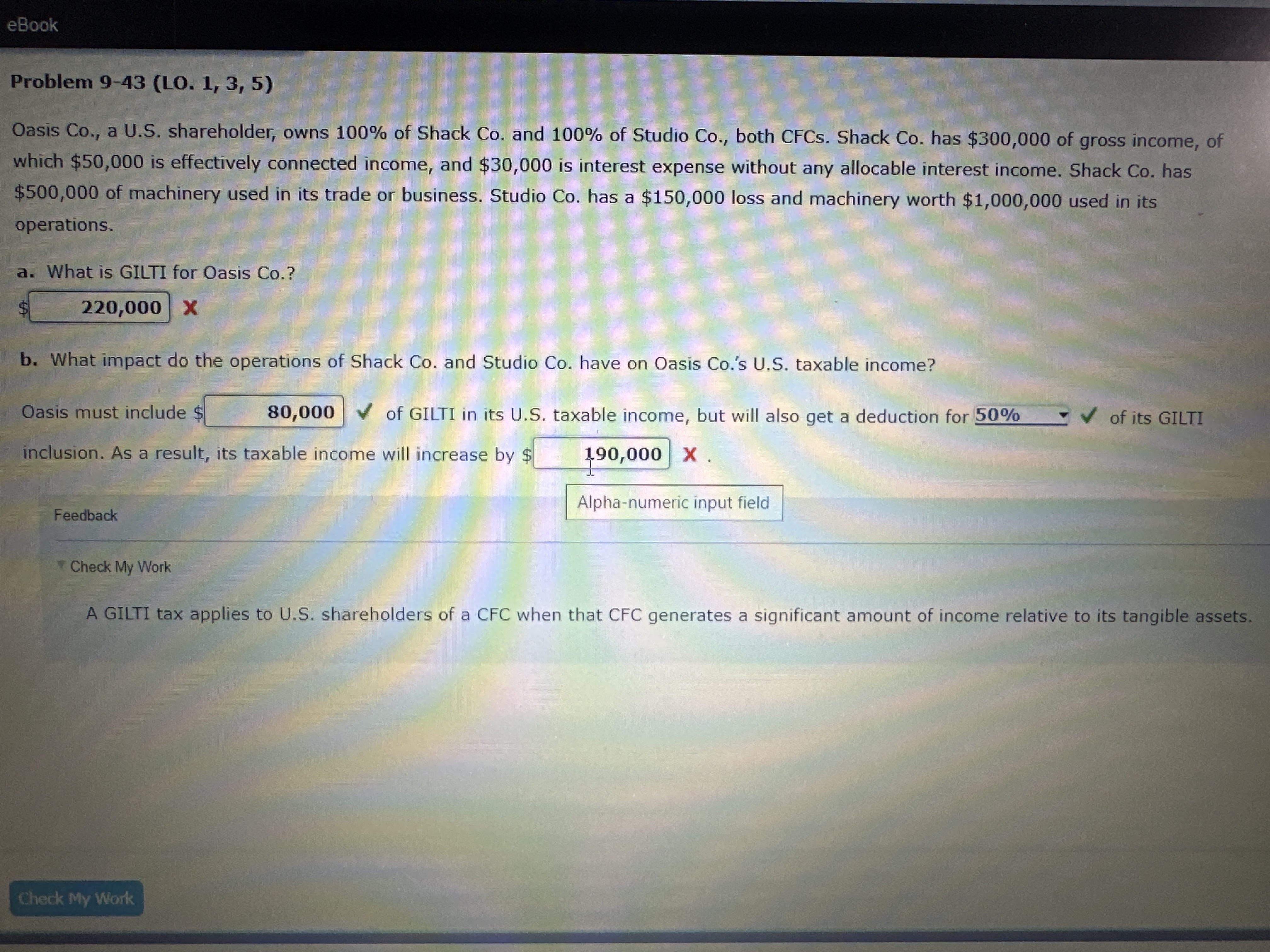

Oasis Co a US shareholder, owns of Shack Co and of Studio Co both CFCs Shack Co has $ of gross income, of

which $ is effectively connected income, and $ is interest expense without any allocable interest income. Shack Co has

$ of machinery used in its trade or business. Studio Co has a $ loss and machinery worth $ used in its

operations.

a What is GILTI for Oasis Co

b What impact do the operations of Shack Co and Studio Co have on Oasis Cos US taxable income?

Oasis must include

of GILTI in its US taxable income, but will also get a deduction for

inclusion. As a result, its taxable income will increase by

Feedback

Check My Work

A GILTI tax applies to US shareholders of a CFC when that CFC generates a significant amount of income relative to its tangible assets.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock