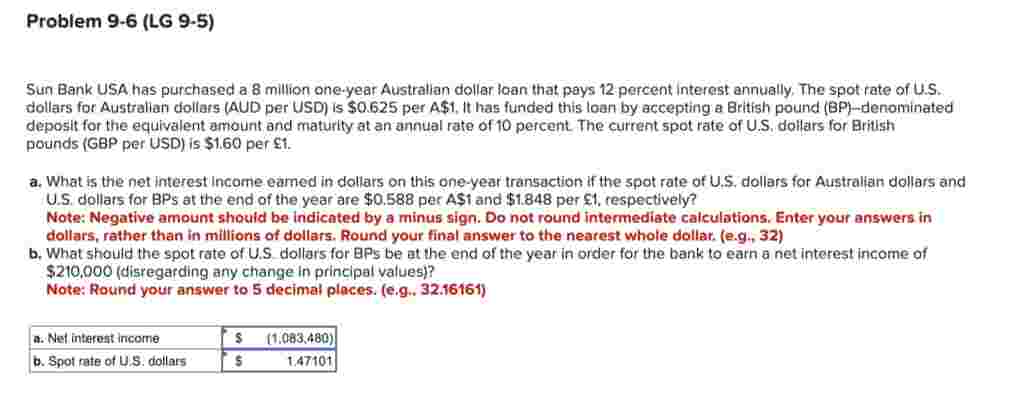

Question: Problem 9 - 6 ( LG 9 - 5 ) Sun Bank USA has purchased a 8 million oneyear Australian dollar loan that pays 1

Problem LG Sun Bank USA has purchased a million oneyear Australian dollar loan that pays percent interest annually, The spot rate of US dollars for Australian dollars AUD per USD is $ per A $ it has funded this loan by accepting a British pound BPdenominated deposit for the equivalent amount and maturity at an annual rate of percent. The current spot rate of US dollars for British pounds GBP per USD is $ per mathbf& a What is the net interest Income eamed in dollars on this oneyear transaction if the spot rate of US dollars for Australian dollars and US dollars for mathrmBP at the end of the year are $ per mathrmA$ and $ per respectively? Note: Negative amount shouid be indicated by a minus sign. Do not round intermediate calculations. Enter your answers in dollars, rather than in millions of dollars. Round your final answer to the nearest whole dollar. eg b What should the spot rate of US dollars for BPs be at the end of the year in order for the bank to earn a net interest income of $ disregarding any change in principal values Note: Round your answer to decimal places. eg

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock