Question: Problem 9 A Bookmark this page Problem 9(a)(i) 0.0/2.0 points (ungraded) You are thinking about buying North Pole Energy (NPE), a privately held green energy

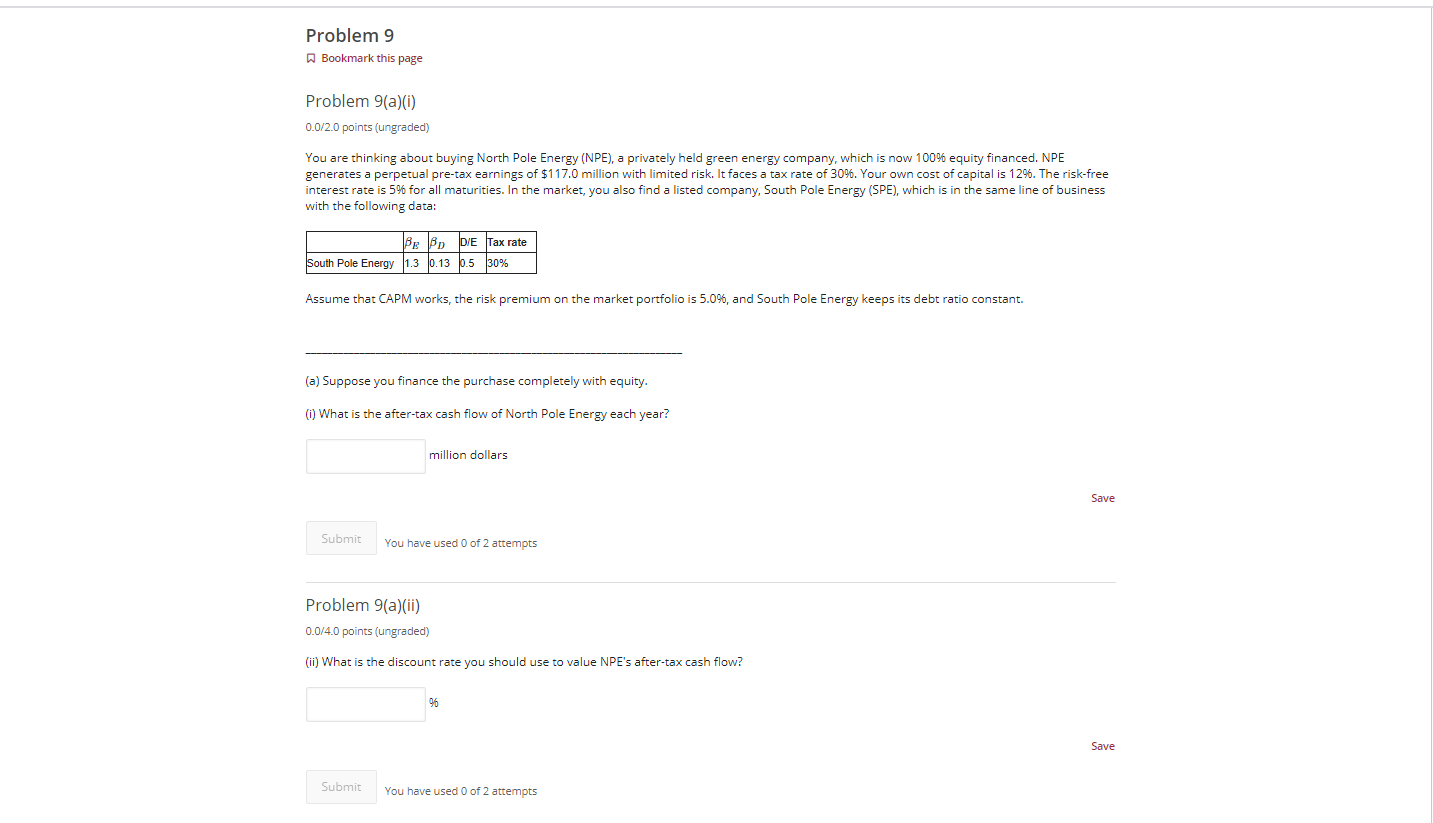

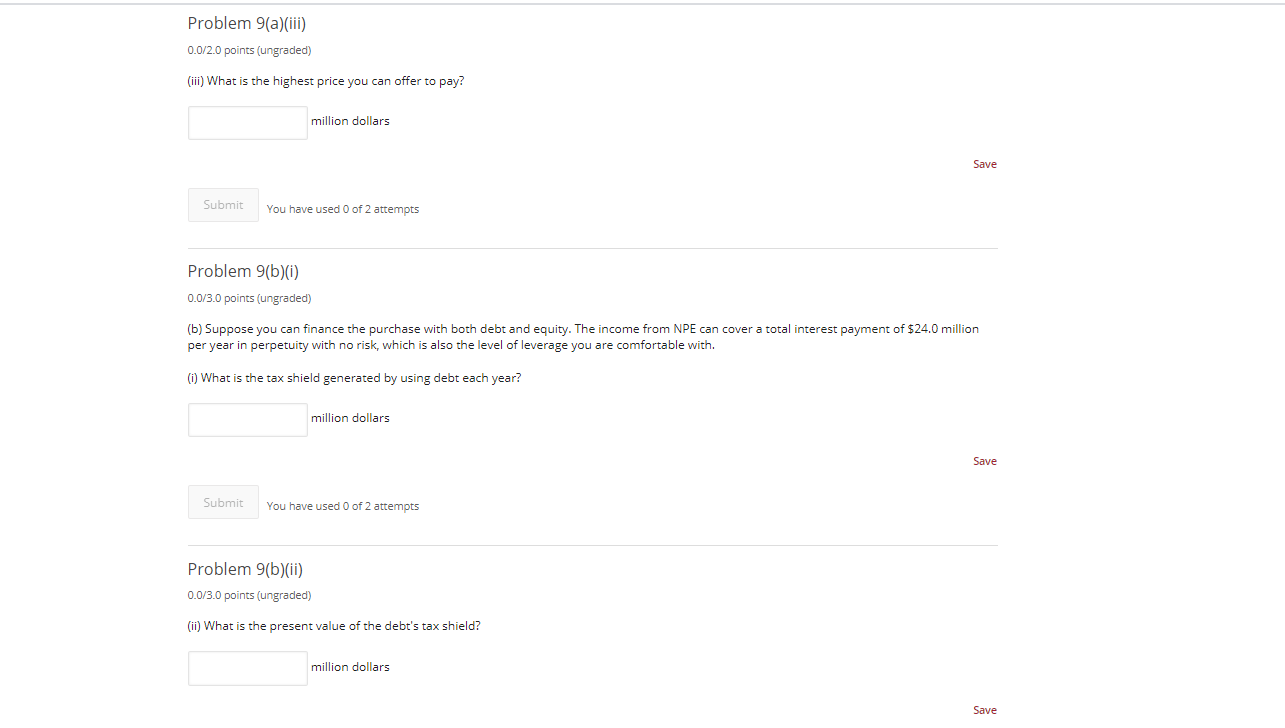

Problem 9 A Bookmark this page Problem 9(a)(i) 0.0/2.0 points (ungraded) You are thinking about buying North Pole Energy (NPE), a privately held green energy company, which is now 100% equity financed. NPE generates a perpetual pre-tax earnings of $117.0 million with limited risk. It faces a tax rate of 30%. Your own cost of capital is 12%. The risk-free interest rate is 5% for all maturities. In the market, you also find a listed company, South Pole Energy (SPE), which is in the same line of business with the following data: Be Bopre Tax rate South Pole Energy 1.3 0.13 0.5 30% Assume that CAPM works, the risk premium on the market portfolio is 5.0%, and South Pole Energy keeps its debt ratio constant. (a) Suppose you finance the purchase completely with equity. 1) What is the after-tax cash flow of North Pole Energy each year? million dollars Save Save Submit You have used 0 of 2 attempts Problem 9(a)(ii) 0.0/4.0 points (ungraded) (ii) What is the discount rate you should use to value NPE's after-tax cash flow? 96 Save Submit You have used 0 of 2 attempts Problem 9(a)(iii) 0.0/2.0 points (ungraded) (iii) What is the highest price you can offer to pay? million dollars Save Submit You have used 0 of 2 attempts Problem 9(b)0) 0.0/3.0 points (ungraded) (b) Suppose you can finance the purchase with both debt and equity. The income from NPE can cover a total interest payment of $24.0 million per year in perpetuity with no risk, which is also the level of leverage you are comfortable with. (i) What is the tax shield generated by using debt each year? million dollars Save Submit You have used 0 of 2 attempts Problem 9(b)(ii) 0.0/3.0 points (ungraded) (ii) What is the present value of the debt's tax shield? million dollars Save Problem 9(b)(iii) 0.0/3.0 points (ungraded) (iii) What is the highest price you can offer now? million dollars Save Submit You have used 0 of 2 attempts Problem 9(b)(iv) 0.0/3.0 points (ungraded) (iv) With your existing business, you can also borrow from your bank $200 million at an interest rate of 7%, which can be used to finance the NPE purchase. Should this change your offer? (No need to do computations.) 0 Yes O No Save Submit You have used 0 of 1 attempt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts